2021 anual report walt disney company

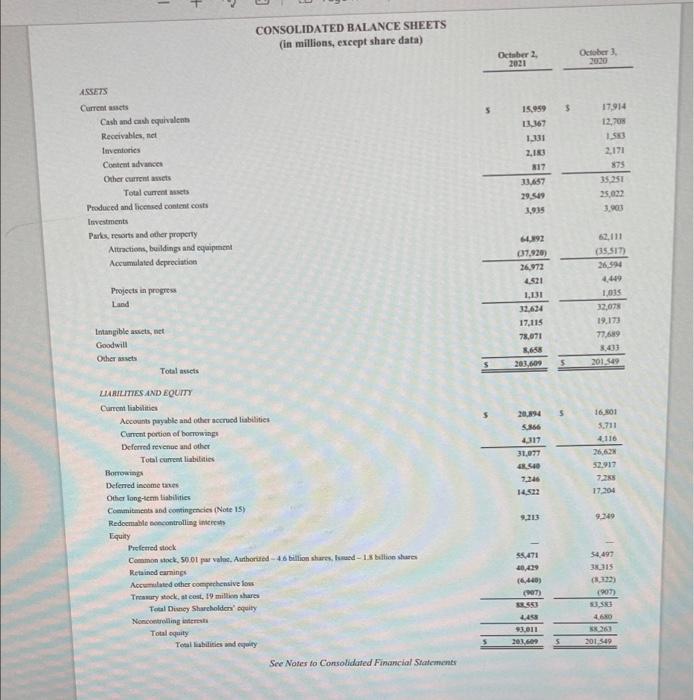

19. What period of time is measured by the annual report (fiscal year-check carefully the balance sheet)? What does that mean for each financial statement? 20. Why do you think the company chose that particular time period for their reporting? BALANCE SHEET 21. What is the balance sheet equation for the most recent year? Show the numbers. 22. What three assets are largest in amount on the most recent balance sheet? I 23. Does the kind and size of assets listed seem consistent with the business of the company? Explain. 24. What three liabilities are largest in amount on the most recent balance sheet? 25. What is larger in amount for the most recent year-contributed capital or retained earnings? 26. Calculate the percentage of total assets for each item listed on the most recent balance sheet. Present in a spreadsheet that is easily understood. 27. What is the percentage of current assets to total assets for the most recent year? 28. What is the debt ratio for the most recent year- compare it to the previous year? What does this say about the company? 29. What is the current ratio for the most recent year and how does that compare to the year before? What does this say about the company? 30. What percentage did total assets change between the last two years? 31. What is the par value, shares authorized and shares issued at the end of the most recent year? INCOME STATEMENT 1 1 + + CONSOLIDATED BALANCE SHEETS (in millions, except share data) October October 2 2021 5 3 ASSETS Current Cash and cash equivalent Receivables, et Inventories Content advances Other current acts Total current sets Produced and licensed content costs Investments Parles, resorts and other property Attractions, buildings and equipment Accumulated depreciation 15.959 11367 1.131 2.13 317 23.457 29,519 3,935 17.914 12,700 1.53 2.171 75 35251 25.022 3.03 Projects in progress Land 0892 037,920) 26.972 4521 1.31 12634 17.115 78.071 3,658 201,609 62,111 (35,517) 2.594 4449 1.015 32,073 19.173 77.69 803 2015 Intangible assets, et Goodwill Other assets Total assets $ 5 5 20,894 5866 4 31.077 16.01 31.711 4.116 26.62 52.917 725 17304 7316 13 9.249 LIABILITIES AND EQUITY Current liabilities Accounts payable and other socred liabilities Current portion of borrowings Deforved revenue and other Total current liabilities Deferred income taxes Other long-term isbilities Commitments and contingencies (Note 15) Redeemable controlling in Equity Preferred stock Common stock, 5001 pw value. Authored 46 billion shares, brand - 1.3 billion shares Retained earnings Accumulated other competensive forms Treasury seck, stoest, 19 million shares Total Dimney Shurcholders' quity No controlling Total quity Teal liabilities and polity See Notes to Consolidated Financial Statements 54,497 315 (332) 1907 $8.471 40,429 16.440) (07 553 4.45 9301 201609 4.60 5 201349 19. What period of time is measured by the annual report (fiscal year-check carefully the balance sheet)? What does that mean for each financial statement? 20. Why do you think the company chose that particular time period for their reporting? BALANCE SHEET 21. What is the balance sheet equation for the most recent year? Show the numbers. 22. What three assets are largest in amount on the most recent balance sheet? I 23. Does the kind and size of assets listed seem consistent with the business of the company? Explain. 24. What three liabilities are largest in amount on the most recent balance sheet? 25. What is larger in amount for the most recent year-contributed capital or retained earnings? 26. Calculate the percentage of total assets for each item listed on the most recent balance sheet. Present in a spreadsheet that is easily understood. 27. What is the percentage of current assets to total assets for the most recent year? 28. What is the debt ratio for the most recent year- compare it to the previous year? What does this say about the company? 29. What is the current ratio for the most recent year and how does that compare to the year before? What does this say about the company? 30. What percentage did total assets change between the last two years? 31. What is the par value, shares authorized and shares issued at the end of the most recent year? INCOME STATEMENT 1 1 + + CONSOLIDATED BALANCE SHEETS (in millions, except share data) October October 2 2021 5 3 ASSETS Current Cash and cash equivalent Receivables, et Inventories Content advances Other current acts Total current sets Produced and licensed content costs Investments Parles, resorts and other property Attractions, buildings and equipment Accumulated depreciation 15.959 11367 1.131 2.13 317 23.457 29,519 3,935 17.914 12,700 1.53 2.171 75 35251 25.022 3.03 Projects in progress Land 0892 037,920) 26.972 4521 1.31 12634 17.115 78.071 3,658 201,609 62,111 (35,517) 2.594 4449 1.015 32,073 19.173 77.69 803 2015 Intangible assets, et Goodwill Other assets Total assets $ 5 5 20,894 5866 4 31.077 16.01 31.711 4.116 26.62 52.917 725 17304 7316 13 9.249 LIABILITIES AND EQUITY Current liabilities Accounts payable and other socred liabilities Current portion of borrowings Deforved revenue and other Total current liabilities Deferred income taxes Other long-term isbilities Commitments and contingencies (Note 15) Redeemable controlling in Equity Preferred stock Common stock, 5001 pw value. Authored 46 billion shares, brand - 1.3 billion shares Retained earnings Accumulated other competensive forms Treasury seck, stoest, 19 million shares Total Dimney Shurcholders' quity No controlling Total quity Teal liabilities and polity See Notes to Consolidated Financial Statements 54,497 315 (332) 1907 $8.471 40,429 16.440) (07 553 4.45 9301 201609 4.60 5 201349