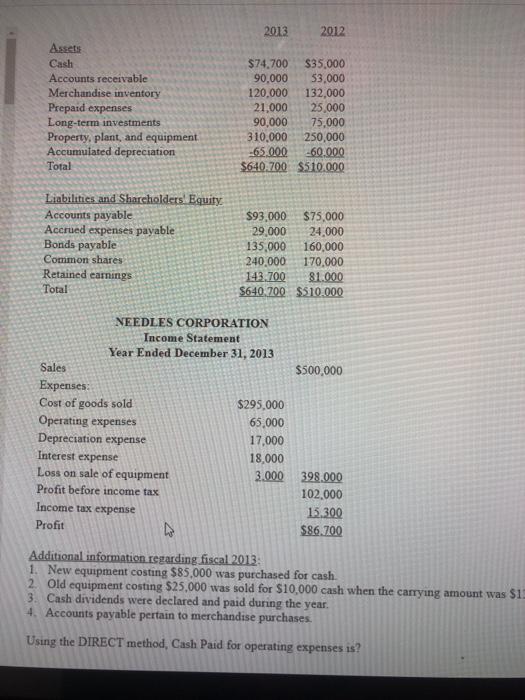

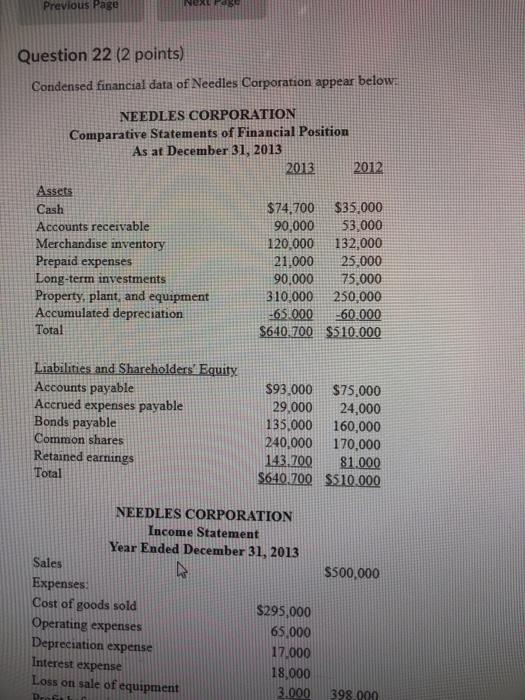

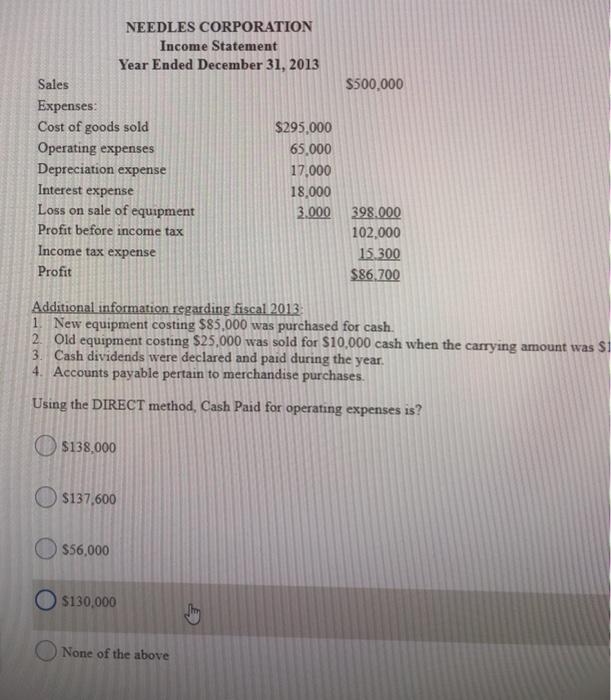

2013 2012 Assets Cash Accounts receivable Merchandise inventory Prepaid expenses Long-term investments Property, plant, and equipment Accumulated depreciation Total $74.700 $35.000 90.000 53,000 120,000 132,000 21,000 25,000 90,000 75,000 310,000 250,000 -65.000 -60.000 $640,700 S510.000 Liabilities and Sharcholders Equity Accounts payable Accrued expenses payable Bonds payable Common shares Retained earnings Total $93.000 $75,000 29,000 24,000 135,000 160,000 240 000 170,000 143.700 81.000 S640.700 $510.000 $500,000 NEEDLES CORPORATION Income Statement Year Ended December 31, 2013 Sales Expenses: Cost of goods sold $295,000 Operating expenses 65,000 Depreciation expense 17.000 Interest expense 18,000 Loss on sale of equipment 3.000 Profit before income tax Income tax expense Profit 398.000 102.000 15.300 $86.700 Additional information regarding fiscal 2013: 1. New equipment costing $85,000 was purchased for cash. 2. Old equipment costing $25,000 was sold for $10,000 cash when the carrying amount was $13 3. Cash dividends were declared and paid during the year. 4. Accounts payable pertain to merchandise purchases. Using the DIRECT method, Cash Paid for operating expenses is? Previous Page Question 22 (2 points) Condensed financial data of Needles Corporation appear below: NEEDLES CORPORATION Comparative Statements of Financial Position As at December 31, 2013 2013 2012 Assets Cash $74.700 $35.000 Accounts receivable 90,000 53,000 Merchandise inventory 120,000 132,000 Prepaid expenses 21,000 25,000 Long-term investments 90.000 75.000 Property, plant, and equipment 310,000 250,000 Accumulated depreciation -65.000 -60.000 Total $640.700 $510.000 Liabilities and Shareholders' Equity Accounts payable Accrued expenses payable Bonds payable Common shares Retained earnings Total $93.000 $75,000 29,000 24,000 135.000 160,000 240,000 170,000 143.700 81.000 $640.700. $510.000 $500,000 NEEDLES CORPORATION Income Statement Year Ended December 31, 2013 Sales Expenses Cost of goods sold $295,000 Operating expenses 65.000 Depreciation expense 17.000 Interest expense 18,000 Loss on sale of equipment 3.000 Dro 398.000 $500,000 NEEDLES CORPORATION Income Statement Year Ended December 31, 2013 Sales Expenses: Cost of goods sold $295.000 Operating expenses 65,000 Depreciation expense 17,000 Interest expense 18,000 Loss on sale of equipment 3.000 Profit before income tax Income tax expense Profit 398.000 102.000 15.300 $86.700 Additional information regarding fiscal 2013 1. New equipment costing $85.000 was purchased for cash. 2. Old equipment costing $25,000 was sold for $10,000 cash when the carrying amount was Si 3. Cash dividends were declared and paid during the year. 4. Accounts payable pertain to merchandise purchases. Using the DIRECT method, Cash Paid for operating expenses is? O $138,000 $137,600 $56,000 $130,000 ty None of the above