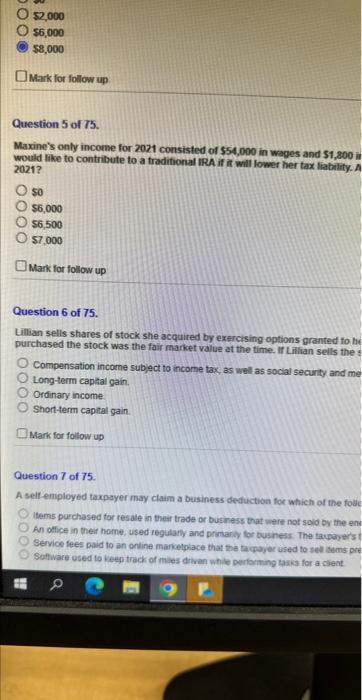

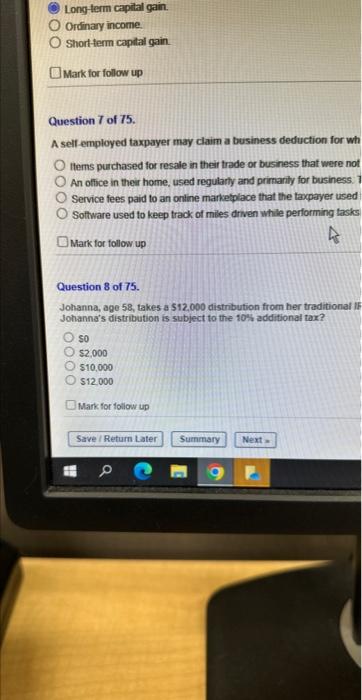

$2,000$5,000$8,000 Mark for follow up Question 5 of 75 . Maxine's only income for 2021 consisted of 554,000 in wages and 51,800 i. would like to contribute to a traditional IRA if it will lower her tax liability.. 2021? $0$6,000$6,500$7,000 Mark for follow up Question 6 of 75. Lillian sells shares of stock she acquired by exercising options granted to hy purchased the stock was the fair market value at the time. If Lillian sells the : Compensation income subject to income tax as well as social security and me Longterm captal gain. Ordinary income. Short-term capital gain. Mark for follow up Question 7 of 75 . A self employed taxpayer may claim a business deduction for which of the follc. items purchased for resale in their trade or business that were not soid by the ens An oflice in their home, used regulany and primanicy for busness. The tayayer's t Service fees paid to an ontine marielplace that the taceyer used to sel cems pre Sotware used to Leep track of mies diven whis perronting taks for a clent. Longterm capital gain. Ordinary income. Shortterm capital gain. Mark for follow up Question 7 of 75. A self employed taxpayer may claim a business deduction for wh Iterns purchased for resale in their trade or business that were not An office in their home, used regularty and primarily for business. 7 Service fees paid to an onine marketplace that the taxpayer used Soltware used to keep track of miles driven while performing tasks. Mark for follow up Question 8 of 75. Johanna, age 58 , takes a $12,000 distribution from her traditional If Johanna,'s distribution is subject to the 10% additional tax? so 52,000 510,000 $12.000 Mark for follow up $2,000$5,000$8,000 Mark for follow up Question 5 of 75 . Maxine's only income for 2021 consisted of 554,000 in wages and 51,800 i. would like to contribute to a traditional IRA if it will lower her tax liability.. 2021? $0$6,000$6,500$7,000 Mark for follow up Question 6 of 75. Lillian sells shares of stock she acquired by exercising options granted to hy purchased the stock was the fair market value at the time. If Lillian sells the : Compensation income subject to income tax as well as social security and me Longterm captal gain. Ordinary income. Short-term capital gain. Mark for follow up Question 7 of 75 . A self employed taxpayer may claim a business deduction for which of the follc. items purchased for resale in their trade or business that were not soid by the ens An oflice in their home, used regulany and primanicy for busness. The tayayer's t Service fees paid to an ontine marielplace that the taceyer used to sel cems pre Sotware used to Leep track of mies diven whis perronting taks for a clent. Longterm capital gain. Ordinary income. Shortterm capital gain. Mark for follow up Question 7 of 75. A self employed taxpayer may claim a business deduction for wh Iterns purchased for resale in their trade or business that were not An office in their home, used regularty and primarily for business. 7 Service fees paid to an onine marketplace that the taxpayer used Soltware used to keep track of miles driven while performing tasks. Mark for follow up Question 8 of 75. Johanna, age 58 , takes a $12,000 distribution from her traditional If Johanna,'s distribution is subject to the 10% additional tax? so 52,000 510,000 $12.000 Mark for follow up