Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(20 points) A machine purchased 9 years ago for $45,000 is expected to have the salvage values and operating costs shown below for additional

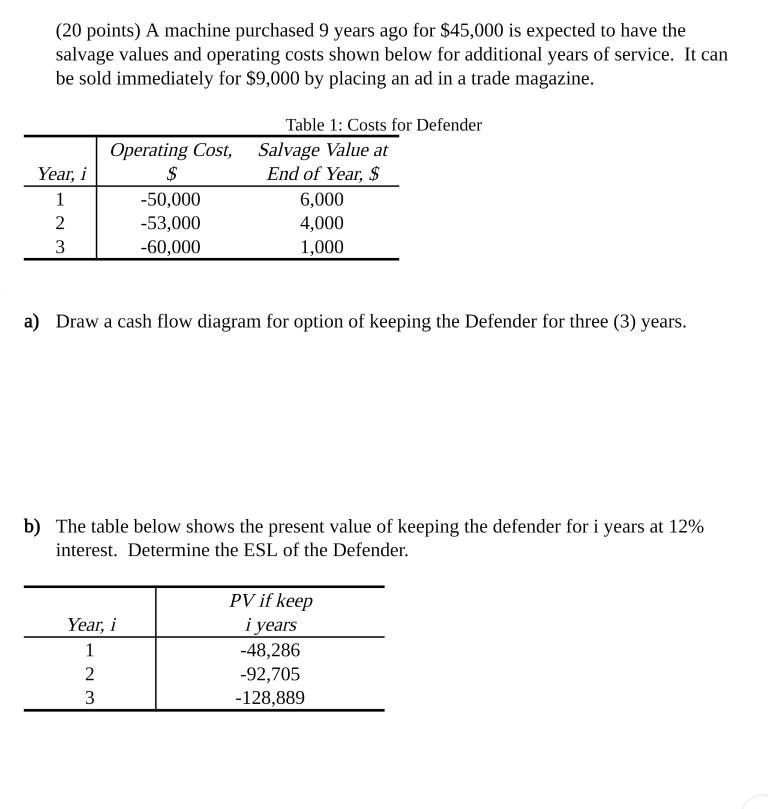

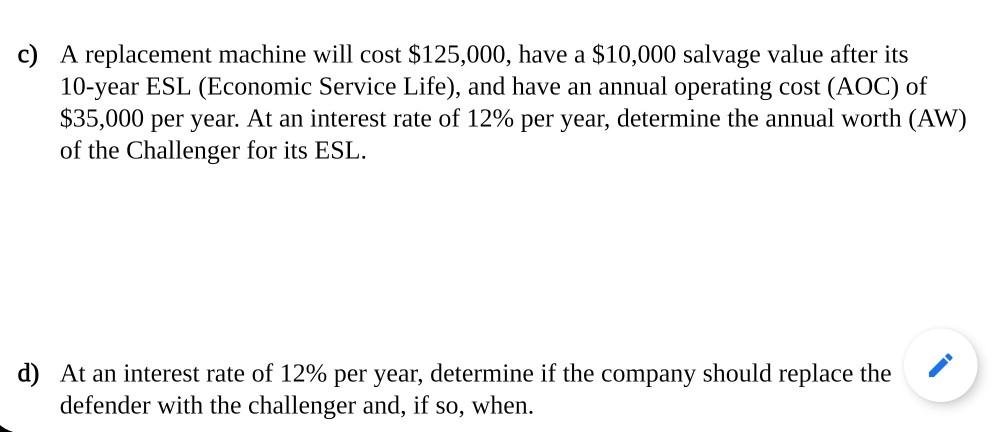

(20 points) A machine purchased 9 years ago for $45,000 is expected to have the salvage values and operating costs shown below for additional years of service. It can be sold immediately for $9,000 by placing an ad in a trade magazine. Table 1: Costs for Defender Operating Cost, Salvage Value at Year, i $ End of Year, $ 1 -50,000 6,000 2 -53,000 4,000 3 -60,000 1,000 a) Draw a cash flow diagram for option of keeping the Defender for three (3) years. b) The table below shows the present value of keeping the defender for i years at 12% interest. Determine the ESL of the Defender. Year, i 1 2 3 PV if keep i years -48,286 -92,705 -128,889 c) A replacement machine will cost $125,000, have a $10,000 salvage value after its 10-year ESL (Economic Service Life), and have an annual operating cost (AOC) of $35,000 per year. At an interest rate of 12% per year, determine the annual worth (AW) of the Challenger for its ESL. d) At an interest rate of 12% per year, determine if the company should replace the defender with the challenger and, if so, when.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started