Question: (20 points) Your company is considering a five-year project to boost your sales. By purchasing a new machine, you expect to increase sales by X

-

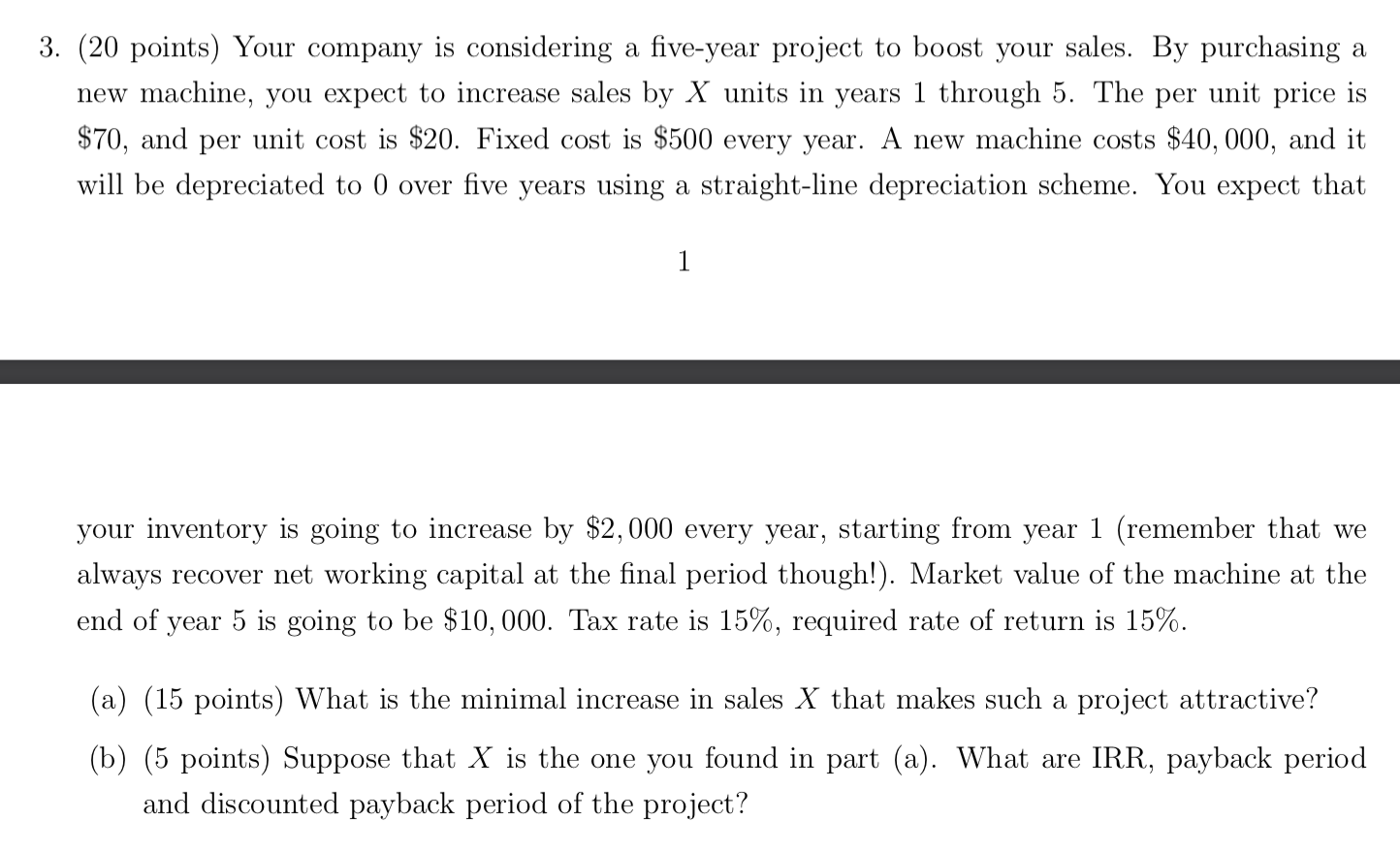

(20 points) Your company is considering a five-year project to boost your sales. By purchasing a new machine, you expect to increase sales by X units in years 1 through 5. The per unit price is $70, and per unit cost is $20. Fixed cost is $500 every year. A new machine costs $40, 000, and it will be depreciated to 0 over five years using a straight-line depreciation scheme. You expect that your inventory is going to increase by $2, 000 every year, starting from year 1 (remember that we always recover net working capital at the final period though!). Market value of the machine at the end of year 5 is going to be $10, 000. Tax rate is 15%, required rate of return is 15%. (a) (15 points) What is the minimal increase in sales X that makes such a project attractive? (b) (5 points) Suppose that X is the one you found in part (a). What are IRR, payback period and discounted payback period of the project?

3. (20 points) Your company is considering a five-year project to boost your sales. By purchasing a new machine, you expect to increase sales by X units in years 1 through 5. The per unit price is $70, and per unit cost is $20. Fixed cost is $500 every year. A new machine costs $40,000, and it will be depreciated to 0 over five years using a straight-line depreciation scheme. You expect that 1 your inventory is going to increase by $2,000 every year, starting from year 1 (remember that we always recover net working capital at the final period though!). Market value of the machine at the end of year 5 is going to be $10,000. Tax rate is 15%, required rate of return is 15%. (a) (15 points) What is the minimal increase in sales X that makes such a project attractive? (b) (5 points) Suppose that X is the one you found in part (a). What are IRR, payback period and discounted payback period of the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts