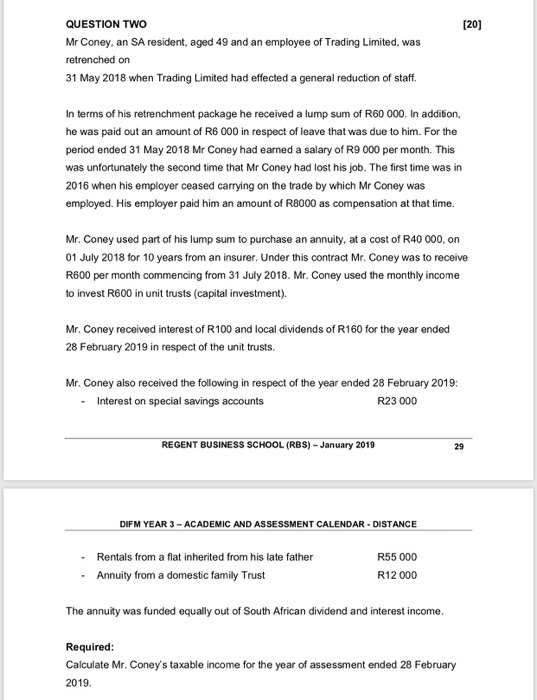

[20] QUESTION TWO Mr Coney, an SA resident, aged 49 and an employee of Trading Limited, was retrenched on 31 May 2018 when Trading Limited had effected a general reduction of staff. In terms of his retrenchment package he received a lump sum of R60 000. In addition, he was paid out an amount of R6 000 in respect of leave that was due to him. For the period ended 31 May 2018 Mr Coney had earned a salary of R9 000 per month. This was unfortunately the second time that Mr Coney had lost his job. The first time was in 2016 when his employer ceased carrying on the trade by which Mr Coney was employed. His employer paid him an amount of R8000 as compensation at that time. Mr. Coney used part of his lump sum to purchase an annuity, at a cost of R40 000, on 01 July 2018 for 10 years from an insurer. Under this contract Mr. Coney was to receive R600 per month commencing from 31 July 2018. Mr. Coney used the monthly income to invest R600 in unit trusts (capital investment). Mr. Coney received interest of R100 and local dividends of R160 for the year ended 28 February 2019 in respect of the unit trusts. Mr. Coney also received the following in respect of the year ended 28 February 2019: Interest on special savings accounts R23 000 REGENT BUSINESS SCHOOL (RBS) - January 2019 29 DIFM YEAR 3 - ACADEMIC AND ASSESSMENT CALENDAR - DISTANCE Rentals from a flat inherited from his late father Annuity from a domestic family Trust R55 000 R12 000 The annuity was funded equally out of South African dividend and interest income. Required: Calculate Mr. Coney's taxable income for the year of assessment ended 28 February 2019. [20] QUESTION TWO Mr Coney, an SA resident, aged 49 and an employee of Trading Limited, was retrenched on 31 May 2018 when Trading Limited had effected a general reduction of staff. In terms of his retrenchment package he received a lump sum of R60 000. In addition, he was paid out an amount of R6 000 in respect of leave that was due to him. For the period ended 31 May 2018 Mr Coney had earned a salary of R9 000 per month. This was unfortunately the second time that Mr Coney had lost his job. The first time was in 2016 when his employer ceased carrying on the trade by which Mr Coney was employed. His employer paid him an amount of R8000 as compensation at that time. Mr. Coney used part of his lump sum to purchase an annuity, at a cost of R40 000, on 01 July 2018 for 10 years from an insurer. Under this contract Mr. Coney was to receive R600 per month commencing from 31 July 2018. Mr. Coney used the monthly income to invest R600 in unit trusts (capital investment). Mr. Coney received interest of R100 and local dividends of R160 for the year ended 28 February 2019 in respect of the unit trusts. Mr. Coney also received the following in respect of the year ended 28 February 2019: Interest on special savings accounts R23 000 REGENT BUSINESS SCHOOL (RBS) - January 2019 29 DIFM YEAR 3 - ACADEMIC AND ASSESSMENT CALENDAR - DISTANCE Rentals from a flat inherited from his late father Annuity from a domestic family Trust R55 000 R12 000 The annuity was funded equally out of South African dividend and interest income. Required: Calculate Mr. Coney's taxable income for the year of assessment ended 28 February 2019