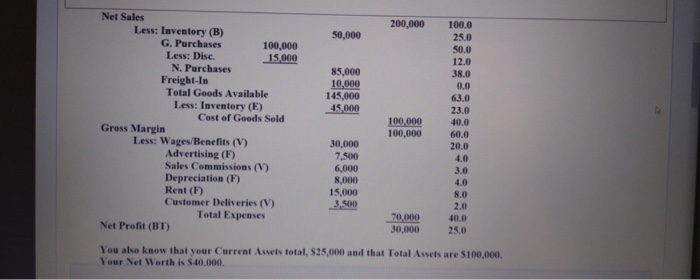

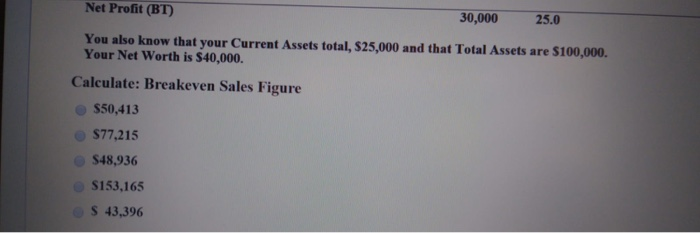

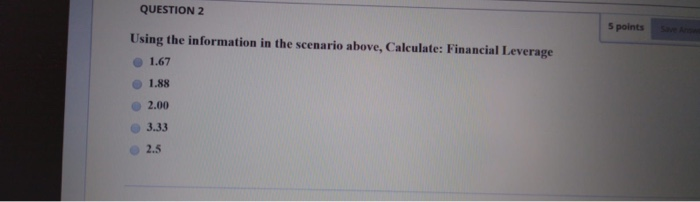

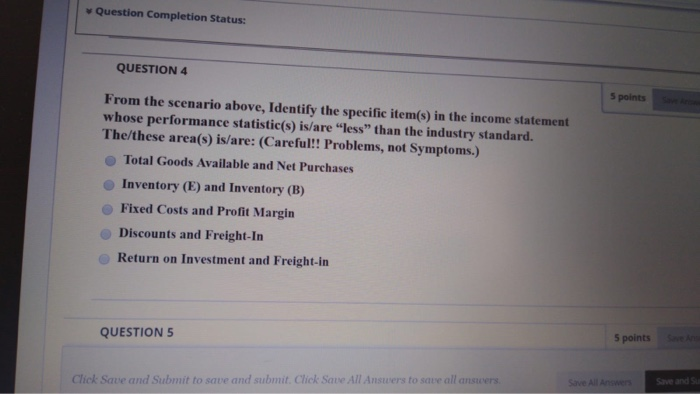

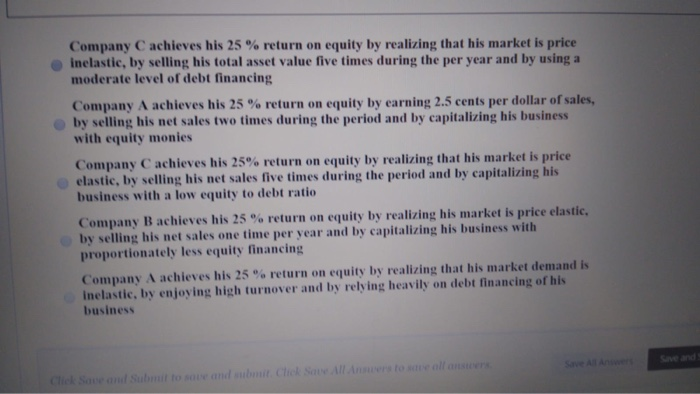

200,000 50,000 100.0 25.0 50.0 12.0 38.0 85,000 10,000 145,000 45,000 0.0 63.0 23.0 Net Sales Less: Inventory (B) G. Purchases 100,000 Less: Disc. 15,000 N. Purchases Freight-In Total Goods Available Less: Inventory (E) Cost of Goods Sold Gross Margin Less: Wages/Benefits (V) Advertising (F) Sales Commissions (V) Depreciation (F) Rent (F) Customer Deliveries (V) Total Expenses Net Profit (BT) 100,000 100,000 30,000 7,500 6,000 8,000 15.000 3.500 60.0 20.0 4.0 3.0 4.0 8.0 2.0 70,000 30.000 25.0 You ako know that your Current Assets total, $25,000 and that Total Assets are $100,000. Your Net Worth is $40.000. Net Profit (BT) 30,000 25.0 You also know that your Current Assets total, $25,000 and that Total Assets are $100,000. Your Net Worth is $40,000. Calculate: Breakeven Sales Figure $50,413 $77,215 S48,936 S153,165 S 43.396 QUESTION 2 5 points Using the information in the scenario above, Calculate: Financial Leverage 1.67 1.88 2.00 Question Completion Status: QUESTION 4 5 points From the scenario above, Identify the specific item(s) in the income statement whose performance statistic(s) is/are "less" than the industry standard. The/these area(s) is/are: (Careful!! Problems, not Symptoms.) Total Goods Available and Net Purchases Inventory (E) and Inventory (B) Fixed Costs and Profit Margin Discounts and Freight-In Return on Investment and Freight-in QUESTION 5 5 points Click Save and Submit to save and submit. Click Save All Answers to see all answer Save All Answers Save and su Company C achieves his 25 % return on equity by realizing that his market is price inelastic, by selling his total asset value five times during the per year and by using a moderate level of debt financing Company A achieves his 25 % return on equity by earning 2.5 cents per dollar of sales. by selling his net sales two times during the period and by capitalizing his business with equity monies Company Cachieves his 25% return on equity by realizing that his market is price elastie, by selling his net sales five times during the period and by capitalizing his business with a low equity to debt ratio Company B achieves his 25 % return on equity by realizing his market is price elastic. by selling his net sales one time per year and by capitalizing his business with proportionately less equity financing Company Aachieves his 25% return on equity by realizing that his market demand is Inelastie, by enjoying high turnover and by relying heavily on debt financing of his business Click Save and submit to save and subunt. Click Save All Answers to save all answers. 200,000 50,000 100.0 25.0 50.0 12.0 38.0 85,000 10,000 145,000 45,000 0.0 63.0 23.0 Net Sales Less: Inventory (B) G. Purchases 100,000 Less: Disc. 15,000 N. Purchases Freight-In Total Goods Available Less: Inventory (E) Cost of Goods Sold Gross Margin Less: Wages/Benefits (V) Advertising (F) Sales Commissions (V) Depreciation (F) Rent (F) Customer Deliveries (V) Total Expenses Net Profit (BT) 100,000 100,000 30,000 7,500 6,000 8,000 15.000 3.500 60.0 20.0 4.0 3.0 4.0 8.0 2.0 70,000 30.000 25.0 You ako know that your Current Assets total, $25,000 and that Total Assets are $100,000. Your Net Worth is $40.000. Net Profit (BT) 30,000 25.0 You also know that your Current Assets total, $25,000 and that Total Assets are $100,000. Your Net Worth is $40,000. Calculate: Breakeven Sales Figure $50,413 $77,215 S48,936 S153,165 S 43.396 QUESTION 2 5 points Using the information in the scenario above, Calculate: Financial Leverage 1.67 1.88 2.00 Question Completion Status: QUESTION 4 5 points From the scenario above, Identify the specific item(s) in the income statement whose performance statistic(s) is/are "less" than the industry standard. The/these area(s) is/are: (Careful!! Problems, not Symptoms.) Total Goods Available and Net Purchases Inventory (E) and Inventory (B) Fixed Costs and Profit Margin Discounts and Freight-In Return on Investment and Freight-in QUESTION 5 5 points Click Save and Submit to save and submit. Click Save All Answers to see all answer Save All Answers Save and su Company C achieves his 25 % return on equity by realizing that his market is price inelastic, by selling his total asset value five times during the per year and by using a moderate level of debt financing Company A achieves his 25 % return on equity by earning 2.5 cents per dollar of sales. by selling his net sales two times during the period and by capitalizing his business with equity monies Company Cachieves his 25% return on equity by realizing that his market is price elastie, by selling his net sales five times during the period and by capitalizing his business with a low equity to debt ratio Company B achieves his 25 % return on equity by realizing his market is price elastic. by selling his net sales one time per year and by capitalizing his business with proportionately less equity financing Company Aachieves his 25% return on equity by realizing that his market demand is Inelastie, by enjoying high turnover and by relying heavily on debt financing of his business Click Save and submit to save and subunt. Click Save All Answers to save all answers