Answered step by step

Verified Expert Solution

Question

1 Approved Answer

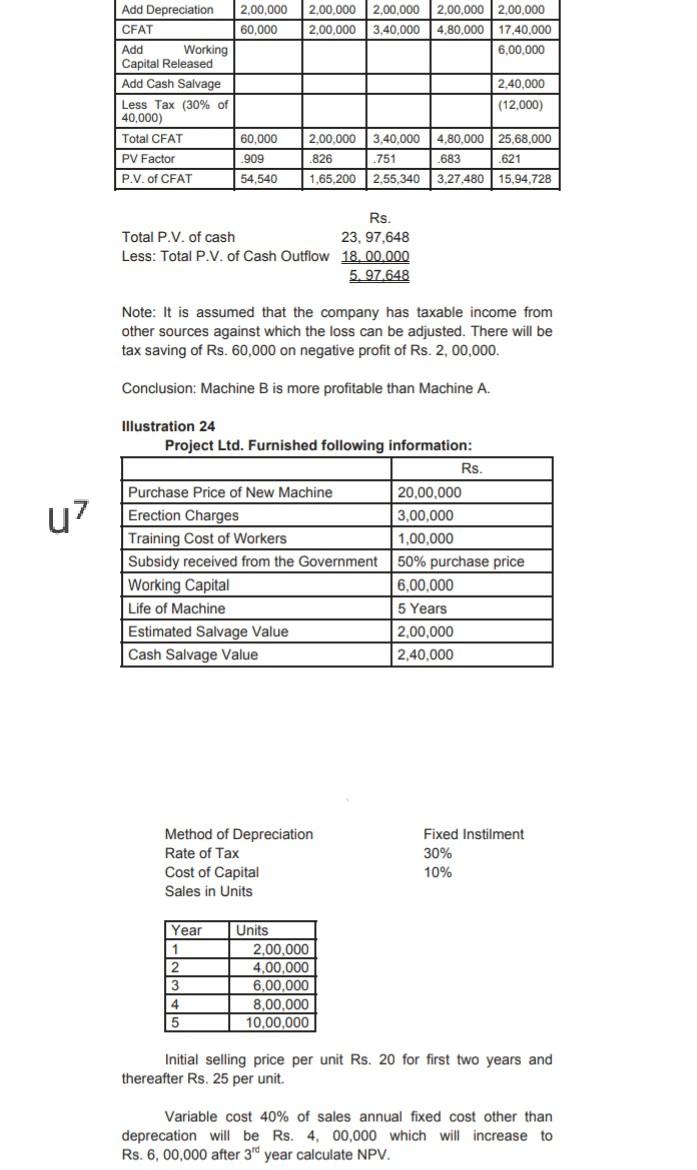

2,00,000 60,000 2,00.000 2,00,000 2,00,000 3,40,000 2,00,000 2,00,000 4,80.000 17,40,000 6,00.000 Add Depreciation CFAT Add Working Capital Released Add Cash Salvage Less Tax (30% of

2,00,000 60,000 2,00.000 2,00,000 2,00,000 3,40,000 2,00,000 2,00,000 4,80.000 17,40,000 6,00.000 Add Depreciation CFAT Add Working Capital Released Add Cash Salvage Less Tax (30% of 40,000) Total CFAT PV Factor P.V. of CFAT 2.40.000 (12,000) 60.000 .909 54,540 2.00.000 .826 3,40,000 751 2.55.340 4,80,000 25,68,000 _683 .621 3.27.480 15,94,728 1.65.200 Rs. Total P.V. of cash 23, 97,648 Less: Total P.V. of Cash Outflow 18.00.000 5. 97.648 Note: It is assumed that the company has taxable income from other sources against which the loss can be adjusted. There will be tax saving of Rs. 60,000 on negative profit of Rs. 2, 00,000. Conclusion: Machine B is more profitable than Machine A. u7 Illustration 24 Project Ltd. Furnished following information: Rs. Purchase Price of New Machine 20,00,000 Erection Charges 3,00,000 Training Cost of Workers 1,00,000 Subsidy received from the Government 50% purchase price Working Capital 6.00,000 Life of Machine 5 Years Estimated Salvage Value 2,00,000 Cash Salvage Value 2,40,000 Method of Depreciation Rate of Tax Cost of Capital Sales in Units Fixed Instilment 30% 10% Year 1 2 3 4 Units 2,00,000 4,00,000 6,00,000 8,00.000 10,00,000 5 Initial selling price per unit Rs. 20 for first two years and thereafter Rs. 25 per unit. Variable cost 40% of sales annual fixed cost other than deprecation will be Rs. 4, 00,000 which will increase to Rs. 6,00,000 after 3rd year calculate NPV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started