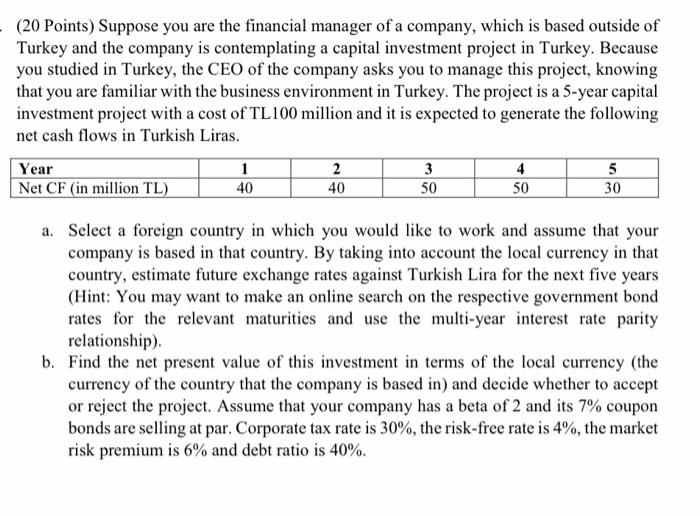

(20 Points) Suppose you are the financial manager of a company, which is based outside of Turkey and the company is contemplating a capital investment project in Turkey. Because you studied in Turkey, the CEO of the company asks you to manage this project, knowing that you are familiar with the business environment in Turkey. The project is a 5-year capital investment project with a cost of TL 100 million and it is expected to generate the following net cash flows in Turkish Liras. Year 1 2 3 4 5 Net CF (in million TL) 50 40 40 50 30 a. Select a foreign country in which you would like to work and assume that your company is based in that country. By taking into account the local currency in that country, estimate future exchange rates against Turkish Lira for the next five years (Hint: You may want to make an online search on the respective government bond rates for the relevant maturities and use the multi-year interest rate parity relationship) b. Find the net present value of this investment in terms of the local currency (the currency of the country that the company is based in) and decide whether to accept or reject the project. Assume that your company has a beta of 2 and its 7% coupon bonds are selling at par. Corporate tax rate is 30%, the risk-free rate is 4%, the market risk premium is 6% and debt ratio is 40%. (20 Points) Suppose you are the financial manager of a company, which is based outside of Turkey and the company is contemplating a capital investment project in Turkey. Because you studied in Turkey, the CEO of the company asks you to manage this project, knowing that you are familiar with the business environment in Turkey. The project is a 5-year capital investment project with a cost of TL 100 million and it is expected to generate the following net cash flows in Turkish Liras. Year 1 2 3 4 5 Net CF (in million TL) 50 40 40 50 30 a. Select a foreign country in which you would like to work and assume that your company is based in that country. By taking into account the local currency in that country, estimate future exchange rates against Turkish Lira for the next five years (Hint: You may want to make an online search on the respective government bond rates for the relevant maturities and use the multi-year interest rate parity relationship) b. Find the net present value of this investment in terms of the local currency (the currency of the country that the company is based in) and decide whether to accept or reject the project. Assume that your company has a beta of 2 and its 7% coupon bonds are selling at par. Corporate tax rate is 30%, the risk-free rate is 4%, the market risk premium is 6% and debt ratio is 40%