Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(20 points) The balance sheet for an Egyptian subsidiary of a British company appears below. The home reporting currency is the British pound (UK),

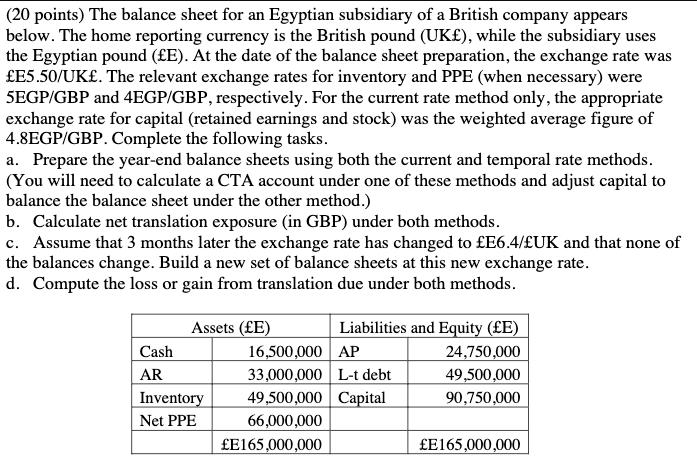

(20 points) The balance sheet for an Egyptian subsidiary of a British company appears below. The home reporting currency is the British pound (UK), while the subsidiary uses the Egyptian pound (E). At the date of the balance sheet preparation, the exchange rate was E5.50/UK. The relevant exchange rates for inventory and PPE (when necessary) were 5EGP/GBP and 4EGP/GBP, respectively. For the current rate method only, the appropriate exchange rate for capital (retained earnings and stock) was the weighted average figure of 4.8EGP/GBP. Complete the following tasks. a. Prepare the year-end balance sheets using both the current and temporal rate methods. (You will need to calculate a CTA account under one of these methods and adjust capital to balance the balance sheet under the other method.) b. Calculate net translation exposure (in GBP) under both methods. c. Assume that 3 months later the exchange rate has changed to E6.4/UK and that none of the balances change. Build a new set of balance sheets at this new exchange rate. d. Compute the loss or gain from translation due under both methods. Cash AR Assets (E) Inventory Net PPE Liabilities and Equity (E) 24,750,000 49,500,000 90,750,000 16,500,000 AP 33,000,000 L-t debt 49,500,000 Capital 66,000,000 E165,000,000 E165,000,000

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below A Current Rate Method Assets E Cash 165...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started