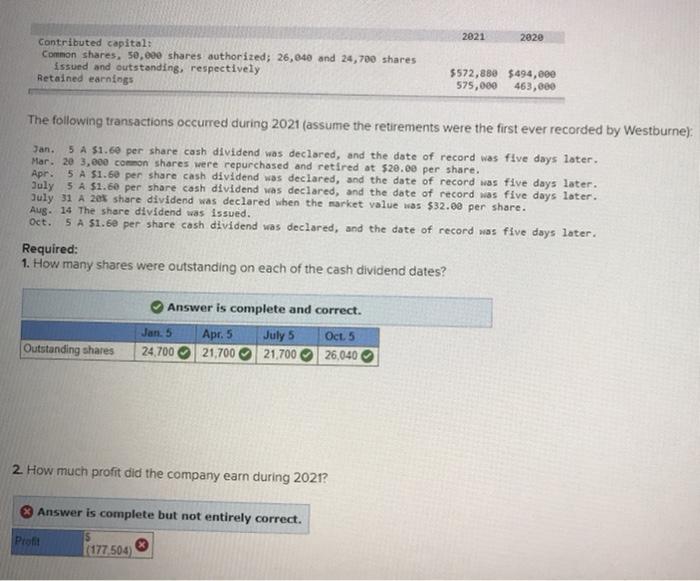

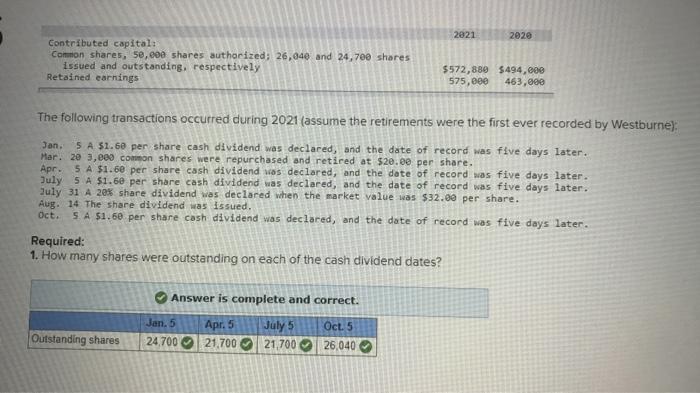

2021 2020 Contributed capital: Common shares, 50.000 shares authorized; 26,840 and 24,780 shares issued and outstanding, respectively Retained earnings 5572,880 $494,000 575,000 463,000 The following transactions occurred during 2021 (assume the retirements were the first ever recorded by Westburne): Jan. 5 A $1.60 per share cash dividend was declared, and the date of record was five days later. Mar. 20 3,000 common shares were repurchased and retired at $20.00 per share. Apr. 5 A $1.50 per share cash dividend was declared, and the date of record was five days later. July 5 A $1.60 per share cash dividend was declared, and the date of record was five days later. July 31 A 200 share dividend was declared when the market value was $32.00 per share. Aug. 14 The share dividend was issued. Oct. 5 A $1.60 per share cash dividend was declared, and the date of record was five days later. Required: 1. How many shares were outstanding on each of the cash dividend dates? Answer is complete and correct. Jan 5 Apr. 5 July 5 Oct. 5 24,700 21,700 21,700 26.040 Outstanding shares 2. How much profit did the company earn during 2021? Answer is complete but not entirely correct. Profit (177504 2821 2020 Contributed capital: Common shares, 50,000 shares authorized; 26,840 and 24,700 shares Issued and outstanding, respectively Retained earnings $572,889 5494,000 575,080 463,990 The following transactions occurred during 2021 (assume the retirements were the first ever recorded by Westburne): Jan. 5 A $1.60 per share cash dividend was declared, and the date of record was five days later. Mar. 20 3,eee common shares were repurchased and retired at $20.00 per share. Apr. 5 A $1.60 per share cash dividend was declared, and the date of record was five days later. July 5 A $1.6e per share cash dividend was declared, and the date of record was five days later. July 31 A 20% share dividend was declared when the market value was $32.00 per share. Aug. 14 The share dividend was issued. Oct. 5 A $1.50 per share cash dividend was declared, and the date of record was five days later. Required: 1. How many shares were outstanding on each of the cash dividend dates? Answer is complete and correct. Jan. 5 Apr. 5 July 5 Oct. 5 24 700 21,700 21.700 26,040 Outstanding shares