Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(20 points) Assume that one option contract gives the buyer the right to buy one share of each common stock on which the option

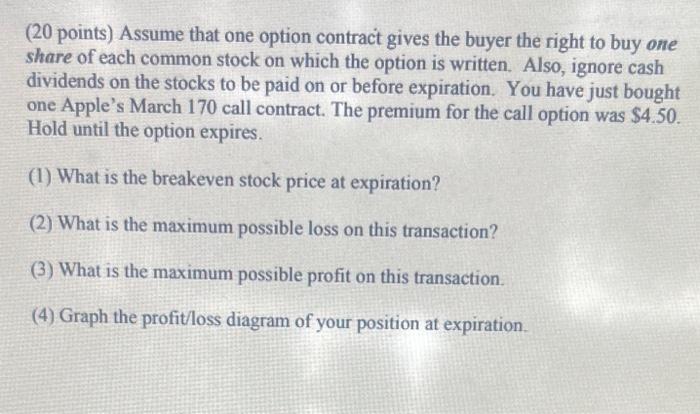

(20 points) Assume that one option contract gives the buyer the right to buy one share of each common stock on which the option is written. Also, ignore cash dividends on the stocks to be paid on or before expiration. You have just bought one Apple's March 170 call contract. The premium for the call option was $4.50. Hold until the option expires. (1) What is the breakeven stock price at expiration? (2) What is the maximum possible loss on this transaction? (3) What is the maximum possible profit on this transaction. (4) Graph the profit/loss diagram of your position at expiration. (20 points) Assume that one option contract gives the buyer the right to buy one share of each common stock on which the option is written. Also, ignore cash dividends on the stocks to be paid on or before expiration. You have just bought one Apple's March 170 call contract. The premium for the call option was $4.50. Hold until the option expires. (1) What is the breakeven stock price at expiration? (2) What is the maximum possible loss on this transaction? (3) What is the maximum possible profit on this transaction. (4) Graph the profit/loss diagram of your position at expiration. (20 points) Assume that one option contract gives the buyer the right to buy one share of each common stock on which the option is written. Also, ignore cash dividends on the stocks to be paid on or before expiration. You have just bought one Apple's March 170 call contract. The premium for the call option was $4.50. Hold until the option expires. (1) What is the breakeven stock price at expiration? (2) What is the maximum possible loss on this transaction? (3) What is the maximum possible profit on this transaction. (4) Graph the profit/loss diagram of your position at expiration.

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 The breakeven stock price at expiration is calculated as the strike price plus the premium paid fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started