Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare Monica Montes' 2020 Federal tax return. 2020 Federal income tax return ( Form 1040, Schedule 1, possibly Schedule A) Monica has one child, Mollie,

Prepare Monica Montes' 2020 Federal tax return.

2020 Federal income tax return ( Form 1040, Schedule 1, possibly Schedule A)

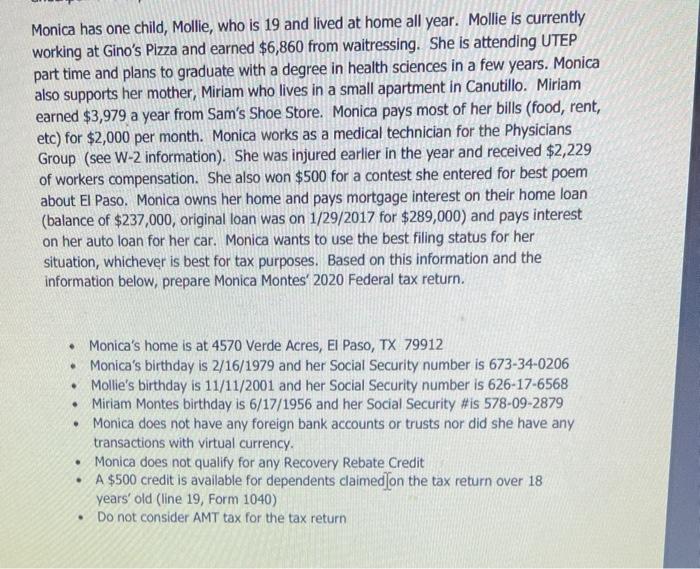

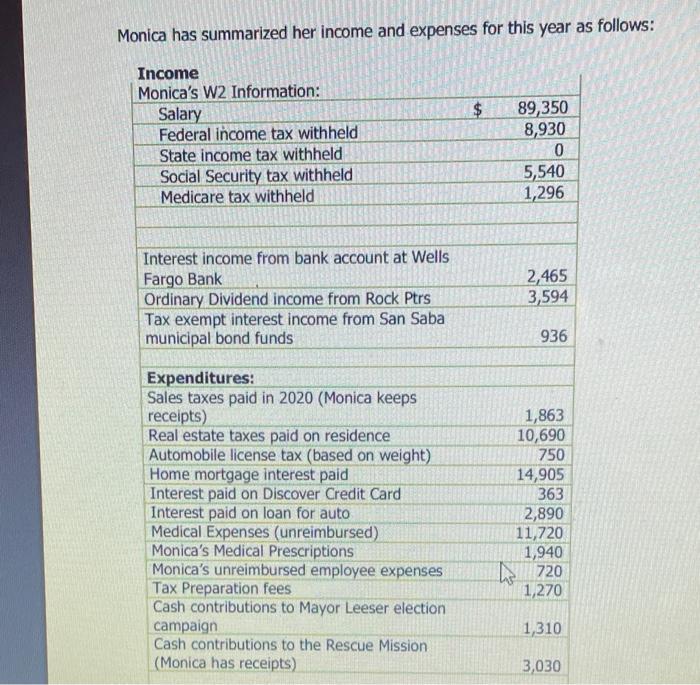

Monica has one child, Mollie, who is 19 and lived at home all year. Mollie is currently working at Gino's Pizza and earned $6,860 from waitressing. She is attending UTEP part time and plans to graduate with a degree in health sciences in a few years. Monica also supports her mother, Miriam who lives in a small apartment in Canutillo. Miriam earned $3,979 a year from Sam's Shoe Store. Monica pays most of her bills (food, rent, etc) for $2,000 per month. Monica works as a medical technician for the Physicians Group (see W-2 information). She was injured earlier in the year and received $2,229 of workers compensation. She also won $500 for a contest she entered for best poem about El Paso. Monica owns her home and pays mortgage interest on their home loan (balance of $237,000, original loan was on 1/29/2017 for $289,000) and pays interest on her auto loan for her car. Monica wants to use the best filing status for her situation, whichever is best for tax purposes. Based on this information and the information below, prepare Monica Montes' 2020 Federal tax return. Monica's home is at 4570 Verde Acres, El Paso, TX 79912 . Monica's birthday is 2/16/1979 and her Social Security number is 673-34-0206 Mollie's birthday is 11/11/2001 and her Social Security number is 626-17-6568 Miriam Montes birthday is 6/17/1956 and her Social Security #is 578-09-2879 Monica does not have any foreign bank accounts or trusts nor did she have any transactions with virtual currency. Monica does not qualify for any Recovery Rebate Credit . A $500 credit is available for dependents claimed on the tax return over 18 years' old (line 19, Form 1040) . Do not consider AMT tax for the tax return

Step by Step Solution

★★★★★

3.37 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started