Answered step by step

Verified Expert Solution

Question

1 Approved Answer

20 min left Starrs Bakery started 12 months ago as a supplier of gluten-free desserts to restaurants all over the province. During its first year

20 min left

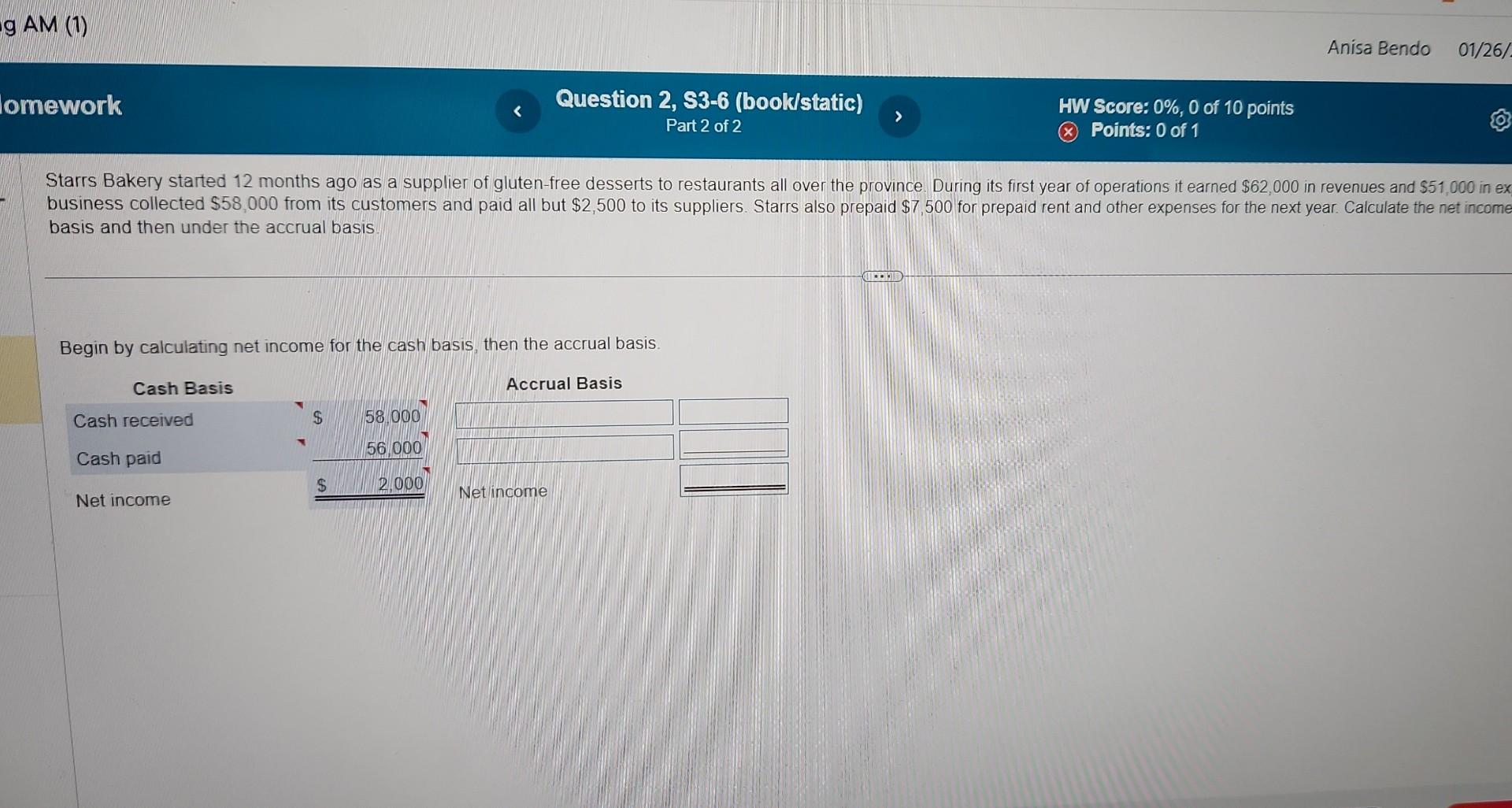

Starrs Bakery started 12 months ago as a supplier of gluten-free desserts to restaurants all over the province. During its first year of operations it earned $62,000 in revenues and $51,000 in ex business collected $58,000 from its customers and paid all but $2,500 to its suppliers. Starrs also prepaid $7,500 for prepaid rent and other expenses for the next year. Calculate the net income basis and then under the accrual basis Begin by calculating net income for the cash basis, then the accrual basisStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started