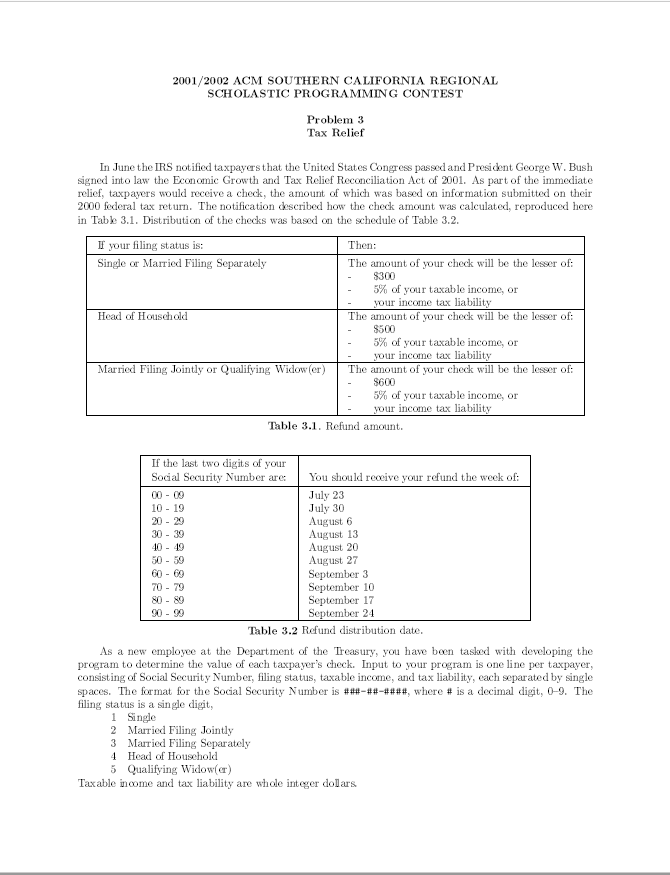

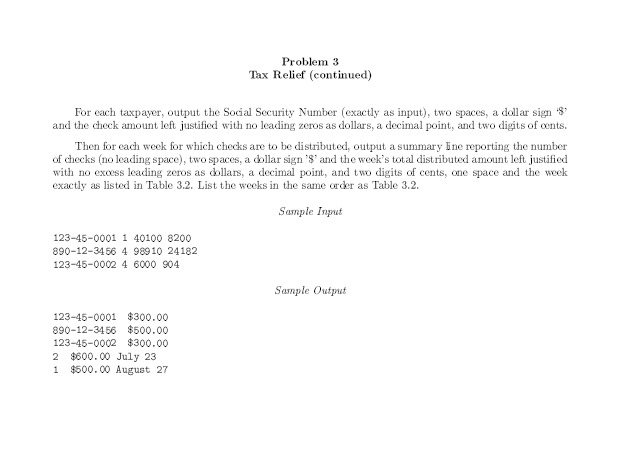

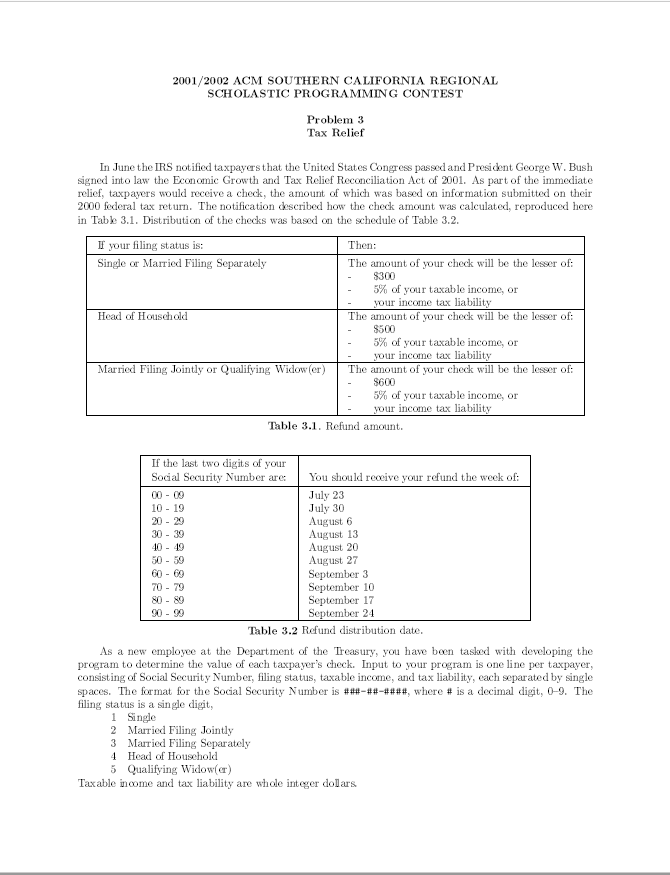

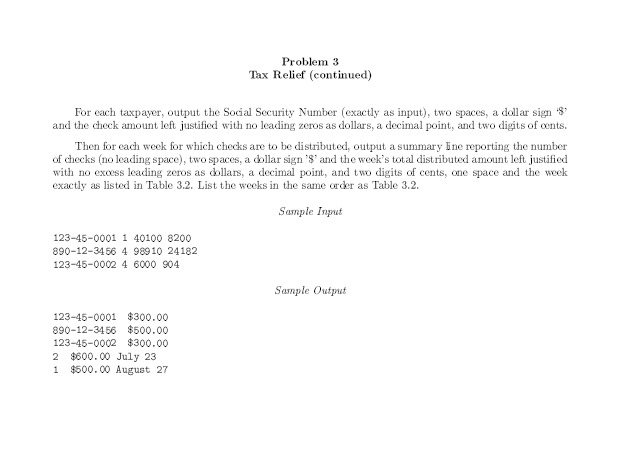

200 1/2002 ACM SOUTHERN CALIFORNIA REGIONAL SCHOLASTIC PROGRAMMING CONTEST Problem 3 Tax Relief In June the IRS notified taxpayers that the United States Congress passed and President George W. Bush signed into law the Economic Growth and Tax Relief Reconciliation Act of 2001. As part of the immediate relicf, taxpayers would receive a check, the amunt of which was basedon information submitted on their 2000 federal tax return. The notification described how the check amount was calculated, reproduced here in Table 3.1. Distribution of the checks was based on the schedule of Table 3.2. F your filing status is: Single or Married Filing Separately Then: The amount of your check will be the lesser of: 8300 5% of your taxable income, or your incme tax liability Head of Houschold The amount of your check will be the lesser of: 5% of your taxable income, or your income tax liability Married Filing Jointly or Qualifying Wid(The amount of your check will be the lesser of: 5% of your taxable income, or your income tax liability Table 3.1. Refund amount If the last two digits of your Social Security NumberYou should r 00-00 10- 19 20- 29 30 - 39 40-49 50- 59 60- 69 reocive your refund the week of July 23 July 30 August 13 August 20 August 27 September 3 80- 89 September 17 September 24 Table 3.2 Refund distribution date As a new employee at the Department of the Treasury, you have boen tasked with developing the program to determine the value of each taxpayer's check. Input to your program is one line per taxpayer, consisting of Social Security Number, filing status, taxable income, and tax liability each separated by single spaces. The format for the Social Security Number is ###-## ####, where # is a decimal digi, 0-9. The filing status is a single digit, 1 Single 2 Married Filing Jointly 3 Married Filing Separately Head of Houschold 5 Qualifying Widow(er Taxable ioome and tax liability are whole integer dolars 200 1/2002 ACM SOUTHERN CALIFORNIA REGIONAL SCHOLASTIC PROGRAMMING CONTEST Problem 3 Tax Relief In June the IRS notified taxpayers that the United States Congress passed and President George W. Bush signed into law the Economic Growth and Tax Relief Reconciliation Act of 2001. As part of the immediate relicf, taxpayers would receive a check, the amunt of which was basedon information submitted on their 2000 federal tax return. The notification described how the check amount was calculated, reproduced here in Table 3.1. Distribution of the checks was based on the schedule of Table 3.2. F your filing status is: Single or Married Filing Separately Then: The amount of your check will be the lesser of: 8300 5% of your taxable income, or your incme tax liability Head of Houschold The amount of your check will be the lesser of: 5% of your taxable income, or your income tax liability Married Filing Jointly or Qualifying Wid(The amount of your check will be the lesser of: 5% of your taxable income, or your income tax liability Table 3.1. Refund amount If the last two digits of your Social Security NumberYou should r 00-00 10- 19 20- 29 30 - 39 40-49 50- 59 60- 69 reocive your refund the week of July 23 July 30 August 13 August 20 August 27 September 3 80- 89 September 17 September 24 Table 3.2 Refund distribution date As a new employee at the Department of the Treasury, you have boen tasked with developing the program to determine the value of each taxpayer's check. Input to your program is one line per taxpayer, consisting of Social Security Number, filing status, taxable income, and tax liability each separated by single spaces. The format for the Social Security Number is ###-## ####, where # is a decimal digi, 0-9. The filing status is a single digit, 1 Single 2 Married Filing Jointly 3 Married Filing Separately Head of Houschold 5 Qualifying Widow(er Taxable ioome and tax liability are whole integer dolars