Answered step by step

Verified Expert Solution

Question

1 Approved Answer

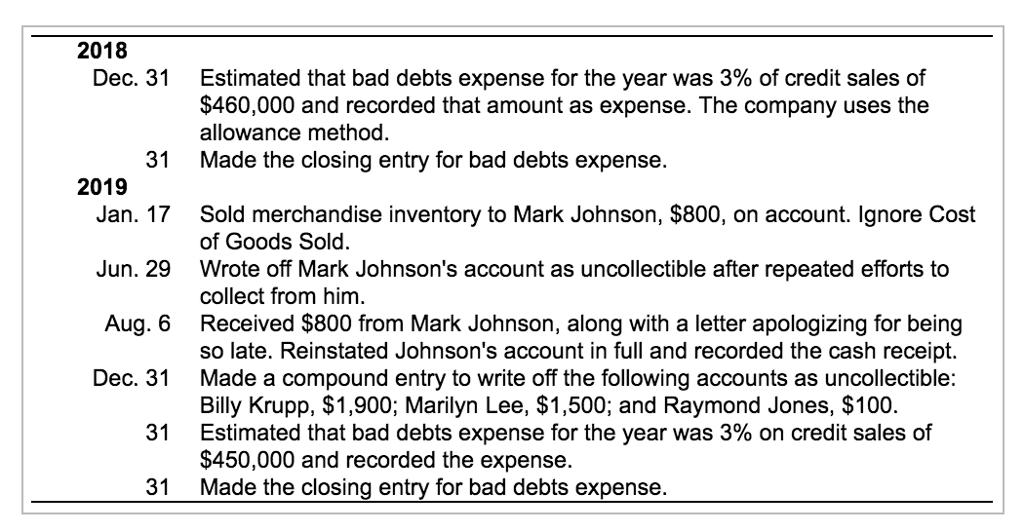

2018 Dec. 31 2019 31 Jan. 17 Jun. 29 Aug. 6 Dec. 31 31 31 Estimated that bad debts expense for the year was

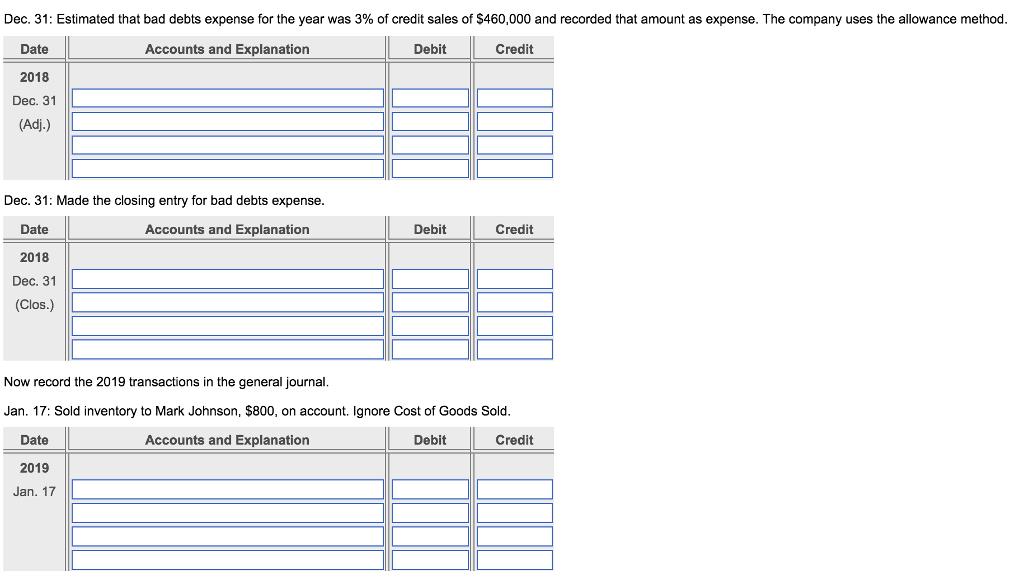

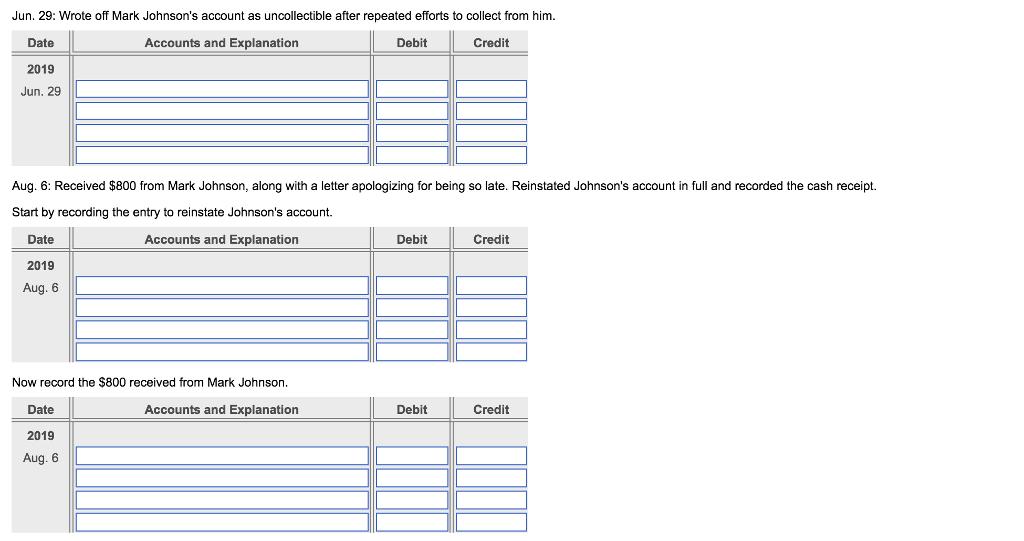

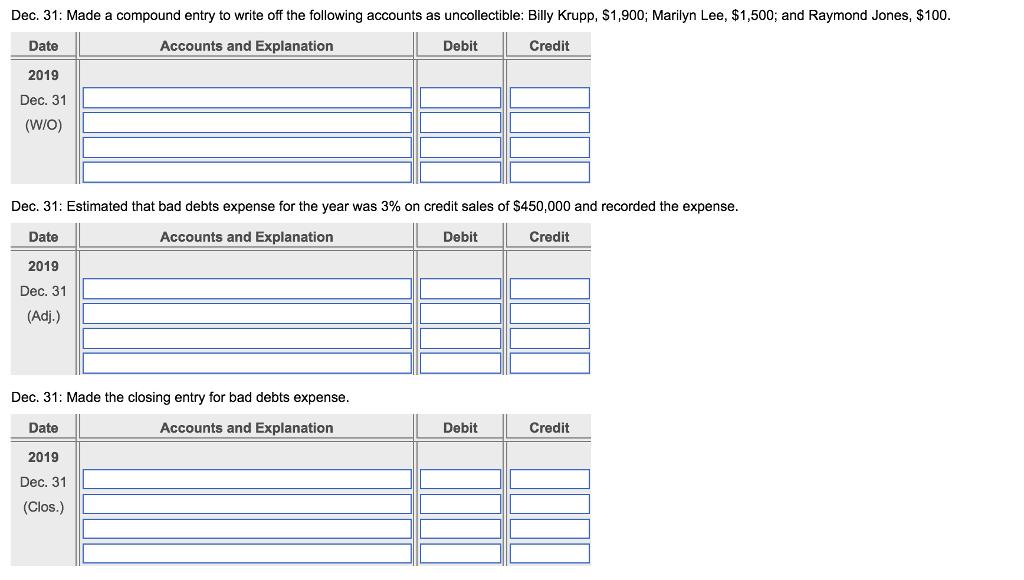

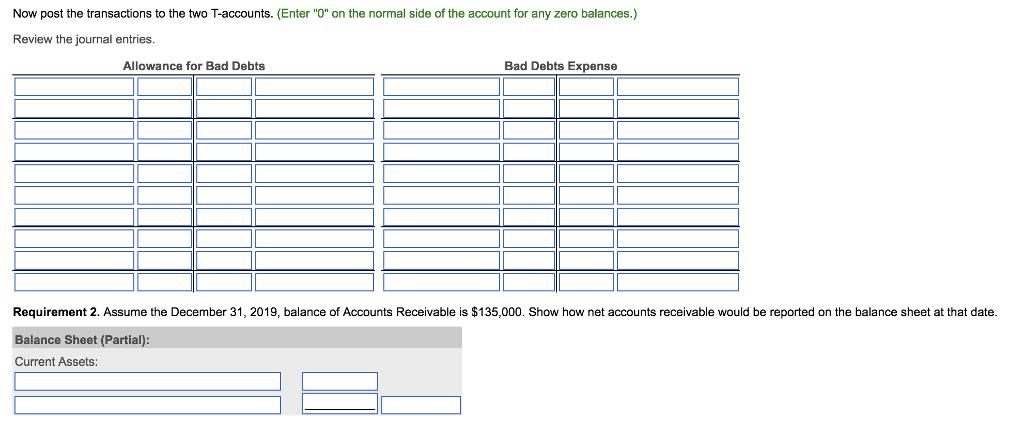

2018 Dec. 31 2019 31 Jan. 17 Jun. 29 Aug. 6 Dec. 31 31 31 Estimated that bad debts expense for the year was 3% of credit sales of $460,000 and recorded that amount as expense. The company uses the allowance method. Made the closing entry for bad debts expense. Sold merchandise inventory to Mark Johnson, $800, on account. Ignore Cost of Goods Sold. Wrote off Mark Johnson's account as uncollectible after repeated efforts to collect from him. Received $800 from Mark Johnson, along with a letter apologizing for being so late. Reinstated Johnson's account in full and recorded the cash receipt. Made a compound entry to write off the following accounts as uncollectible: Billy Krupp, $1,900; Marilyn Lee, $1,500; and Raymond Jones, $100. Estimated that bad debts expense for the year was 3% on credit sales of $450,000 and recorded the expense. Made the closing entry for bad debts expense. Dec. 31: Estimated that bad debts expense for the year was 3% of credit sales of $460,000 and recorded that amount as expense. The company uses the allowance method. Accounts and Explanation Debit Credit Date 2018 Dec. 31 (Adj.) Dec. 31: Made the closing entry for bad debts expense. Date Accounts and Explanation 2018 Dec. 31 (Clos.) Debit Credit Now record the 2019 transactions in the general journal. Jan. 17: Sold inventory to Mark Johnson, $800, on account. Ignore Cost of Goods Sold. Date Accounts and Explanation Debit Credit 2019 Jan. 17 Jun. 29: Wrote off Mark Johnson's account as uncollectible after repeated efforts to collect from him. Date Accounts and Explanation Credit 2019 Jun. 29 Aug. 6: Received $800 from Mark Johnson, along with a letter apologizing for being so late. Reinstated Johnson's account in full and recorded the cash receipt. Start by recording the entry to reinstate Johnson's account. Date Accounts and Explanation 2019 Aug. 6 Now record the $800 received from Mark Johnson. Accounts and Explanation Date Debit 2019 Aug. 6 Debit Debit Credit Credit Dec. 31: Made a compound entry to write off the following accounts as uncollectible: Billy Krupp, $1,900; Marilyn Lee, $1,500; and Raymond Jones, $100. Date Accounts and Explanation Credit 2019 Dec. 31 (W/O) Debit Dec. 31: Estimated that bad debts expense for the year was 3% on credit sales of $450,000 and recorded the expense. Date Accounts and Explanation Debit Credit 2019 Dec. 31 (Adj.) Dec. 31: Made the closing entry for bad debts expense. Date Accounts and Explanation 2019 Dec. 31 (Clos.) Debit Credit Now post the transactions to the two T-accounts. (Enter "0" on the normal side of the account for any zero balances.) Review the journal entries. Allowance for Bad Debts Bad Debts Expense Requirement 2. Assume the December 31, 2019, balance of Accounts Receivable is $135,000. Show how net accounts receivable would be reported on the balance sheet at that date. Balance Sheet (Partial): Current Assets:

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Date 2018 Dec 31 Ady Date 2018 Bad debt expense Dec 31 close Date 2019 Jan 17 Date 2019 Jun 29 Date ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started