Question

20. Suppose that Jeff thinks that Ganargua Hydros stock will rise, and wants to buy options for 500 shares. The companys current share price is

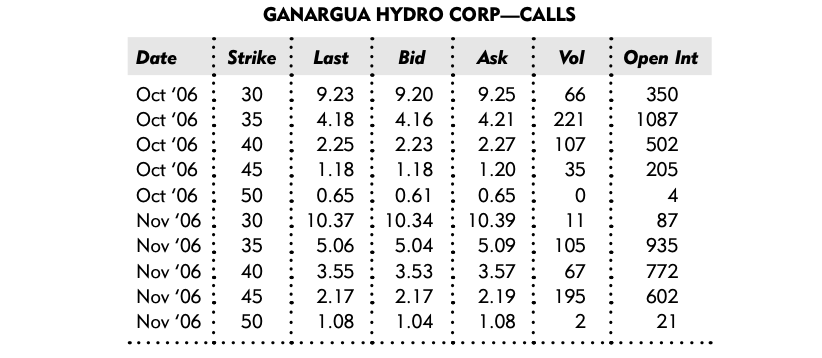

20. Suppose that Jeff thinks that Ganargua Hydros stock will rise, and wants to buy options for 500 shares. The companys current share price is $35.59. Each contract represents the right to buy 100 shares. From the book "The mathematics of Money, math for business and personal finance decision by Thimothy J. Biehler.

20. Suppose that Jeff thinks that Ganargua Hydros stock will rise, and wants to buy options for 500 shares. The companys current share price is $35.59. Each contract represents the right to buy 100 shares. From the book "The mathematics of Money, math for business and personal finance decision by Thimothy J. Biehler.

a. How many options contracts would Jeff buy?

b. Calculate the total cost for Jeff to buy a November 2006 call option for 500 shares at a strike price of $45.

c. Suppose that Jeff is right that the price will rise. If the price rises to $45 a share and he exercises his option, calculate his profit or loss. d. If the price rises to $50 a share and he exercises his option, calculate his profit or loss.

e. Suppose that Jeff exercises his options 55 days after buying the contract, when the stock price is $49.93. Calculate his profi t as a percent rate of return.

f. What is the minimum share price at which Jeff can exercise his options without losing money?

GANARGUA HYDRO CORP-CALLS Date Strike Last Bid Ask Vol Open Int Oct '06 : 30 Oct '06: 35 Oct '06 40 Oct '06 45 Oct '06 50 Nov '06: 30 Nov '06 35 Nov '06 40 Nov '06: 45 Nov '06: 50 9.23 : 9.20 9.25 : 66 4.18 4.16 4.21 : 221 2.25 2.23 2.27 107 1.18 1.18 1.20 35 0.65 0.61 0.65 0 10.37 : 10.34 : 10.39 11 5.06 : 5.04 5.09 105 3.55 3.53 3.57 67 2.17 2.17 2.19 195 1.08 : 1.04 1.08 2 350 1087 502 205 4 87 935 772 602 21 GANARGUA HYDRO CORP-CALLS Date Strike Last Bid Ask Vol Open Int Oct '06 : 30 Oct '06: 35 Oct '06 40 Oct '06 45 Oct '06 50 Nov '06: 30 Nov '06 35 Nov '06 40 Nov '06: 45 Nov '06: 50 9.23 : 9.20 9.25 : 66 4.18 4.16 4.21 : 221 2.25 2.23 2.27 107 1.18 1.18 1.20 35 0.65 0.61 0.65 0 10.37 : 10.34 : 10.39 11 5.06 : 5.04 5.09 105 3.55 3.53 3.57 67 2.17 2.17 2.19 195 1.08 : 1.04 1.08 2 350 1087 502 205 4 87 935 772 602 21Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started