Answered step by step

Verified Expert Solution

Question

1 Approved Answer

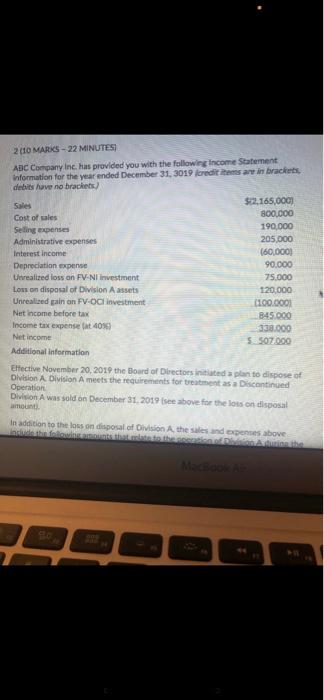

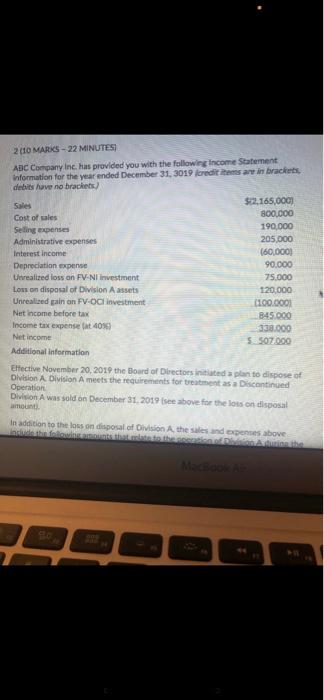

2010 MARKS- 22 MINUTES ABC Company Inc. has provided you with the following income Statement information for the year ended December 31, 3019 credits are

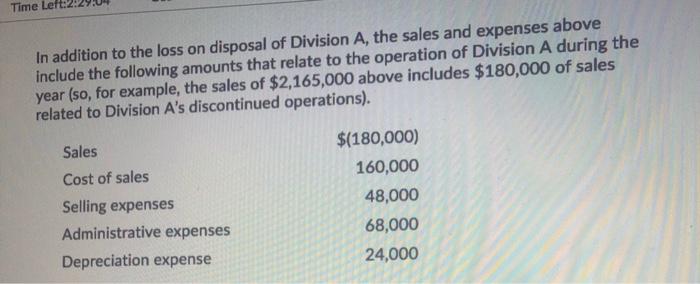

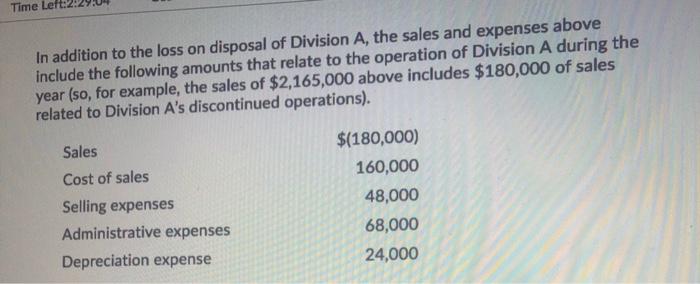

2010 MARKS- 22 MINUTES ABC Company Inc. has provided you with the following income Statement information for the year ended December 31, 3019 credits are in brackets debits have no brackets $22,165,000) 800,000 Cost of sales 190,000 Seting expenses Administrative expenses 205,000 Interest income 160,000) Depreciation expense 90.000 Unrealized loss on FV-NI investment 75.000 Low on disposal of Division A assets 120,000 Unrealized gain on FV-O investment 100.000 Net Income before tax 845.000 Income tax expense at 4099 5338.000 Net income 5.507.000 Additional information Effective November 20, 2014 the Board of Directors in a plan to dispose of Division A Division Ameets the requirements for treatment as a Discontinued Operation Division A was sold on December 31, 2019 see above for the loss on disposal amount In addition to the loss on disposal of Division A the sales and openses above acude the Time Lef In addition to the loss on disposal of Division A, the sales and expenses above include the following amounts that relate to the operation of Division A during the year (so, for example, the sales of $2,165,000 above includes $180,000 of sales related to Division A's discontinued operations). Sales Cost of sales Selling expenses Administrative expenses Depreciation expense $(180,000) 160,000 48,000 68,000 24,000 Journal entries for November 15th when all of the heaters for the bundles are shipped, including the related costs for the heaters. Format v BIU - *** 2010 MARKS- 22 MINUTES ABC Company Inc. has provided you with the following income Statement information for the year ended December 31, 3019 credits are in brackets debits have no brackets $22,165,000) 800,000 Cost of sales 190,000 Seting expenses Administrative expenses 205,000 Interest income 160,000) Depreciation expense 90.000 Unrealized loss on FV-NI investment 75.000 Low on disposal of Division A assets 120,000 Unrealized gain on FV-O investment 100.000 Net Income before tax 845.000 Income tax expense at 4099 5338.000 Net income 5.507.000 Additional information Effective November 20, 2014 the Board of Directors in a plan to dispose of Division A Division Ameets the requirements for treatment as a Discontinued Operation Division A was sold on December 31, 2019 see above for the loss on disposal amount In addition to the loss on disposal of Division A the sales and openses above acude the Time Lef In addition to the loss on disposal of Division A, the sales and expenses above include the following amounts that relate to the operation of Division A during the year (so, for example, the sales of $2,165,000 above includes $180,000 of sales related to Division A's discontinued operations). Sales Cost of sales Selling expenses Administrative expenses Depreciation expense $(180,000) 160,000 48,000 68,000 24,000 Journal entries for November 15th when all of the heaters for the bundles are shipped, including the related costs for the heaters. Format v BIU - ***

2010 MARKS- 22 MINUTES ABC Company Inc. has provided you with the following income Statement information for the year ended December 31, 3019 credits are in brackets debits have no brackets $22,165,000) 800,000 Cost of sales 190,000 Seting expenses Administrative expenses 205,000 Interest income 160,000) Depreciation expense 90.000 Unrealized loss on FV-NI investment 75.000 Low on disposal of Division A assets 120,000 Unrealized gain on FV-O investment 100.000 Net Income before tax 845.000 Income tax expense at 4099 5338.000 Net income 5.507.000 Additional information Effective November 20, 2014 the Board of Directors in a plan to dispose of Division A Division Ameets the requirements for treatment as a Discontinued Operation Division A was sold on December 31, 2019 see above for the loss on disposal amount In addition to the loss on disposal of Division A the sales and openses above acude the Time Lef In addition to the loss on disposal of Division A, the sales and expenses above include the following amounts that relate to the operation of Division A during the year (so, for example, the sales of $2,165,000 above includes $180,000 of sales related to Division A's discontinued operations). Sales Cost of sales Selling expenses Administrative expenses Depreciation expense $(180,000) 160,000 48,000 68,000 24,000 Journal entries for November 15th when all of the heaters for the bundles are shipped, including the related costs for the heaters. Format v BIU - *** 2010 MARKS- 22 MINUTES ABC Company Inc. has provided you with the following income Statement information for the year ended December 31, 3019 credits are in brackets debits have no brackets $22,165,000) 800,000 Cost of sales 190,000 Seting expenses Administrative expenses 205,000 Interest income 160,000) Depreciation expense 90.000 Unrealized loss on FV-NI investment 75.000 Low on disposal of Division A assets 120,000 Unrealized gain on FV-O investment 100.000 Net Income before tax 845.000 Income tax expense at 4099 5338.000 Net income 5.507.000 Additional information Effective November 20, 2014 the Board of Directors in a plan to dispose of Division A Division Ameets the requirements for treatment as a Discontinued Operation Division A was sold on December 31, 2019 see above for the loss on disposal amount In addition to the loss on disposal of Division A the sales and openses above acude the Time Lef In addition to the loss on disposal of Division A, the sales and expenses above include the following amounts that relate to the operation of Division A during the year (so, for example, the sales of $2,165,000 above includes $180,000 of sales related to Division A's discontinued operations). Sales Cost of sales Selling expenses Administrative expenses Depreciation expense $(180,000) 160,000 48,000 68,000 24,000 Journal entries for November 15th when all of the heaters for the bundles are shipped, including the related costs for the heaters. Format v BIU - ***

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started