Answered step by step

Verified Expert Solution

Question

1 Approved Answer

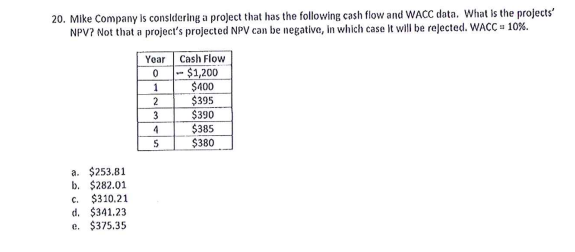

20. Mike Company is consldering a project that has the following cash flow and WACC data. What is the projects' NPV? Not that a project's

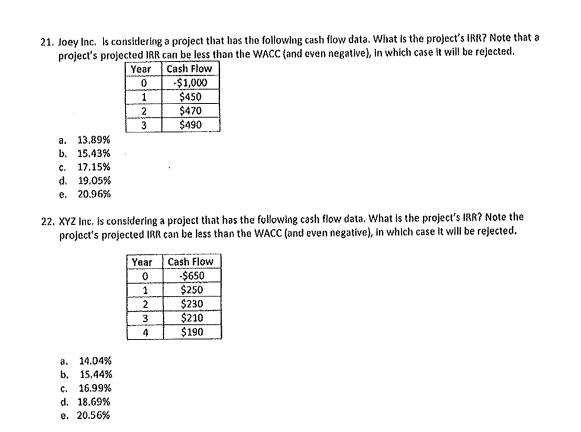

20. Mike Company is consldering a project that has the following cash flow and WACC data. What is the projects' NPV? Not that a project's projected NPV can be negative, in which case it will be rejected. WACC a 10%. a. $253,81 b. $282.01 c. $310.21 d. $341.23 e. $375.35 21. Joey Inc. Is considering a project that has the following cash flow data. What is the project's IRR? Note that a project's projected IRR can be less than the WACC (and even negative), in which case it will be rejected. a. 13.89% b. 15,43% c. 17.15% d. 19.05% e. 20.96% 22. XYZ inc. is considering a project that has the following cash flow data. What is the project's IRR? Note the project's projected IRR can be less than the WACC (and even negative), in which case it will be rejected. a. 14.04% b. 15,44% c. 16.99% d. 18.69% e. 20.56%

20. Mike Company is consldering a project that has the following cash flow and WACC data. What is the projects' NPV? Not that a project's projected NPV can be negative, in which case it will be rejected. WACC a 10%. a. $253,81 b. $282.01 c. $310.21 d. $341.23 e. $375.35 21. Joey Inc. Is considering a project that has the following cash flow data. What is the project's IRR? Note that a project's projected IRR can be less than the WACC (and even negative), in which case it will be rejected. a. 13.89% b. 15,43% c. 17.15% d. 19.05% e. 20.96% 22. XYZ inc. is considering a project that has the following cash flow data. What is the project's IRR? Note the project's projected IRR can be less than the WACC (and even negative), in which case it will be rejected. a. 14.04% b. 15,44% c. 16.99% d. 18.69% e. 20.56% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started