Answered step by step

Verified Expert Solution

Question

1 Approved Answer

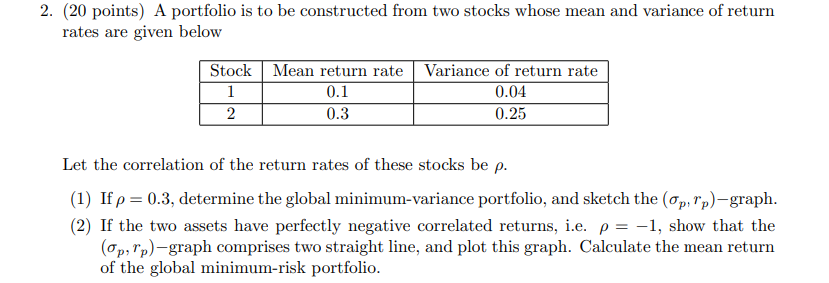

(20 points) A portfolio is to be constructed from two stocks whose mean and variance of return rates are given below Let the correlation of

(20 points) A portfolio is to be constructed from two stocks whose mean and variance of return rates are given below Let the correlation of the return rates of these stocks be . (1) If =0.3, determine the global minimum-variance portfolio, and sketch the (p,rp) graph. (2) If the two assets have perfectly negative correlated returns, i.e. =1, show that the (p,rp)-graph comprises two straight line, and plot this graph. Calculate the mean return of the global minimum-risk portfolio. (20 points) A portfolio is to be constructed from two stocks whose mean and variance of return rates are given below Let the correlation of the return rates of these stocks be . (1) If =0.3, determine the global minimum-variance portfolio, and sketch the (p,rp) graph. (2) If the two assets have perfectly negative correlated returns, i.e. =1, show that the (p,rp)-graph comprises two straight line, and plot this graph. Calculate the mean return of the global minimum-risk portfolio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started