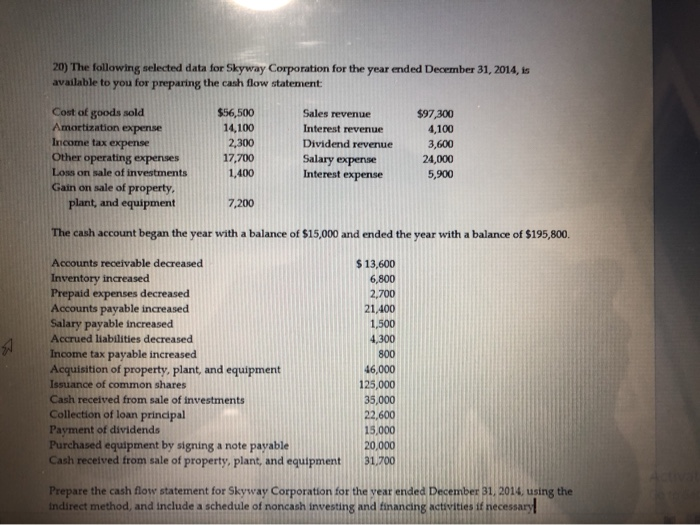

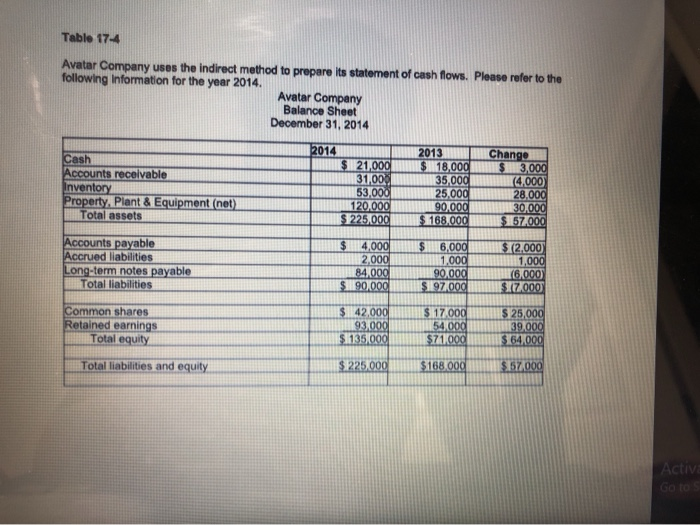

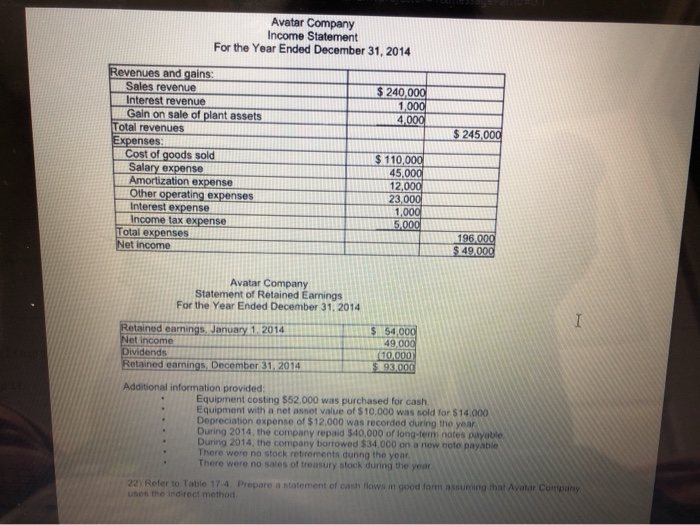

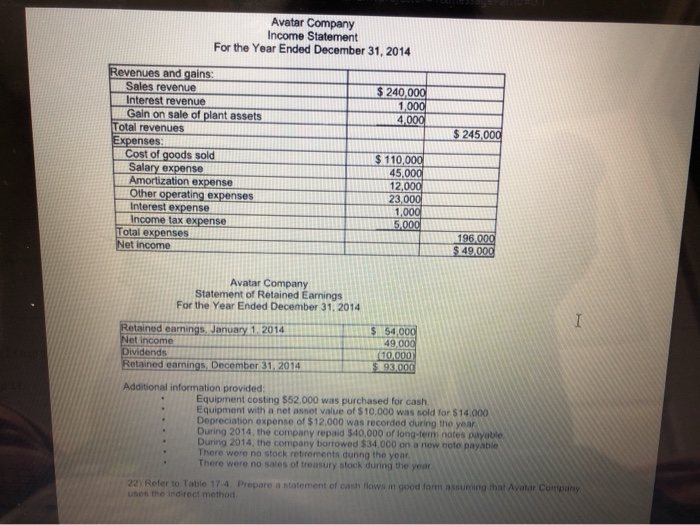

20) The following selected data for Skyway Corporation for the year ended December 31, 2014, is available to you for preparing the cash flow statement Cost of goods sold $56,500 Sales revenue $97,300 Amortization expense 14,100 Interest revenue 4,100 Income tax expense 2,300 Dividend revenue 3,600 Other operating experises 17,700 Salary expense 24,000 Loss on sale of investments 1,400 Interest expense 5,900 Gain on sale of property, plant, and equipment 7,200 The cash account began the year with a balance of $15,000 and ended the year with a balance of $195,800 Accounts receivable decreased Inventory increased Prepaid expenses decreased Accounts payable increased Salary payable increased Accrued liabilities decreased Income tax payable increased Acquisition of property, plant, and equipment Issuance of common shares Cash received from sale of investments Collection of loan principal Payment of dividends Purchased equipment by signing a note payable Cash received from sale of property, plant, and equipment $ 13,600 6,800 2,700 21,400 1,500 4,300 800 46,000 125,000 35,000 22,600 15,000 20,000 31,700 Prepare the cash flow statement for Skyway Corporation for the year ended December 31, 2014, using the Indirect method, and include a schedule of noncash investing and financing activities if necessary! Tablo 17-4 Avatar Company uses the indirect method to prepare its statement of cash flows. Please refer to the following Information for the year 2014. Avatar Company Balance Sheet December 31, 2014 $ Cash Accounts receivable Inventory Property. Plant & Equipment (net) Total assets 2014 $ 21,000 31,000 53,000 120.000 $225,000 2013 $ 18,000 35,000 25,000 90.000 $ 168,000 Change 3,000 (4,000) 28.000 30.000 $ 57.000 Accounts payable Accrued liabilities Long-term notes payable Total liabilities $ 4,000 2,000 84.000 $90.000 6,000 1,000 90,000 SI 97.000 $12.000 1,000 16,000) $17.000 Common shares Retained earnings Total equity $ 42,000 93.000 $ 135,000 $ 17.000 54.000 $71.000 $ 25,000 39.000 $ 64,000 Total liabilities and equity $225,000 $168.000 $57,000 Activi Go to s Avatar Company Income Statement For the Year Ended December 31, 2014 $ 240,000 1,000 4.000 $ 245.000 Revenues and gains: Sales revenue Interest revenue Gain on sale of plant assets Total revenues Expenses Cost of goods sold Salary expense Amortization expense Other operating expenses Interest expense Income tax expense Total expenses Net Income $ 110,000 45,000 12,000 23,000 1,000 5.000 196.000 $ 49.000 Avatar Company Statement of Retained Earnings For the Year Ended December 31, 2014 Retained earnings, January 1, 2014 Net income Dividends Retained earnings, December 31, 2014 $ 54,000 49.000 (10,000) $ 93,000 Additional information provided Equipment costing $52.000 was purchased for cash Equipment with a net asset value of $10,000 was sold for $14.000 Depreciation expense of $12,000 was recorded during the year During 2014, the company repaid $40,000 or long-term notes payable During 2014, the company borrowed $34.000 on a new note payable There were no stock retirements during the year There were no sales of treasury stock during the year 22) Refer to Table 17.4. Prepare a statement of cash flows in good form assuming that Avatar Company use the indirect method