Question

2020 annual report 2021 annual report 2022 annual report For each year from 2020 to 2022, Calculate the breakeven point in Dollars for Airbnb. Comment

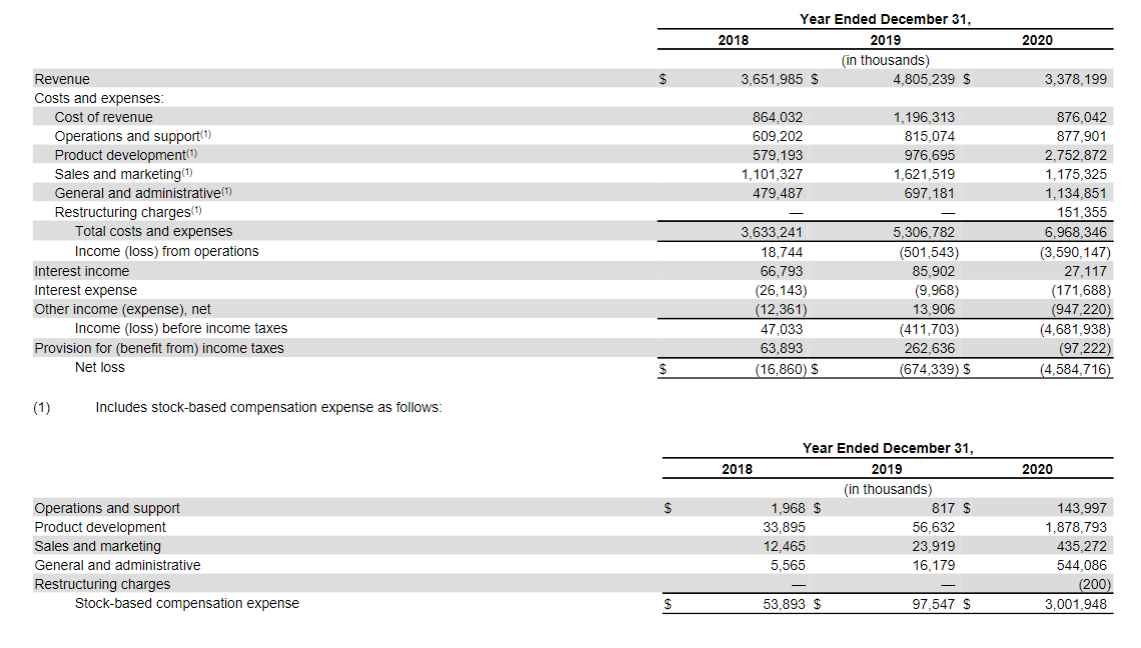

2020 annual report

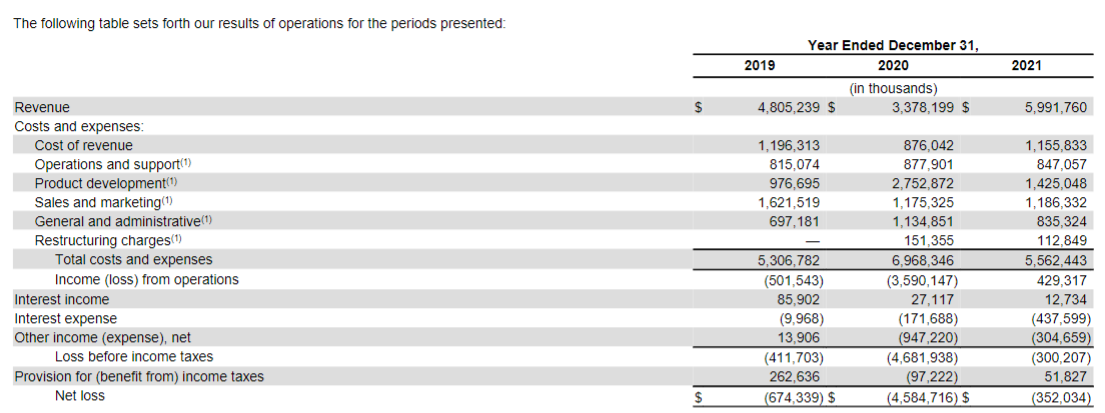

2021 annual report

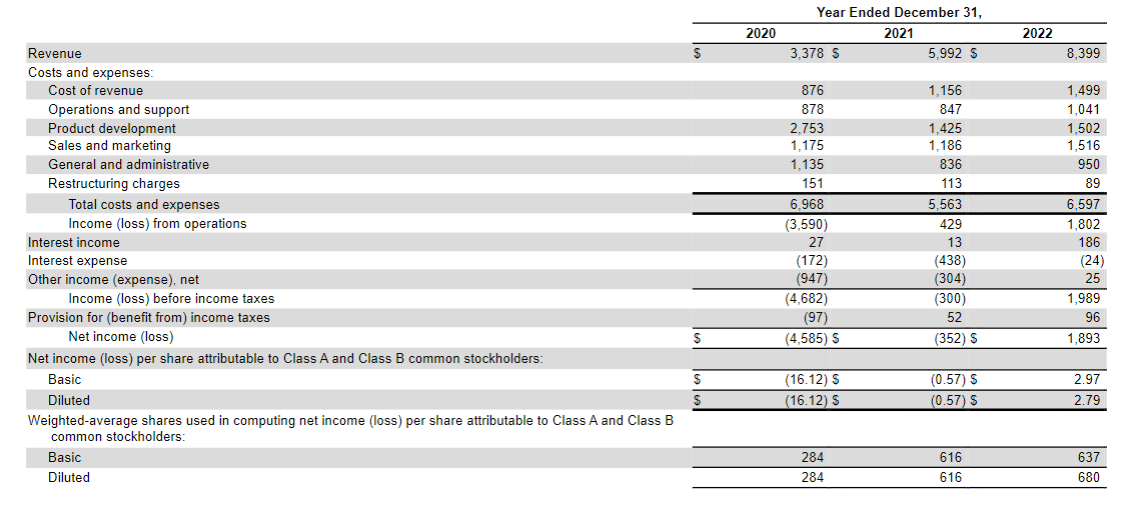

2022 annual report

- For each year from 2020 to 2022, Calculate the breakeven point in Dollars for Airbnb. Comment on the Results.

Notes: Please use financial data from ANNUAL REPORTS. Clearly show the workings, not just the final answers. Use the consolidated financial statements. Also, use the relevant year's annual reports to extract financial information for that particular financial year. For example, to get the sales revenue of Airbnb in 2021, use the figures in the 2021 annual report. Do not use the 2021 figures listed in the 2022 annual report.

Hint: Use the following assumptions when answering the above question.

Cost of Sales (COS) = Total variable cost

All other operating expenses = Fixed costs

The followina table sets forth our results of onerations for the neriods nresented \begin{tabular}{|c|c|c|c|c|} \hline & \multicolumn{4}{|c|}{ Year Ended December 31, } \\ \hline & \multicolumn{2}{|c|}{2020} & 2021 & 2022 \\ \hline Revenue & $ & 3,378S & 5,992S & 8,399 \\ \hline \multicolumn{5}{|l|}{ Costs and expenses: } \\ \hline Cost of revenue & & 876 & 1,156 & 1,499 \\ \hline Operations and support & & 878 & 847 & 1,041 \\ \hline Product development & & 2,753 & 1,425 & 1,502 \\ \hline Sales and marketing & & 1,175 & 1,186 & 1,516 \\ \hline General and administrative & & 1,135 & 836 & 950 \\ \hline Restructuring charges & & 151 & 113 & 89 \\ \hline Total costs and expenses & & 6,968 & 5,563 & 6,597 \\ \hline Income (loss) from operations & & (3,590) & 429 & 1,802 \\ \hline Interest income & & 27 & 13 & 186 \\ \hline Interest expense & & (172) & (438) & (24) \\ \hline Other income (expense), net & & (947) & (304) & 25 \\ \hline Income (loss) before income taxes & & (4,682) & (300) & 1,989 \\ \hline Provision for (benefit from) income taxes & & (97) & 52 & 96 \\ \hline Net income (loss) & $ & (4,585)S & (352) $ & 1,893 \\ \hline \multicolumn{5}{|c|}{ Net income (loss) per share attributable to Class A and Class B common stockholders: } \\ \hline Diluted & $ & (16.12)S & (0.57)S & 2.79 \\ \hline \multicolumn{5}{|c|}{Weighted-averagesharesusedincomputingnetincome(loss)pershareattributabletoClassAandClassBcommonstockholders:} \\ \hline Basic & & 284 & 616 & 637 \\ \hline Diluted & & 284 & 616 & 680 \\ \hline \end{tabular} The followina table sets forth our results of onerations for the neriods nresented \begin{tabular}{|c|c|c|c|c|} \hline & \multicolumn{4}{|c|}{ Year Ended December 31, } \\ \hline & \multicolumn{2}{|c|}{2020} & 2021 & 2022 \\ \hline Revenue & $ & 3,378S & 5,992S & 8,399 \\ \hline \multicolumn{5}{|l|}{ Costs and expenses: } \\ \hline Cost of revenue & & 876 & 1,156 & 1,499 \\ \hline Operations and support & & 878 & 847 & 1,041 \\ \hline Product development & & 2,753 & 1,425 & 1,502 \\ \hline Sales and marketing & & 1,175 & 1,186 & 1,516 \\ \hline General and administrative & & 1,135 & 836 & 950 \\ \hline Restructuring charges & & 151 & 113 & 89 \\ \hline Total costs and expenses & & 6,968 & 5,563 & 6,597 \\ \hline Income (loss) from operations & & (3,590) & 429 & 1,802 \\ \hline Interest income & & 27 & 13 & 186 \\ \hline Interest expense & & (172) & (438) & (24) \\ \hline Other income (expense), net & & (947) & (304) & 25 \\ \hline Income (loss) before income taxes & & (4,682) & (300) & 1,989 \\ \hline Provision for (benefit from) income taxes & & (97) & 52 & 96 \\ \hline Net income (loss) & $ & (4,585)S & (352) $ & 1,893 \\ \hline \multicolumn{5}{|c|}{ Net income (loss) per share attributable to Class A and Class B common stockholders: } \\ \hline Diluted & $ & (16.12)S & (0.57)S & 2.79 \\ \hline \multicolumn{5}{|c|}{Weighted-averagesharesusedincomputingnetincome(loss)pershareattributabletoClassAandClassBcommonstockholders:} \\ \hline Basic & & 284 & 616 & 637 \\ \hline Diluted & & 284 & 616 & 680 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started