Answered step by step

Verified Expert Solution

Question

1 Approved Answer

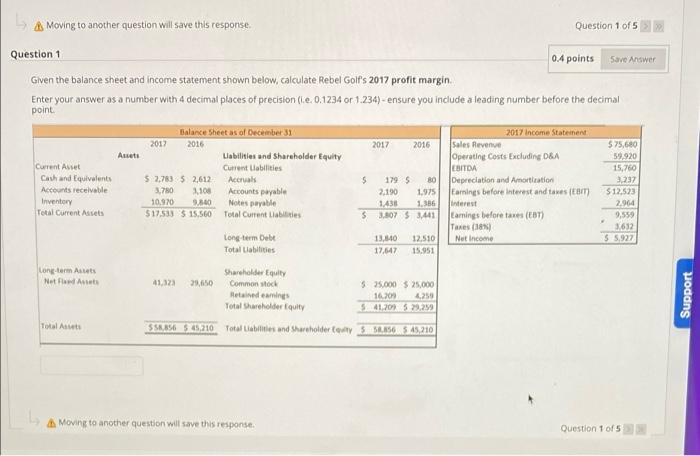

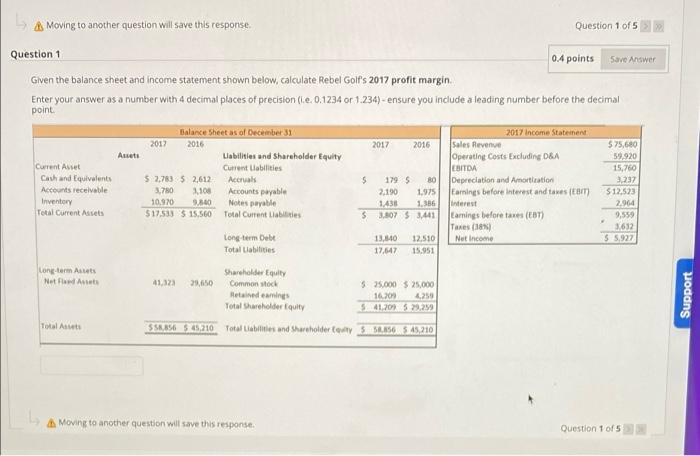

2017 PROFIT MARGIN A Moving to another question will save this response Question 1015 Question 1 0.4 points Save Answer Given the balance sheet and

2017 PROFIT MARGIN

A Moving to another question will save this response Question 1015 Question 1 0.4 points Save Answer Given the balance sheet and income statement shown below, calculate Rebel Golf's 2017 profit margin Enter your answer as a number with 4 decimal places of precision (e. 0.1234 or 1.234) - ensure you include a leading number before the decimal point Balance Sheet as of December 31 2017 Income Statement 2012 2016 2017 2016 Sales Revenue $75,680 t Liabilities and Shareholder Equity Operating costs Excluding DA 59.920 Current Asset Current Liabilities EBITDA 15,760 Cach and Equivalents $ 2,783 5 2,612 Accruals $ 1795 Depreciation and Amortization 2.237 Accounts receivable 3.780 210 Accounts payable 2.190 1.975 Earnings before interest and takes (EBIT) $12,523 Inventory 10.970 9.800 Notes payable 1.386 interest 2.964 Total Current Assets 517.533 5 15.560 Total Current Liabilities S 3.807 $ 3.441 Lamings before taxes (ET) 9,559 Taxes (1851 3,632 Long term Debt 13.50 12.510 Net Income 55.927 Total Liabilities 17,647 15.951 long-term Ants Shareholder Equity Net 41.322 29,50 Common stock 525.000 25.000 Retained emings 14709 4.250 Total Shareholder Equity 5 41,7095 29.259 $58,894 $2,210 Total Liabinies and Shareholder to S56,1565 45,210 Support Moving to another question will save this response Question 1015

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started