Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(20 mars Question 3 a. Lawrence Industries, operator of a small chain of video stores, pur $1,000 worth of merchandise on February 27 from a

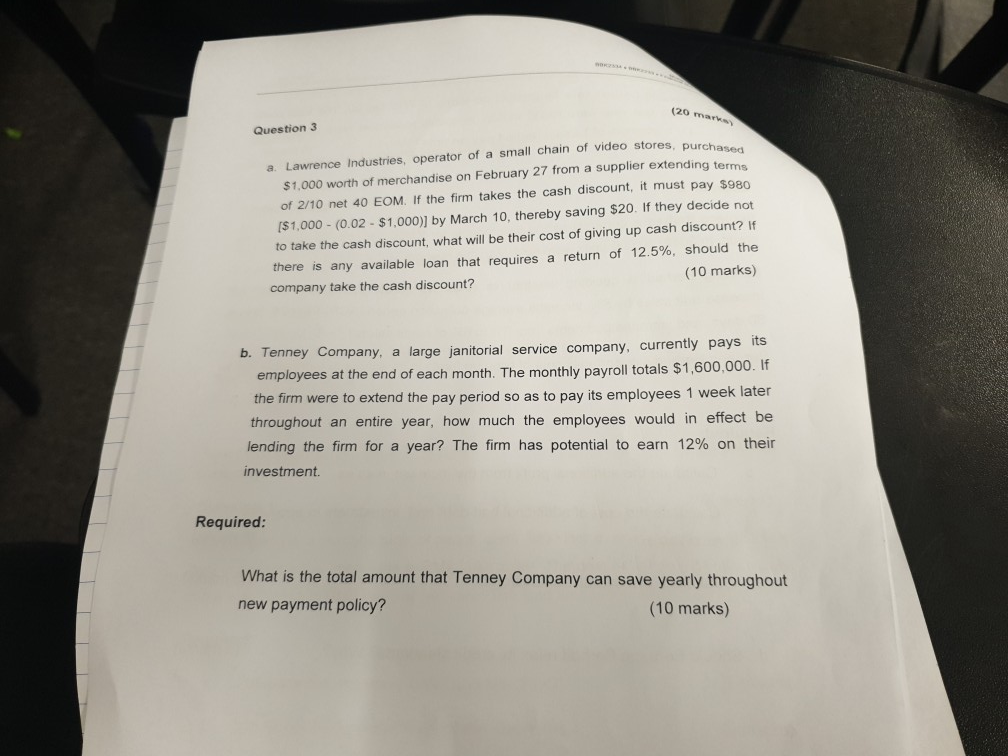

(20 mars Question 3 a. Lawrence Industries, operator of a small chain of video stores, pur $1,000 worth of merchandise on February 27 from a supplier extending terms of 2/10 net 40 EOM. If the firm takes the cash discount, it must pay $980 [$1,000 - (0.02 - $1.000)] by March 10, thereby saving $20. If they decide not to take the cash discount, what will be their cost of giving up cash discount? If there is any available loan that requires a return of 12.5%, should the company take the cash discount? (10 marks) b. Tenney Company, a large janitorial service company, currently pays its employees at the end of each month. The monthly payroll totals $1,600,000. If the firm were to extend the pay period so as to pay its employees 1 week later throughout an entire year, how much the employees would in effect be lending the firm for a year? The firm has potential to earn 12% on their investment Required: What is the total amount that Tenney Company can save yearly throughout new payment policy? (10 marks) (20 mars Question 3 a. Lawrence Industries, operator of a small chain of video stores, pur $1,000 worth of merchandise on February 27 from a supplier extending terms of 2/10 net 40 EOM. If the firm takes the cash discount, it must pay $980 [$1,000 - (0.02 - $1.000)] by March 10, thereby saving $20. If they decide not to take the cash discount, what will be their cost of giving up cash discount? If there is any available loan that requires a return of 12.5%, should the company take the cash discount? (10 marks) b. Tenney Company, a large janitorial service company, currently pays its employees at the end of each month. The monthly payroll totals $1,600,000. If the firm were to extend the pay period so as to pay its employees 1 week later throughout an entire year, how much the employees would in effect be lending the firm for a year? The firm has potential to earn 12% on their investment Required: What is the total amount that Tenney Company can save yearly throughout new payment policy? (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started