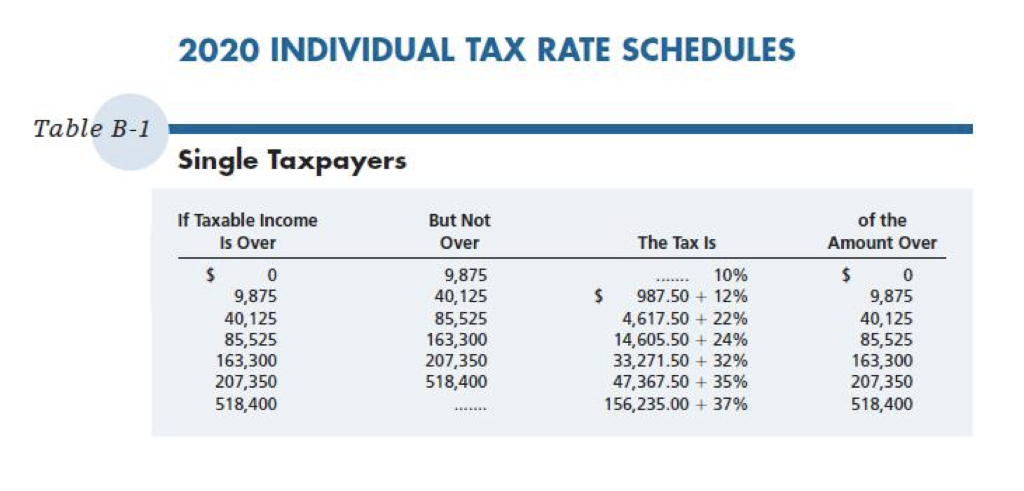

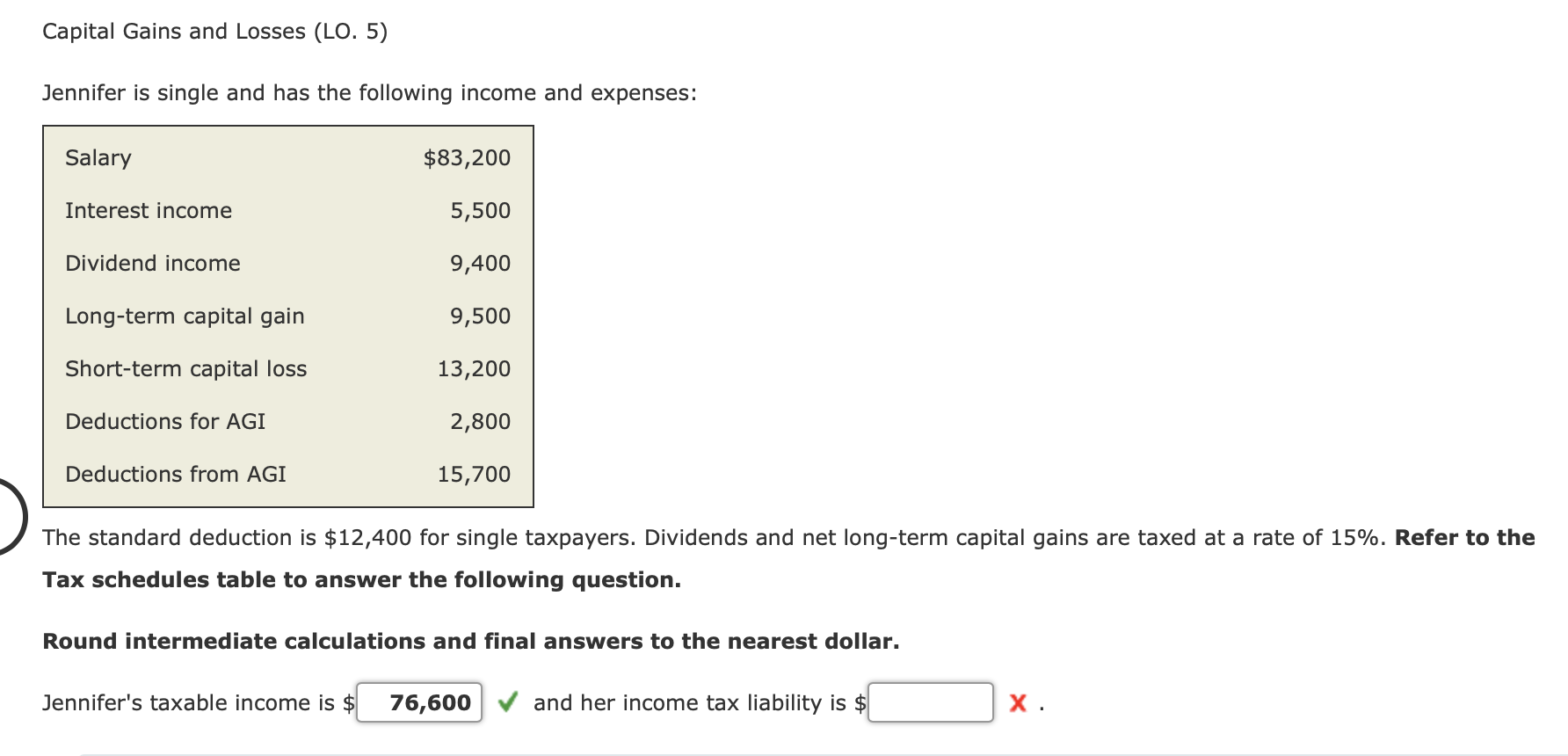

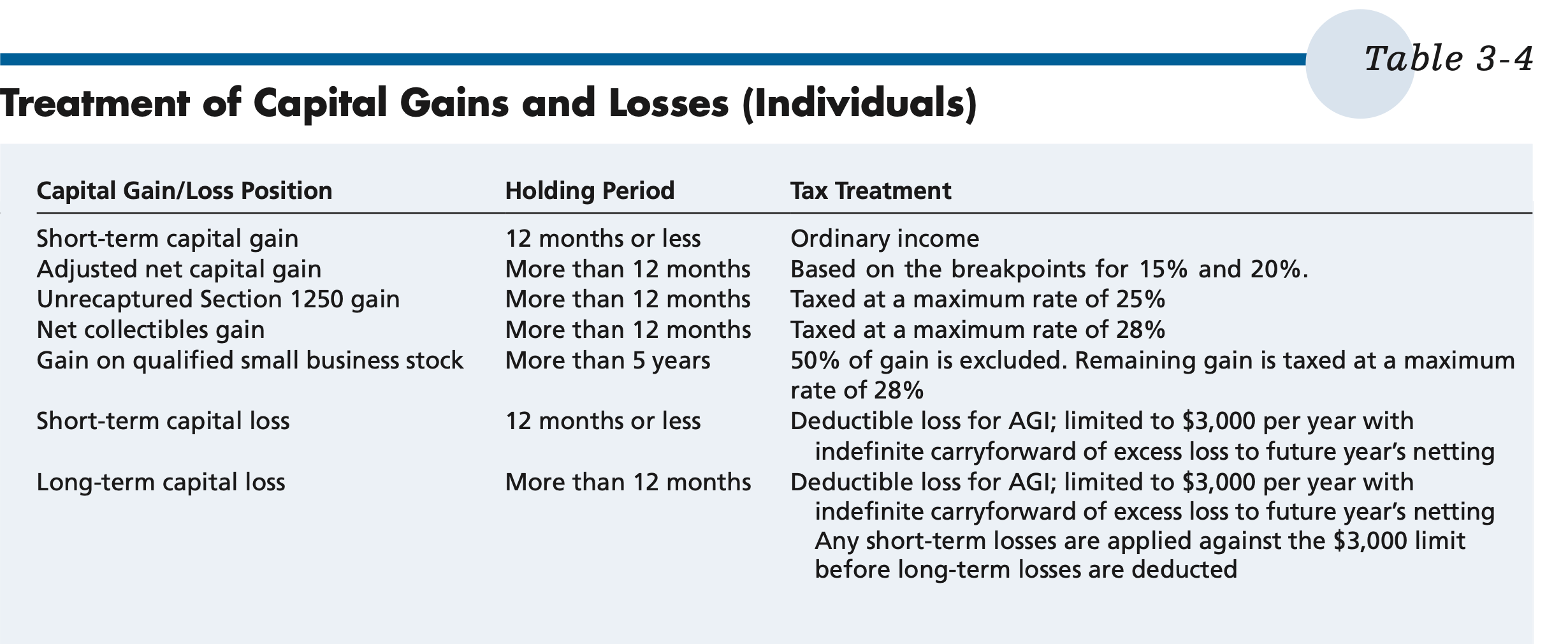

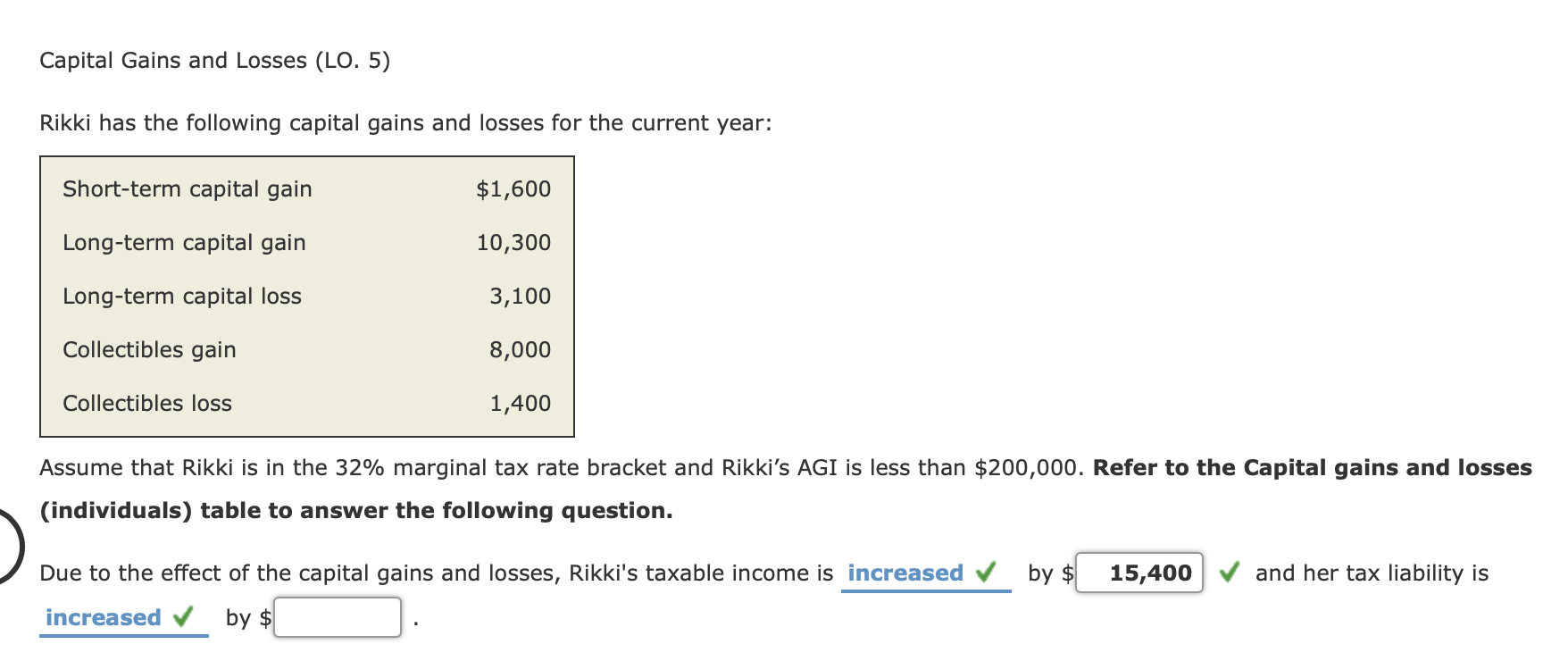

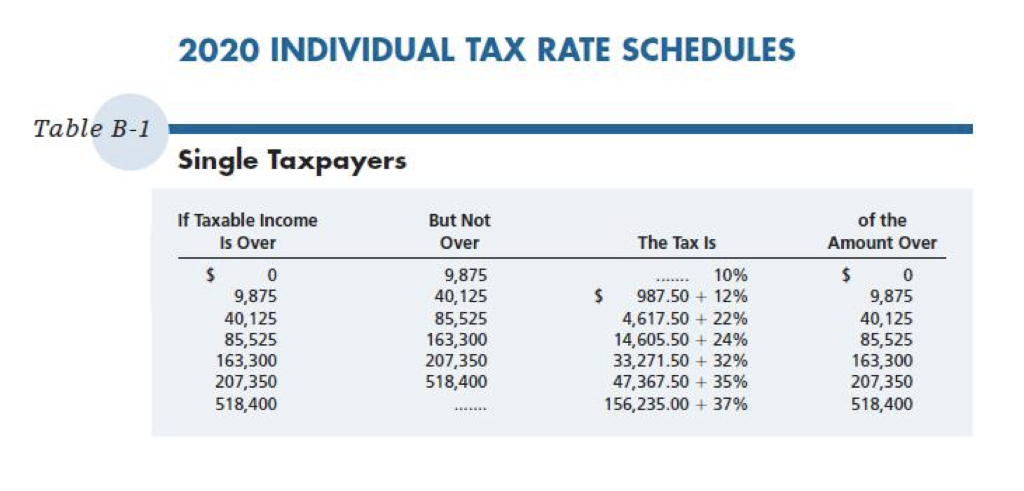

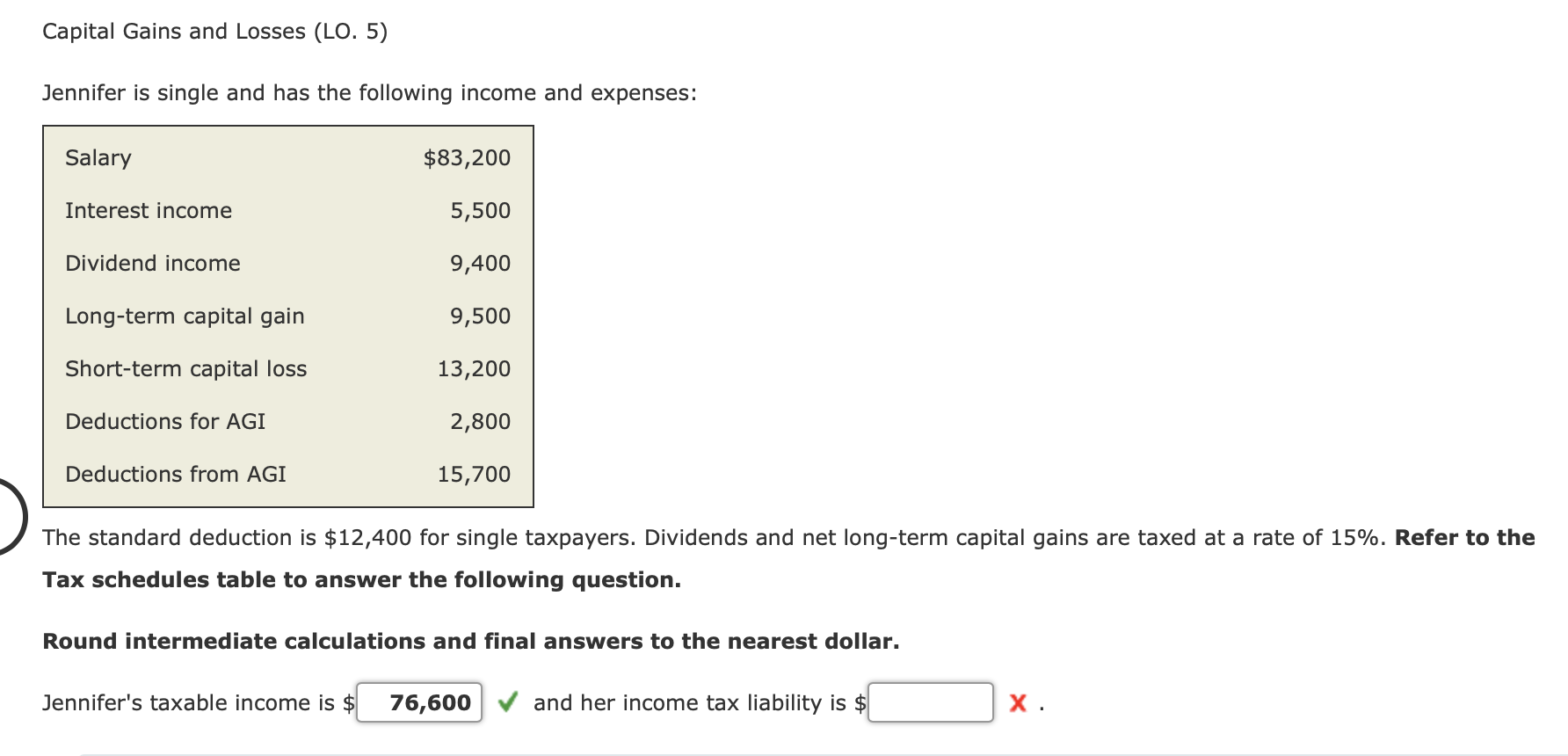

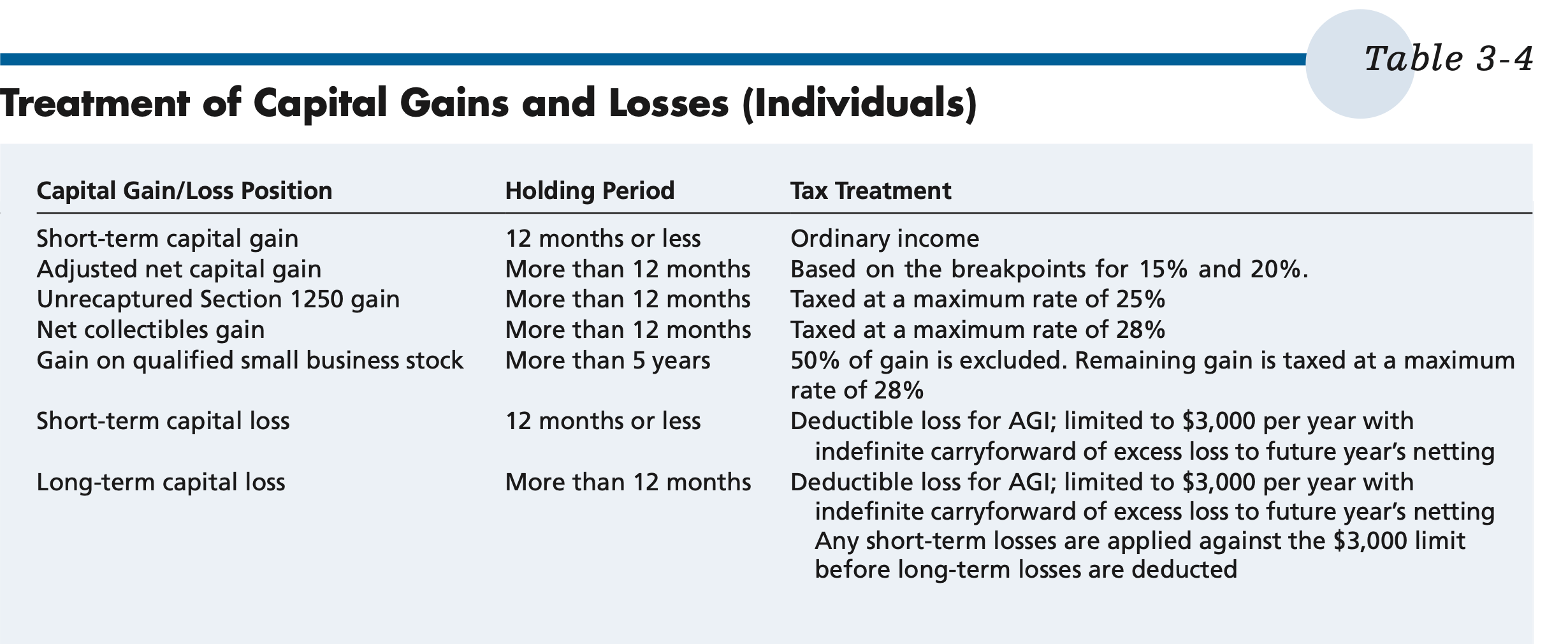

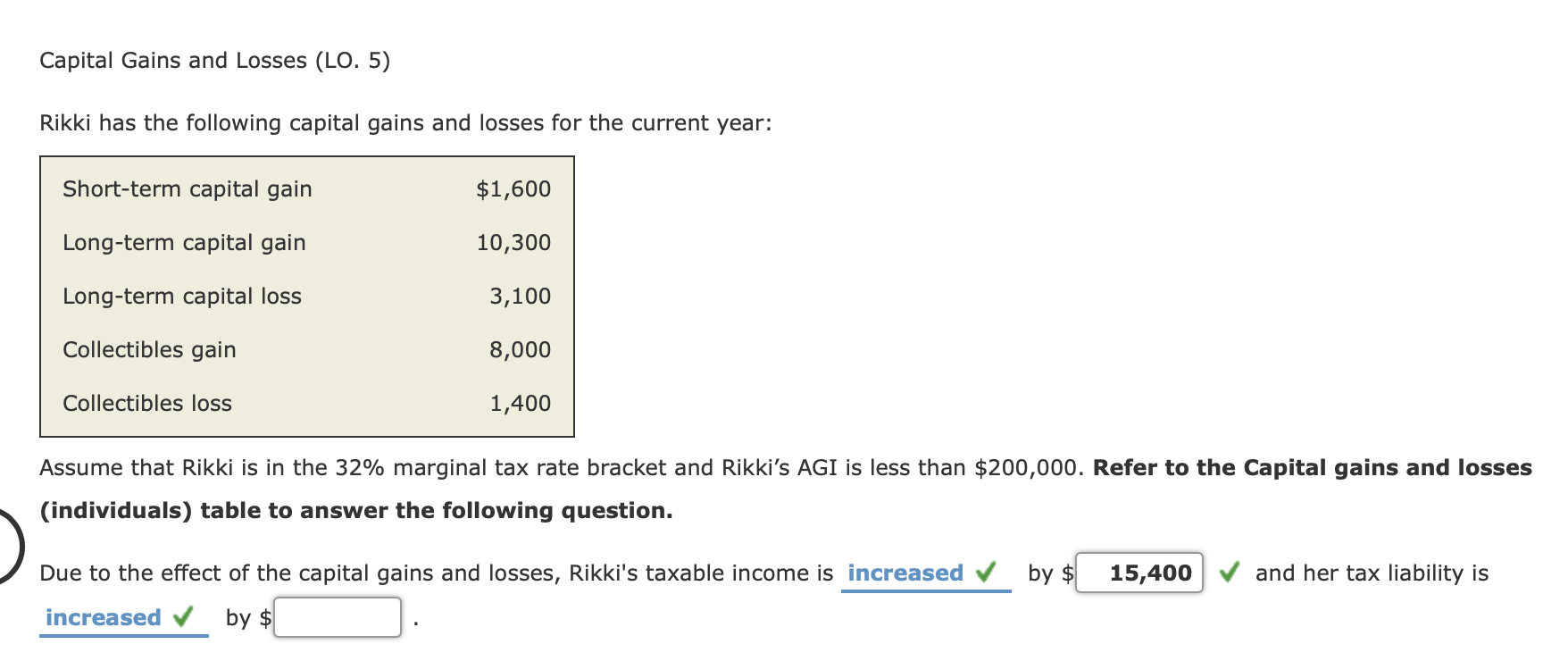

2020 INDIVIDUAL TAX RATE SCHEDULES Table B-1 Single Taxpayers But Not Over of the Amount Over The Tax Is 9,875 40,125 If Taxable income Is Over $ 0 9,875 40,125 85,525 163,300 207,350 518,400 85,525 163,300 207,350 518,400 10% $ 987.50 + 12% 4,617.50 + 22% 14,605.50 + 24% 33,271.50 + 32% 47,367.50 + 35% 156,235.00 + 37% $ 0 9,875 40,125 85,525 163,300 207,350 518,400 Capital Gains and Losses (LO. 5) Jennifer is single and has the following income and expenses: Salary $83,200 Interest income 5,500 Dividend income 9,400 Long-term capital gain 9,500 Short-term capital loss 13,200 Deductions for AGI 2,800 Deductions from AGI 15,700 The standard deduction is $12,400 for single taxpayers. Dividends and net long-term capital gains are taxed at a rate of 15%. Refer to the Tax schedules table to answer the following question. Round intermediate calculations and final answers to the nearest dollar. Jennifer's taxable income is $ 76,600 and her income tax liability is $ X. Table 3-4 Treatment of Capital Gains and Losses (Individuals) Capital Gain/Loss Position Holding Period Tax Treatment Short-term capital gain Adjusted net capital gain Unrecaptured Section 1250 gain Net collectibles gain Gain on qualified small business stock 12 months or less More than 12 months More than 12 months More than 12 months More than 5 years Ordinary income Based on the breakpoints for 15% and 20%. Taxed at a maximum rate of 25% Taxed at a maximum rate of 28% 50% of gain is excluded. Remaining gain is taxed at a maximum rate of 28% Deductible loss for AGI; limited to $3,000 per year with indefinite carryforward of excess loss to future year's netting Deductible loss for AGI; limited to $3,000 per year with indefinite carryforward of excess loss to future year's netting Any short-term losses are applied against the $3,000 limit before long-term losses are deducted Short-term capital loss 12 months or less Long-term capital loss More than 12 months Capital Gains and Losses (LO. 5) Rikki has the following capital gains and losses for the current year: Short-term capital gain $1,600 Long-term capital gain 10,300 Long-term capital loss 3,100 Collectibles gain 8,000 Collectibles loss 1,400 Assume that Rikki is in the 32% marginal tax rate bracket and Rikki's AGI is less than $200,000. Refer to the Capital gains and losses (individuals) table to answer the following question. 15,400 and her tax liability is Due to the effect of the capital gains and losses, Rikki's taxable income is increased by $ increased by $