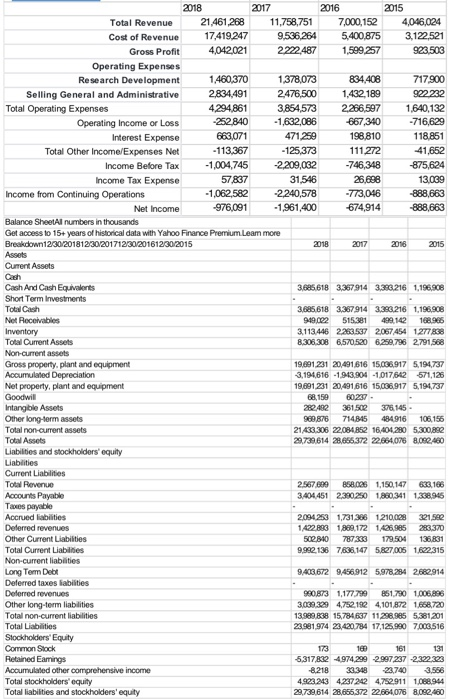

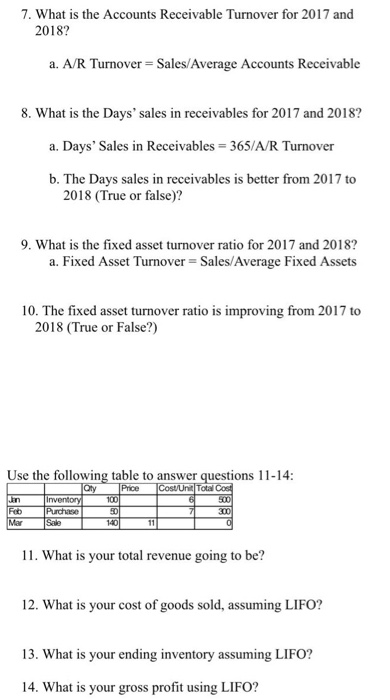

2018 2017 2016 2015 Total Revenue 21.461 268 11.758,751 7,000.152 4,046,024 Cost of Revenue 17,419.247 9.536.264 5.400.875 3,122521 4,042021 2222.487 1,599257 923.503 Operating Expenses Research Development 1460,370 1378,073 834408 717900 Selling General and Administrative 2834,491 2475.500 1.432.189 922232 Total Operating Expenses 4294 861 3.854,573 2266.597 1.640,132 Operating Income or Loss -252840 -1.632,086 667,340 -716,629 Interest Expense 663.071 471250 198,810 118.851 Total Other Income/Expenses Net -113,367 - 125.373 111 272 41,652 Income Before Tax - 1,004,745 2209,032 -746,348 -875,624 Income Tax Expense 57837 31,546 26.888 13.039 Income from Continuing Operations -1,062,582 2240,578 -773,046 -888,663 Net Income 976,091 - 1,961,400 674.914 888,663 Balance Sheetal numbers in thousands Get access to 15+ years of historical data with Yahoo Finance Premium Leam more Breakdown 12/30/201812/30/201712/30/20161230/2015 2018 2017 2016 2015 Awes Current Assets Cach Cash And Cash Equivalents 3.685 618 3,367914 3.383.216 1,196.808 Short Term investments Tot Cash 3,885.618 3,367914 3.383.216 1,196,808 Not Receivables 949.002 515.381 499.142 168.966 Inventory 3.113 446 2263537 2067454 127738 Total Current Assets 8,306,308 6,570,520 6.250,706 2791,568 Non current assets Gross property, plant and equipment 19.891231 20,491616 15.06.917 5,194,737 Accumulated Depreciation 3.194.616 -1943 904 -1 017642 571,126 Net property, plant and equipment 19,891231 20,491616 15,036,917 5,194,737 Goodwill 6 150 6027 Intangible Assets 28240 10 36 145 Other long-term assets 9 875 714.845 484 916 105 155 Total non-current assets 21433 306 22.084 852 16,404280 5.300.882 To Assets 29739.614 28.666,372 22,664,076 8.082 460 Liabilities and stockholders' equity Liabilities Current Liabilities Total Revenue 2.567 309 368.006 1,150.147 623,166 Accounts Payable 3.404451 200 OM I Tes payable Accrued abilities 2094253 1.731.366 1210.0083215 Deferred revenues 1423 1 172 1 200 Other Current Liabilities 502878733 178504 11 Total Current Liabilities 9.992.136 763610 SROT 005 1822-315 Non-current abilities Long Term Deol 9.403,672 9,466912 5.978.284 2800.914 Deferred taxes abilities Deferred m us 980 873 1177 5 0 100 Other long-term labies 3.039.329 4752 192 4101,872 1668.720 Total non-current liabilities 13 15 15 201 Total Labs 23.981974 23.420784 17,126.990 7003,516 Stockholders' Equity Common Sack 173 Retained Emmings 5317622 4974 299 2997 237 2222 Accumulated other comprehensive income 8.218 33.348 23.740 3.566 Total stockholders' equity 4.923.243 4.23722 4742911 10.94 Total liabilities and stockholders' equity 29,739,614 28,656,372 22664,076 8,082,460 7. What is the Accounts Receivable Turnover for 2017 and 2018? a. A/R Turnover = Sales/Average Accounts Receivable 8. What is the Days' sales in receivables for 2017 and 2018? a. Days' Sales in Receivables = 365/A/R Turnover b. The Days sales in receivables is better from 2017 to 2018 (True or false)? 9. What is the fixed asset turnover ratio for 2017 and 2018? a. Fixed Asset Turnover Sales/Average Fixed Assets 10. The fixed asset turnover ratio is improving from 2017 to 2018 (True or False?) Use the following table to answer questions 11-14: Oty Price Cost/UnitTotal Cost Inventory FD Purchase Mr 11. What is your total revenue going to be? 12. What is your cost of goods sold, assuming LIFO? 13. What is your ending inventory assuming LIFO? 14. What is your gross profit using LIFO