Answered step by step

Verified Expert Solution

Question

1 Approved Answer

20. On January 1, 20X1, Tatag Company granted to an employee the right to choose either: O Share alternative equal to 50,000 shares with

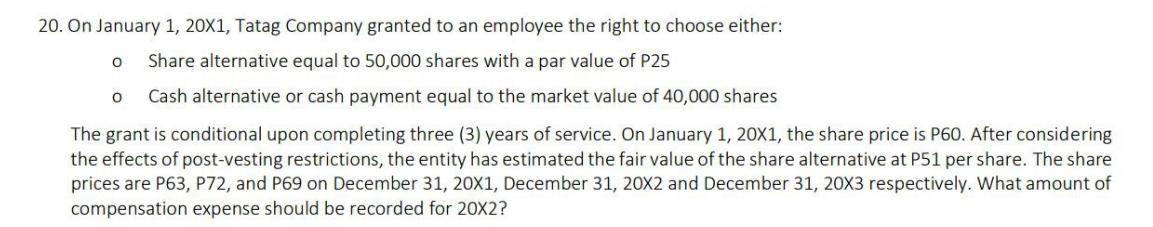

20. On January 1, 20X1, Tatag Company granted to an employee the right to choose either: O Share alternative equal to 50,000 shares with a par value of P25 Cash alternative or cash payment equal to the market value of 40,000 shares The grant is conditional upon completing three (3) years of service. On January 1, 20X1, the share price is P60. After considering the effects of post-vesting restrictions, the entity has estimated the fair value of the share alternative at P51 per share. The share prices are P63, P72, and P69 on December 31, 20X1, December 31, 20X2 and December 31, 20X3 respectively. What amount of compensation expense should be recorded for 20X2?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Heres how to calculate the compensation expense for 20X2 1 Identify the Vesting Date The grant is co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started