Answered step by step

Verified Expert Solution

Question

1 Approved Answer

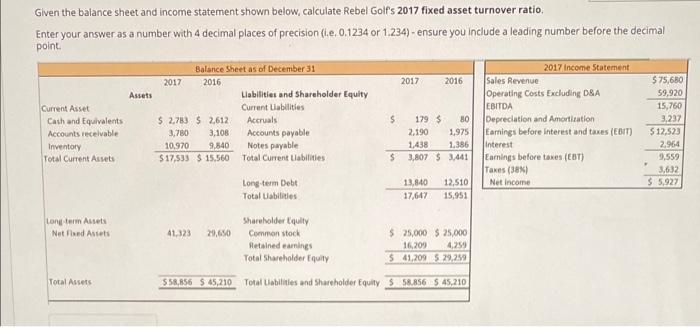

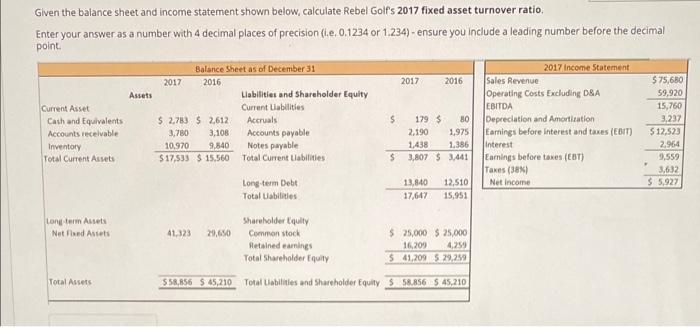

2017 FIXED ASSET TURNOVER RATIO Given the balance sheet and income statement shown below, calculate Rebel Golf's 2017 fixed asset turnover ratio, Enter your answer

2017 FIXED ASSET TURNOVER RATIO

Given the balance sheet and income statement shown below, calculate Rebel Golf's 2017 fixed asset turnover ratio, Enter your answer as a number with 4 decimal places of precision (.e. 0.1234 or 1.234)- ensure you include a leading number before the decimal point Balance Sheet as of December 31 2017 income Statement 2017 2016 2017 2016 Sales Revenue $ 75,680 Assets Liabilities and Shareholder Equity Operating costs Excluding DA 59.920 Current Asset Current Liabilities EBITDA 15,760 Cash and Equivalents $ 2,783 $ 2,612 Accruals $ 179 $ 80 Depreciation and Amortization 3,237 Accounts receivable 3,780 3.108 Accounts payable 2.190 1.975 Earnings before interest and taxes (EBIT) $12,523 Inventory 10.970 9.540 Notes payable 1.438 1.386 Interest 2.964 Total Current Assets $ 17,533 $15.560 Total Current Liabilities $ 3,807 $ 3,441 Earings before taxes (EBT) 9,559 Taxes (38) 3,632 Long-term Debt 13,840 12,510 Net Income $ 5,927 Total abilities 17,647 15,953 Long term Assets Net Fred Assets 41323 29,650 Shareholder Equity Common stock Retained earnings Total Shareholder Equity $ 25,000 $ 25,000 16,209 4.259 $ 41,209 5.29,299 Total Assets 558.856 $ 65,210 Total Liabilities and Shareholder Equity S58.856 $ 45,210

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started