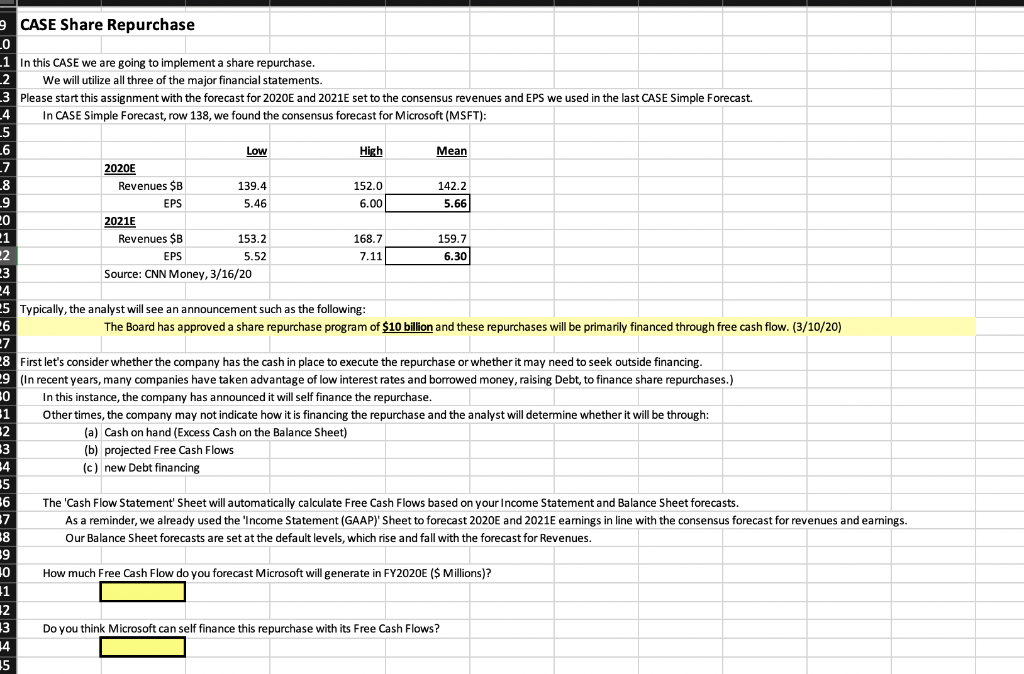

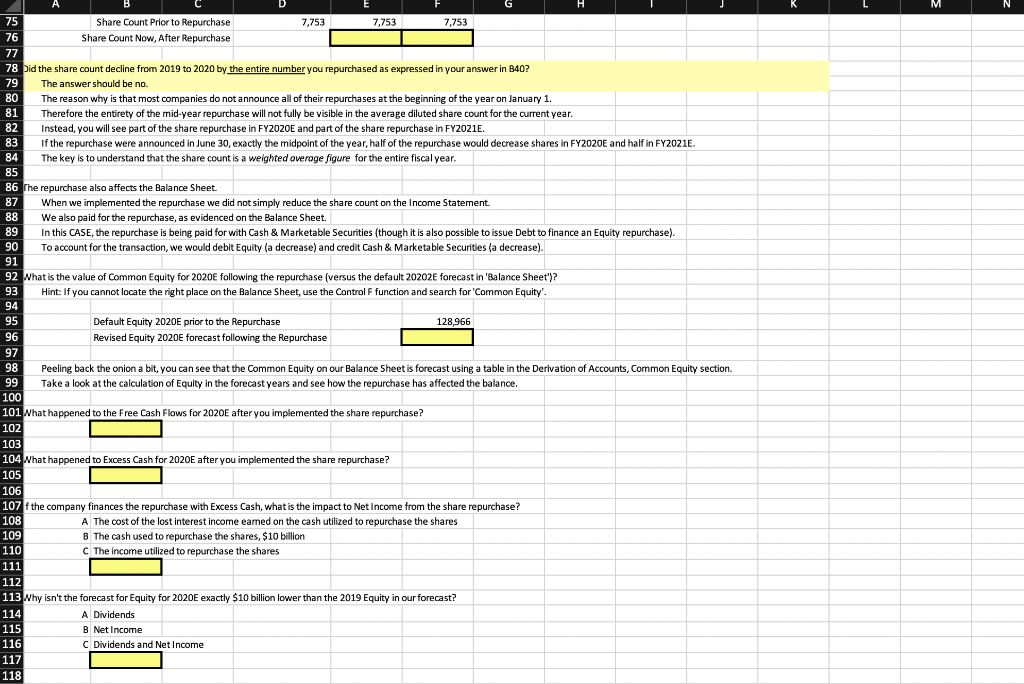

2020E 9 CASE Share Repurchase LO 1 In this CASE we are going to implement a share repurchase. -2 We will utilize all three of the major financial statements. 3 Please start this assignment with the forecast for 2020E and 2021E set to the consensus revenues and EPS we used in the last CASE Simple Forecast. -4 In CASE Simple Forecast, row 138, we found the consensus forecast for Microsoft (MSFT): 5 6 Low High Mean _7 -8 Revenues SB 139.4 152.0 142.2 _9 EPS 5.46 6.00 5.66 20 2021E 21 Revenues $B 153.2 168.7 159.7 22 EPS 5.52 7.11 6.30 23 Source: CNN Money, 3/16/20 24 5 Typically, the analyst will see an announcement such as the following: 26 The Board has approved a share repurchase program of $10 billion and these repurchases will be primarily financed through free cash flow. (3/10/20) 27 8 First let's consider whether the company has the cash in place to execute the repurchase or whether it may need to seek outside financing. 9 (In recent years, many companies have taken advantage of low interest rates and borrowed money, raising Debt, to finance share repurchases.) 30 In this instance, the company has announced it will self finance the repurchase. 31 Other times, the company may not indicate how it is financing the repurchase and the analyst will determine whether it will be through: 12 (a) Cash on hand (Excess Cash on the Balance Sheet) 3 (b) projected Free Cash Flows 34 (c) new Debt financing 35 36 The 'Cash Flow Statement' Sheet will automatically calculate Free Cash Flows based on your Income Statement and Balance Sheet forecasts. 17 As a reminder, we already used the 'Income Statement (GAAP)' Sheet to forecast 2020E and 2021E earnings in line with the consensus forecast for revenues and earnings. 38 Our Balance Sheet forecasts are set at the default levels, which rise and fall with the forecast for Revenues. 39 10 How much Free Cash Flow do you forecast Microsoft will generate in FY2020E ($ Millions)? 11 12 13 Do you think Microsoft can self finance this repurchase with its Free Cash Flows? 14 15 M A E 75 Share Count Prior to Repurchase 7,753 7,753 7,753 76 Share Count Now, After Repurchase 77 78 Did the share count decline from 2019 to 2020 by the entire number you repurchased as expressed in your answer in B40? 79 The answer should be no. 80 The reason why is that most companies do not announce all of their repurchases at the beginning of the year on January 1. 81 Therefore the entirety of the mid-year repurchase will not fully be visible in the average diluted share count for the current year. 82 Instead, you will see part of the share repurchase in FYZOZOE and part of the share repurchase in FY2021E. 83 If the repurchase were announced in June 30, exactly the midpoint of the year, half of the repurchase would decrease shares in FY2020E and half in FY2021E. 84 The key is to understand that the share count is a weighted average figure for the entire fiscal year. 85 86 he repurchase also affects the Balance Sheet. 87 When we implemented the repurchase we did not simply reduce the share count on the Income Statement 88 We also paid for the repurchase, as evidenced on the Balance Sheet. 89 In this CASE, the repurchase is being paid for with Cash & Marketable Securities (though it is also possible to issue Debt to finance an Equity repurchase). 90 To account for the transaction, we would debit Equity (a decrease) and credit Cash & Marketable Securities (a decrease). 91 92 What is the value of common Equity for 2020E following the repurchase (versus the default 20202E forecast in Balance Sheet'? 93 Hint: If you cannot locate the right place on the Balance Sheet, use the Control F function and search for 'Common Equity'. 94 95 Default Equity 2020E prior to the Repurchase 128,966 96 Revised Equity 2020E forecast following the Repurchase 97 98 Peeling back the onion a bit, you can see that the Common Equity on our Balance Sheet is forecast using a table in the Derivation of Accounts, Common Equity section. 99 Take a look at the calculation of Equity in the forecast years and see how the repurchase has affected the balance. 100 101 What happened to the Free Cash Flows for 2020E after you implemented the share repurchase? 102 103 104 What happened to Excess Cash for 2020E after you implemented the share repurchase? 105 106 107 f the company finances the repurchase with Excess Cash, what is the impact to Net Income from the share repurchase? 108 A The cost of the lost interest income earned on the cash utilized to repurchase the shares 109 B The cash used to repurchase the shares, $10 billion 110 C 449 The income utilized to repurchase the shares 111 112 113 Why isn't the forecast for Equity for 2020E exactly $10 billion lower than the 2019 Equity in our forecast? 114 A Dividends 115 B Net Income 116 C Dividends and Net Income 117 118 2020E 9 CASE Share Repurchase LO 1 In this CASE we are going to implement a share repurchase. -2 We will utilize all three of the major financial statements. 3 Please start this assignment with the forecast for 2020E and 2021E set to the consensus revenues and EPS we used in the last CASE Simple Forecast. -4 In CASE Simple Forecast, row 138, we found the consensus forecast for Microsoft (MSFT): 5 6 Low High Mean _7 -8 Revenues SB 139.4 152.0 142.2 _9 EPS 5.46 6.00 5.66 20 2021E 21 Revenues $B 153.2 168.7 159.7 22 EPS 5.52 7.11 6.30 23 Source: CNN Money, 3/16/20 24 5 Typically, the analyst will see an announcement such as the following: 26 The Board has approved a share repurchase program of $10 billion and these repurchases will be primarily financed through free cash flow. (3/10/20) 27 8 First let's consider whether the company has the cash in place to execute the repurchase or whether it may need to seek outside financing. 9 (In recent years, many companies have taken advantage of low interest rates and borrowed money, raising Debt, to finance share repurchases.) 30 In this instance, the company has announced it will self finance the repurchase. 31 Other times, the company may not indicate how it is financing the repurchase and the analyst will determine whether it will be through: 12 (a) Cash on hand (Excess Cash on the Balance Sheet) 3 (b) projected Free Cash Flows 34 (c) new Debt financing 35 36 The 'Cash Flow Statement' Sheet will automatically calculate Free Cash Flows based on your Income Statement and Balance Sheet forecasts. 17 As a reminder, we already used the 'Income Statement (GAAP)' Sheet to forecast 2020E and 2021E earnings in line with the consensus forecast for revenues and earnings. 38 Our Balance Sheet forecasts are set at the default levels, which rise and fall with the forecast for Revenues. 39 10 How much Free Cash Flow do you forecast Microsoft will generate in FY2020E ($ Millions)? 11 12 13 Do you think Microsoft can self finance this repurchase with its Free Cash Flows? 14 15 M A E 75 Share Count Prior to Repurchase 7,753 7,753 7,753 76 Share Count Now, After Repurchase 77 78 Did the share count decline from 2019 to 2020 by the entire number you repurchased as expressed in your answer in B40? 79 The answer should be no. 80 The reason why is that most companies do not announce all of their repurchases at the beginning of the year on January 1. 81 Therefore the entirety of the mid-year repurchase will not fully be visible in the average diluted share count for the current year. 82 Instead, you will see part of the share repurchase in FYZOZOE and part of the share repurchase in FY2021E. 83 If the repurchase were announced in June 30, exactly the midpoint of the year, half of the repurchase would decrease shares in FY2020E and half in FY2021E. 84 The key is to understand that the share count is a weighted average figure for the entire fiscal year. 85 86 he repurchase also affects the Balance Sheet. 87 When we implemented the repurchase we did not simply reduce the share count on the Income Statement 88 We also paid for the repurchase, as evidenced on the Balance Sheet. 89 In this CASE, the repurchase is being paid for with Cash & Marketable Securities (though it is also possible to issue Debt to finance an Equity repurchase). 90 To account for the transaction, we would debit Equity (a decrease) and credit Cash & Marketable Securities (a decrease). 91 92 What is the value of common Equity for 2020E following the repurchase (versus the default 20202E forecast in Balance Sheet'? 93 Hint: If you cannot locate the right place on the Balance Sheet, use the Control F function and search for 'Common Equity'. 94 95 Default Equity 2020E prior to the Repurchase 128,966 96 Revised Equity 2020E forecast following the Repurchase 97 98 Peeling back the onion a bit, you can see that the Common Equity on our Balance Sheet is forecast using a table in the Derivation of Accounts, Common Equity section. 99 Take a look at the calculation of Equity in the forecast years and see how the repurchase has affected the balance. 100 101 What happened to the Free Cash Flows for 2020E after you implemented the share repurchase? 102 103 104 What happened to Excess Cash for 2020E after you implemented the share repurchase? 105 106 107 f the company finances the repurchase with Excess Cash, what is the impact to Net Income from the share repurchase? 108 A The cost of the lost interest income earned on the cash utilized to repurchase the shares 109 B The cash used to repurchase the shares, $10 billion 110 C 449 The income utilized to repurchase the shares 111 112 113 Why isn't the forecast for Equity for 2020E exactly $10 billion lower than the 2019 Equity in our forecast? 114 A Dividends 115 B Net Income 116 C Dividends and Net Income 117 118