Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2017 tax 20. Meade paid $5,000 of state income taxes in 2017. The total actual sales taxes paid during 2017 was $4,500, which did not

2017 tax

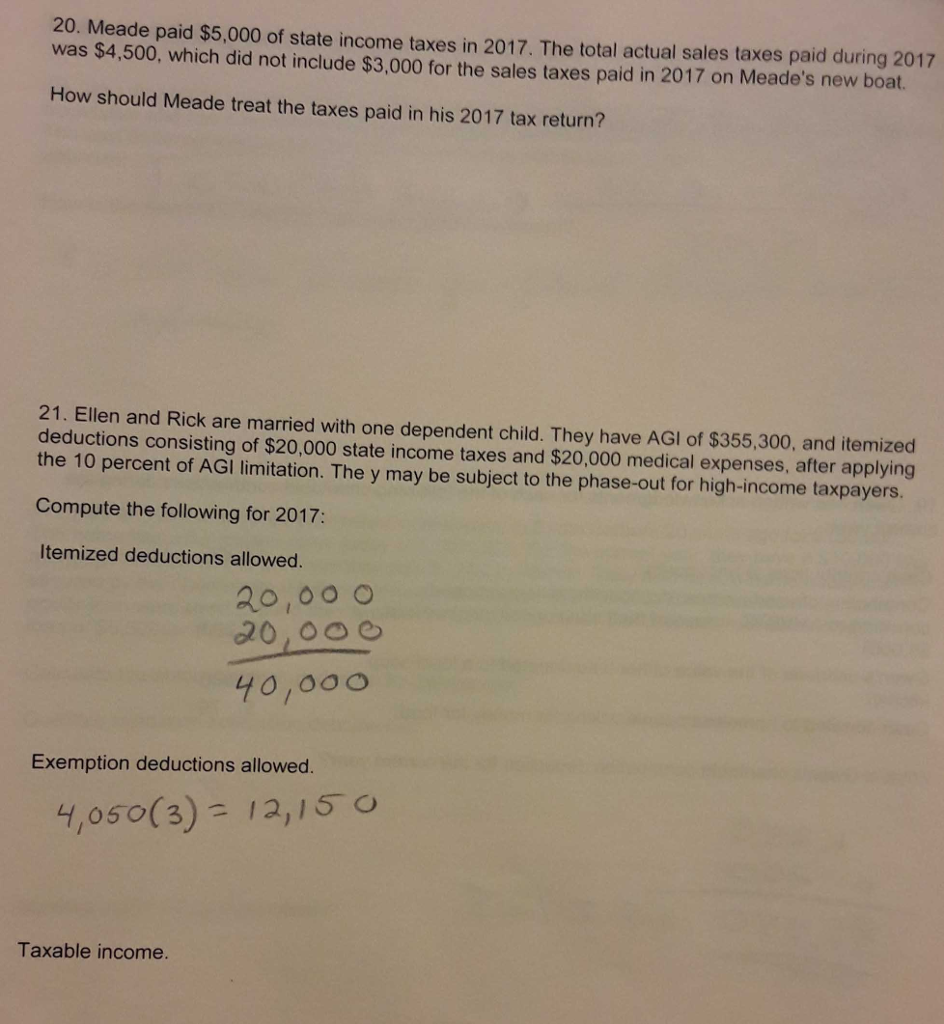

20. Meade paid $5,000 of state income taxes in 2017. The total actual sales taxes paid during 2017 was $4,500, which did not include $3,000 for the sales taxes paid in 2017 on Meade's new boat. How should Meade treat the taxes paid in his 2017 tax return? 21. Ellen and Rick are married with one dependent child. They have AGl of $355,300, and itemized deductions consisting of $20,000 state income taxes and $20,000 medical expenses, after applying the 10 percent of AGI limitation. The y may be subject to the phase-out for high-income taxpayers. Compute the following for 2017: Itemized deductions allowed. Exemption deductions allowed 4,050(3) 12,15 o Taxable incomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started