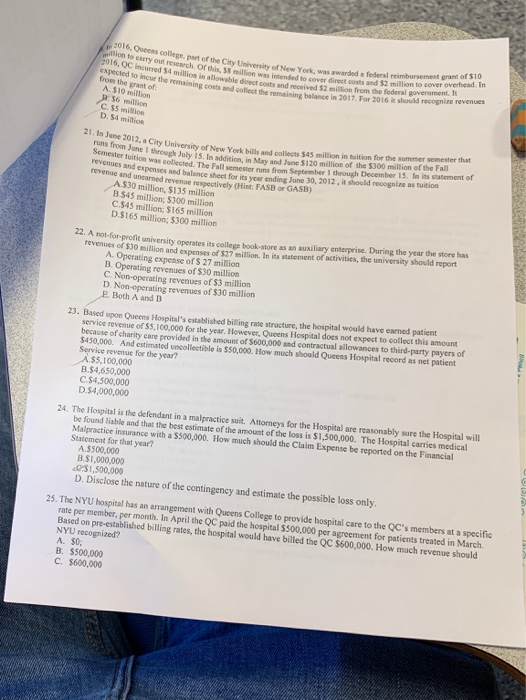

2016. Queen college part of the City University of New York, was awarded a federal reimbursement grant of $10 2016. OC Intwed 54 million in allowable diect costs and received $2 million from the federal government. It expected to incur the remaining could collect the remaining balance in 2017. For 2016 it should recognize revenues A $10 million B. 56 million C. 55 million D. 34 million 21. June 2012, City University of New York bills and collects 545 million in tuition for the summer semester that Semester tuition was collected. The Fall semester runs from September 1 through December 15. In its statement of revenue and uneared revenue respectively (Hint: FASB or GASB) revenues and expenses and balance sheet for its year ending June 30, 2012, it should recognize as tuition A $30 million, 5135 million B.545 million, 5300 million C.545 million, $165 million D.$165 million $300 million 22. A not-for-profit university operates its college book store as an auxiliary enterprise. During the year the store has revenues of $30 million and expenses of $27 million. In its statement of activities, the university should report A. Operating expense of S 27 million B. Operating revenues of $30 million C Non-operating revenues of $3 million D.Non operating revenues of $30 million E. Both A and B 23. Based upon Queens Hospital's established billing rate structure, the hospital would have earned patient service revenue of $5,100,000 for the year. However, Queens Hospital does not expect to collect this amount because of charity care provided in the amount of 5600,000 and contractual allowances to third-party payers of $450,000. And estimated uncollectible is 550,000. How much should Queens Hospital record as net patient Service revenue for the year? A 55,100,000 B.54,650,000 C $4,500,000 D. $4,000,000 24. The Hospital is the defendant in a malpractice suit. Attorneys for the Hospital are reasonably sure the Hospital will be found liable and that the best estimate of the amount of the loss is $1,500,000. The Hospital carries medical Malpractice insurance with a 5500,000. How much should the Claim Expense be reported on the Financial Statement for that year? A. $500,000 B.$1,000,000 $1,500,000 D. Disclose the nature of the contingency and estimate the possible loss only. 25. The NYU hospital has an arrangement with Queens College to provide hospital care to the QC's members at a specific rate per member, per month. In April the QC paid the hospital $500,000 per agreement for patients treated in March. Based on pre-established billing rates, the hospital would have billed the QC 5600,000. How much revenue should NYU recognized? A. 50, B. $500,000 C. $600,000