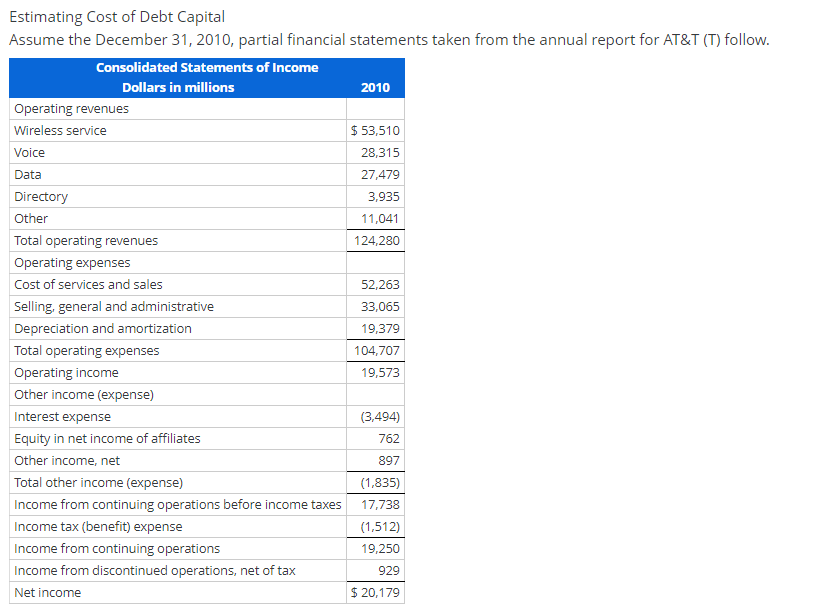

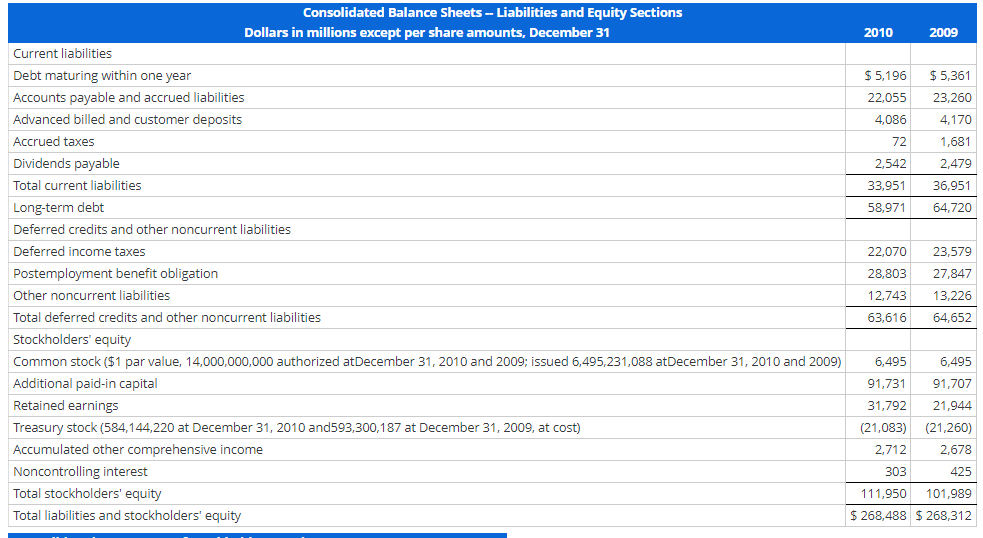

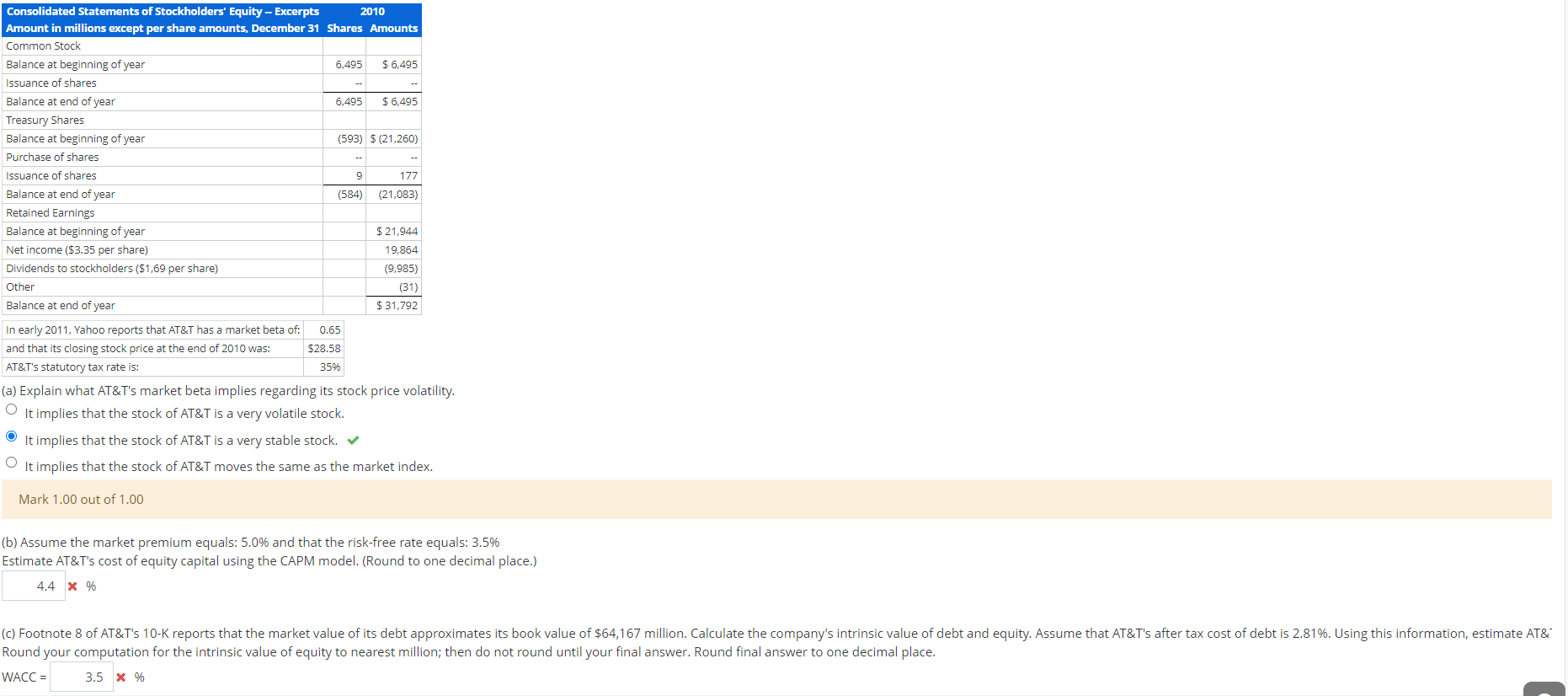

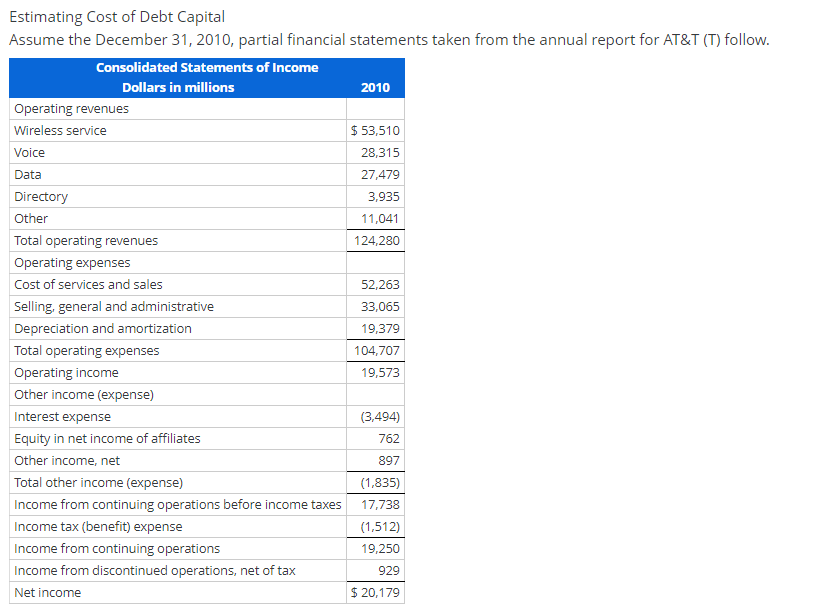

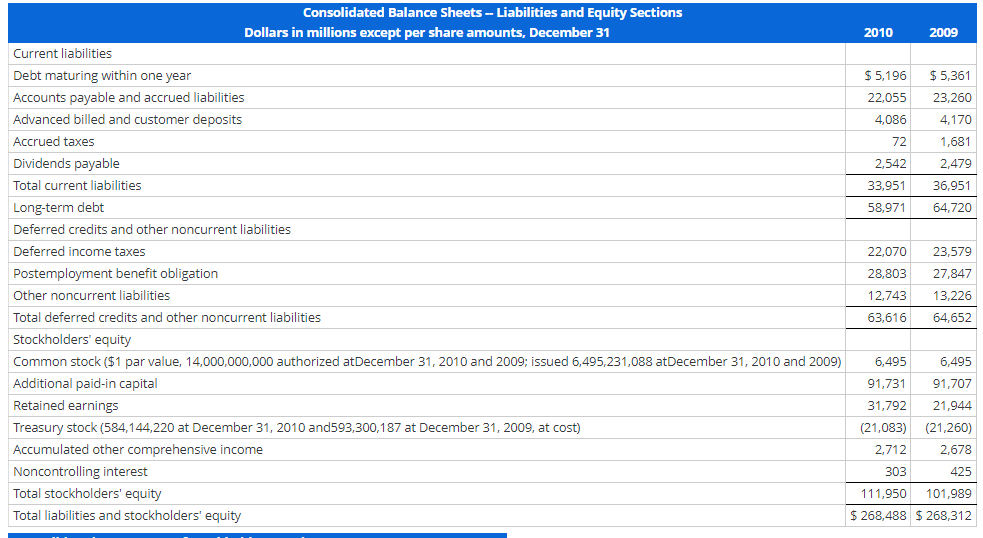

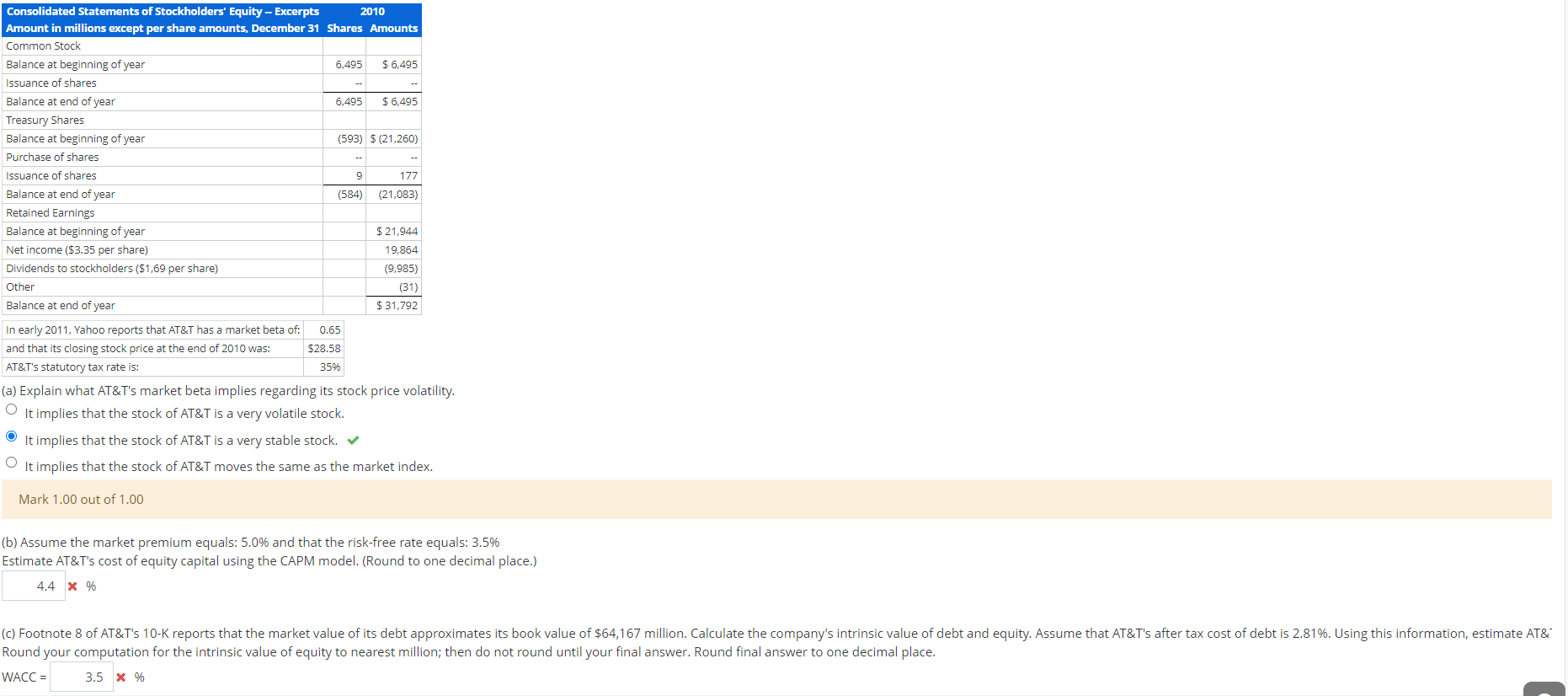

2010 Estimating Cost of Debt Capital Assume the December 31, 2010, partial financial statements taken from the annual report for AT&T (T) follow. Consolidated Statements of Income Dollars in millions Operating revenues Wireless service $ 53,510 Voice 28,315 Data 27,479 Directory 3,935 Other 11,041 Total operating revenues 124,280 Operating expenses Cost of services and sales 52,263 Selling, general and administrative 33,065 Depreciation and amortization 19,379 Total operating expenses 104,707 Operating income 19,573 Other income (expense) Interest expense (3,494) Equity in net income of affiliates 762 Other income, net 897 Total other income (expense) (1,835) Income from continuing operations before income taxes 17,738 Income tax (benefit) expense (1,512) Income from continuing operations 19,250 Income from discontinued operations, net of tax 929 Net income $ 20,179 2010 2009 $5,196 22,055 $ 5,361 23,260 4,086 4,170 72 1,681 2,542 33.951 58,971 2,479 36,951 64,720 Consolidated Balance Sheets -- Liabilities and Equity Sections Dollars in millions except per share amounts, December 31 Current liabilities Debt maturing within one year Accounts payable and accrued liabilities Advanced billed and customer deposits Accrued taxes Dividends payable Total current liabilities Long-term debt Deferred credits and other noncurrent liabilities Deferred income taxes Postemployment benefit obligation Other noncurrent liabilities Total deferred credits and other noncurrent liabilities Stockholders' equity Common stock ($1 par value, 14,000,000,000 authorized at December 31, 2010 and 2009; issued 6,495,231,088 at December 31, 2010 and 2009) Additional paid-in capital Retained earnings Treasury stock (584,144,220 at December 31, 2010 and593,300,187 at December 31, 2009, at cost) Accumulated other comprehensive income Noncontrolling interest Total stockholders' equity Total liabilities and stockholders' equity 22,070 28,803 23,579 27.847 13,226 64,652 12,743 63,616 6,495 6,495 91,731 91,707 31,792 21,944 (21,083) (21,260) 2,712 2,678 303 425 111,950 101,989 $ 268,488 $ 268,312 Consolidated Statements of Stockholders' Equity - Excerpts 2010 Amount in millions except per share amounts, December 31 Shares Amounts Common Stock Balance at beginning of year 6,495 $ 6,495 Issuance of shares Balance at end of year 6,495 $ 6,495 Treasury Shares Balance at beginning of year (593) $ (21,260) Purchase of shares Issuance of shares 9 177 Balance at end of year (584) (21,083) Retained Earnings Balance at beginning of year $ 21,944 Net income ($3.35 per share) 19,864 Dividends to stockholders ($1,69 per share) (9.985) Other (31) Balance at end of year $ 31,792 In early 2011, Yahoo reports that AT&T has a market beta of: 0.65 and that its closing stock price at the end of 2010 was: $28.58 AT&T's statutory tax rate is: 3596 (a) Explain what AT&T's market beta implies regarding its stock price volatility. O It implies that the stock of AT&T is a very volatile stock. It implies that the stock of AT&T is a very stable stock. It implies that the stock of AT&T moves the same as the market index. 0 Mark 1.00 out of 1.00 (b) Assume the market premium equals: 5.0% and that the risk-free rate equals: 3.5% Estimate AT&T's cost of equity capital using the CAPM model. (Round to one decimal place.) 4.4 X % (c) Footnote 8 of AT&T's 10-K reports that the market value of its debt approximates its book value of $64,167 million. Calculate the company's intrinsic value of debt and equity. Assume that AT&T's after tax cost of debt is 2.81%. Using this information, estimate AT& Round your computation for the intrinsic value of equity to nearest million; then do not round until your final answer. Round final answer to one decimal place. WACC = 3.5 X % 2010 Estimating Cost of Debt Capital Assume the December 31, 2010, partial financial statements taken from the annual report for AT&T (T) follow. Consolidated Statements of Income Dollars in millions Operating revenues Wireless service $ 53,510 Voice 28,315 Data 27,479 Directory 3,935 Other 11,041 Total operating revenues 124,280 Operating expenses Cost of services and sales 52,263 Selling, general and administrative 33,065 Depreciation and amortization 19,379 Total operating expenses 104,707 Operating income 19,573 Other income (expense) Interest expense (3,494) Equity in net income of affiliates 762 Other income, net 897 Total other income (expense) (1,835) Income from continuing operations before income taxes 17,738 Income tax (benefit) expense (1,512) Income from continuing operations 19,250 Income from discontinued operations, net of tax 929 Net income $ 20,179 2010 2009 $5,196 22,055 $ 5,361 23,260 4,086 4,170 72 1,681 2,542 33.951 58,971 2,479 36,951 64,720 Consolidated Balance Sheets -- Liabilities and Equity Sections Dollars in millions except per share amounts, December 31 Current liabilities Debt maturing within one year Accounts payable and accrued liabilities Advanced billed and customer deposits Accrued taxes Dividends payable Total current liabilities Long-term debt Deferred credits and other noncurrent liabilities Deferred income taxes Postemployment benefit obligation Other noncurrent liabilities Total deferred credits and other noncurrent liabilities Stockholders' equity Common stock ($1 par value, 14,000,000,000 authorized at December 31, 2010 and 2009; issued 6,495,231,088 at December 31, 2010 and 2009) Additional paid-in capital Retained earnings Treasury stock (584,144,220 at December 31, 2010 and593,300,187 at December 31, 2009, at cost) Accumulated other comprehensive income Noncontrolling interest Total stockholders' equity Total liabilities and stockholders' equity 22,070 28,803 23,579 27.847 13,226 64,652 12,743 63,616 6,495 6,495 91,731 91,707 31,792 21,944 (21,083) (21,260) 2,712 2,678 303 425 111,950 101,989 $ 268,488 $ 268,312 Consolidated Statements of Stockholders' Equity - Excerpts 2010 Amount in millions except per share amounts, December 31 Shares Amounts Common Stock Balance at beginning of year 6,495 $ 6,495 Issuance of shares Balance at end of year 6,495 $ 6,495 Treasury Shares Balance at beginning of year (593) $ (21,260) Purchase of shares Issuance of shares 9 177 Balance at end of year (584) (21,083) Retained Earnings Balance at beginning of year $ 21,944 Net income ($3.35 per share) 19,864 Dividends to stockholders ($1,69 per share) (9.985) Other (31) Balance at end of year $ 31,792 In early 2011, Yahoo reports that AT&T has a market beta of: 0.65 and that its closing stock price at the end of 2010 was: $28.58 AT&T's statutory tax rate is: 3596 (a) Explain what AT&T's market beta implies regarding its stock price volatility. O It implies that the stock of AT&T is a very volatile stock. It implies that the stock of AT&T is a very stable stock. It implies that the stock of AT&T moves the same as the market index. 0 Mark 1.00 out of 1.00 (b) Assume the market premium equals: 5.0% and that the risk-free rate equals: 3.5% Estimate AT&T's cost of equity capital using the CAPM model. (Round to one decimal place.) 4.4 X % (c) Footnote 8 of AT&T's 10-K reports that the market value of its debt approximates its book value of $64,167 million. Calculate the company's intrinsic value of debt and equity. Assume that AT&T's after tax cost of debt is 2.81%. Using this information, estimate AT& Round your computation for the intrinsic value of equity to nearest million; then do not round until your final answer. Round final answer to one decimal place. WACC = 3.5 X %