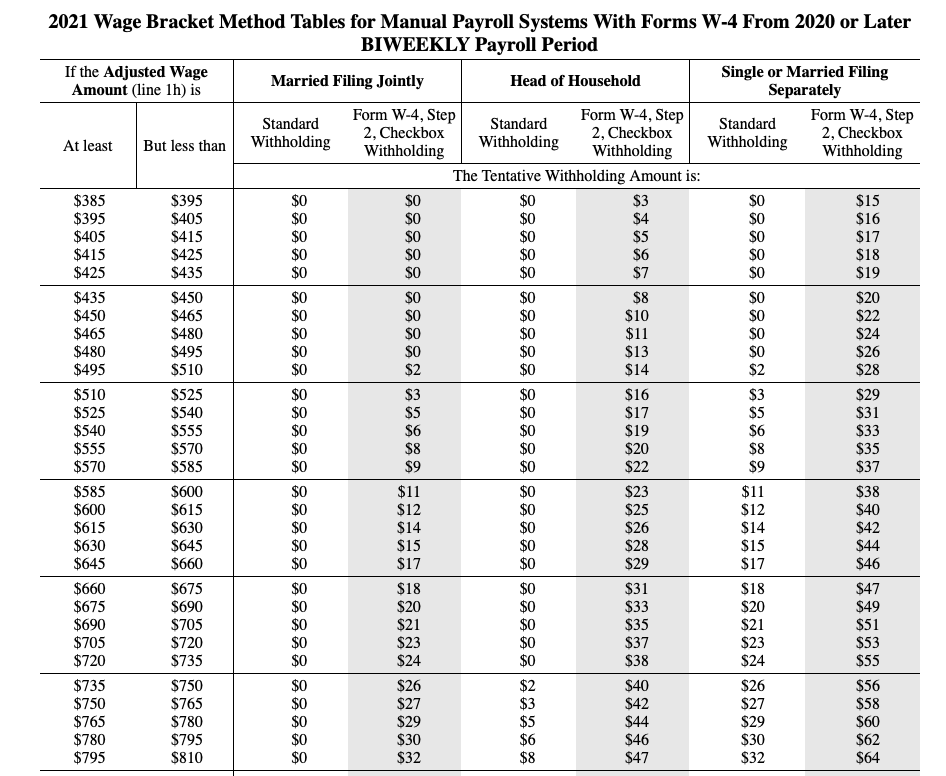

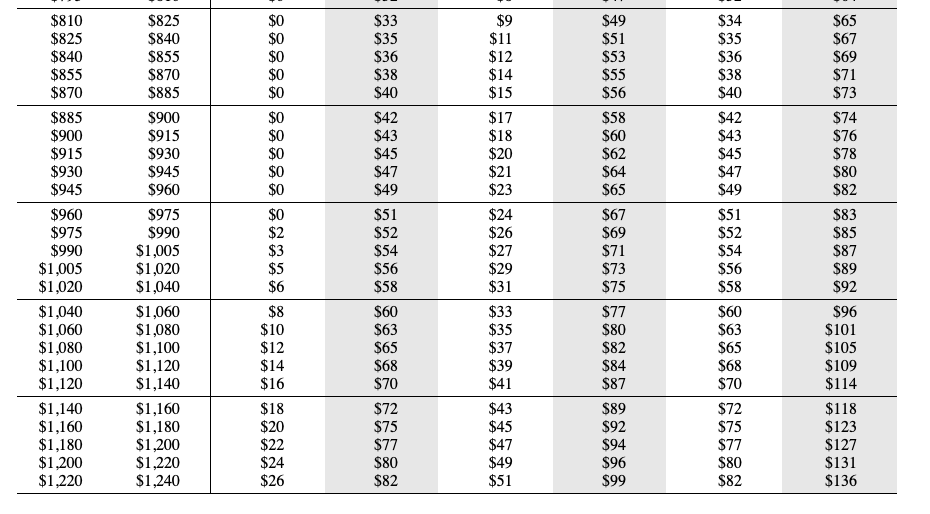

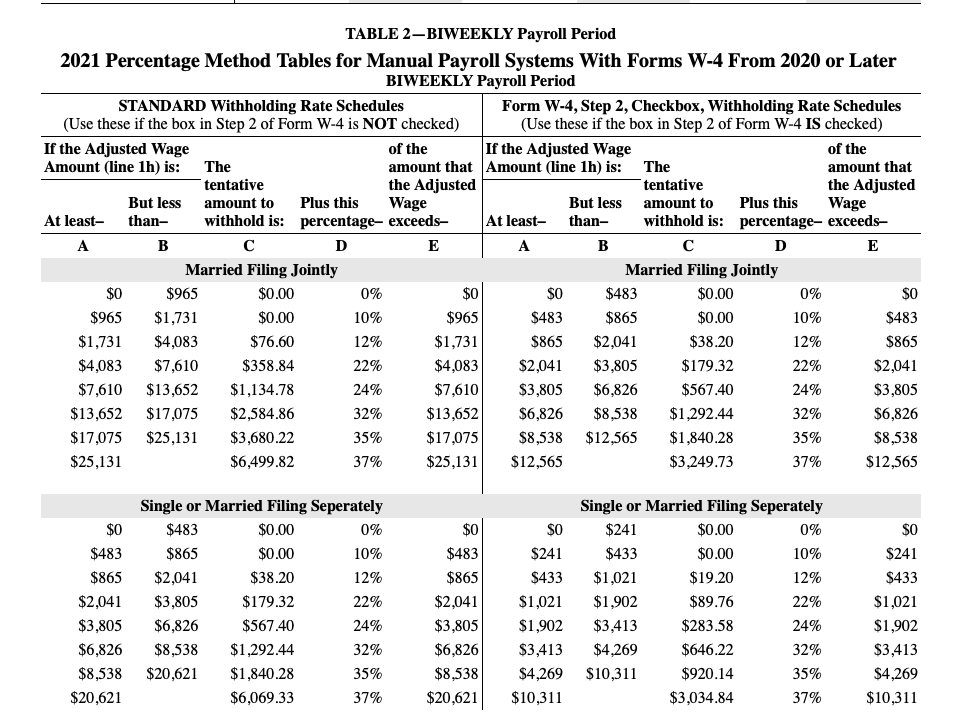

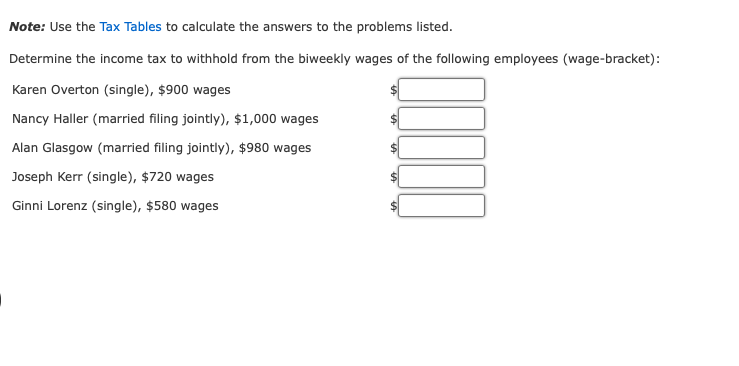

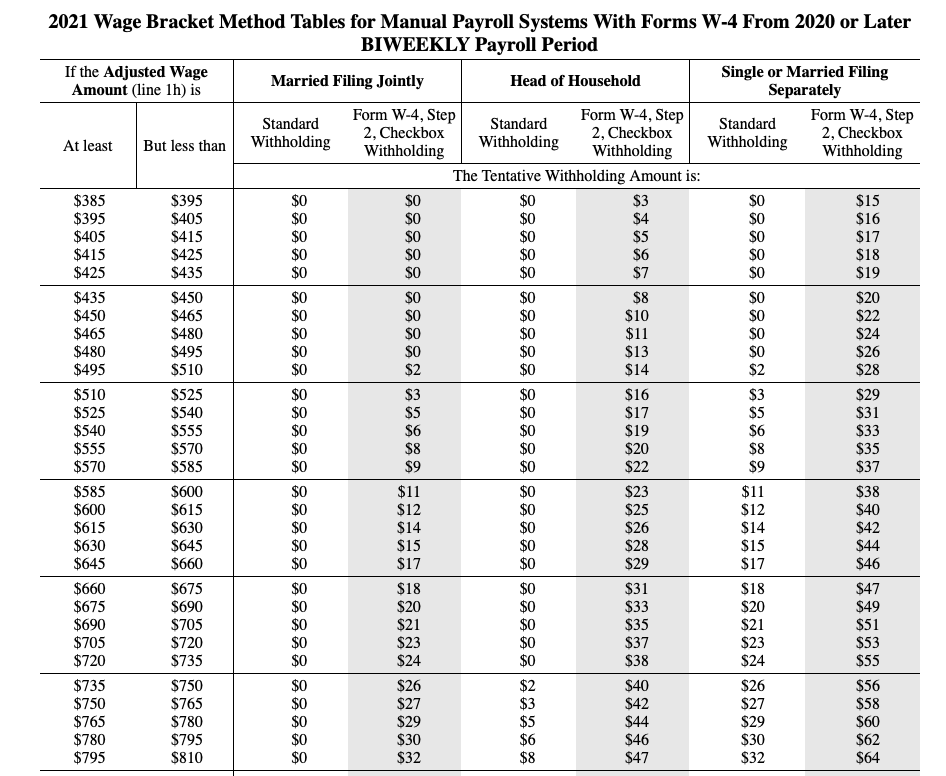

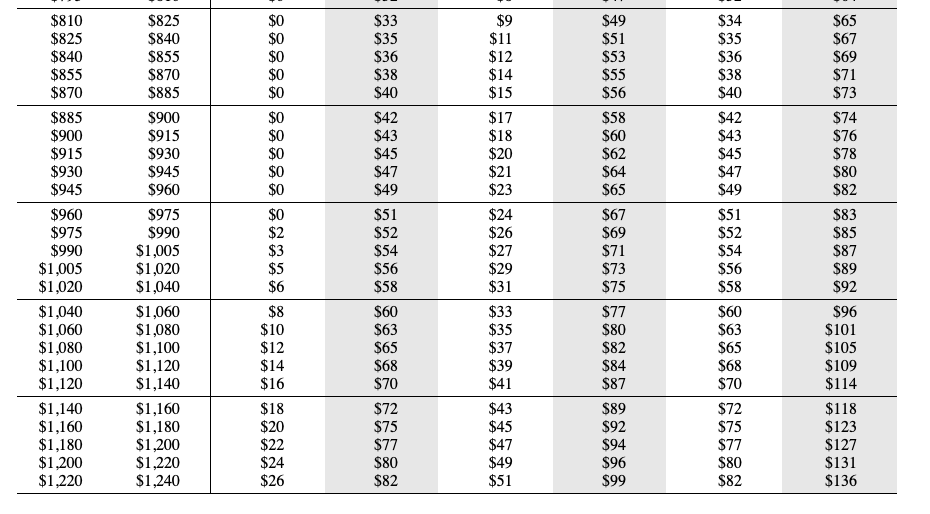

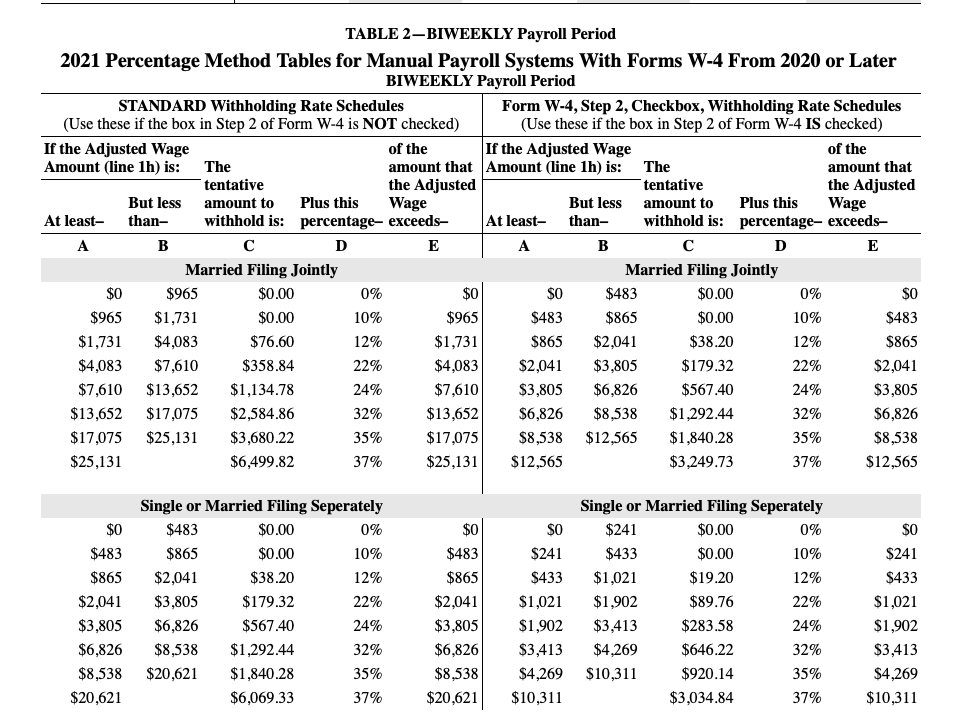

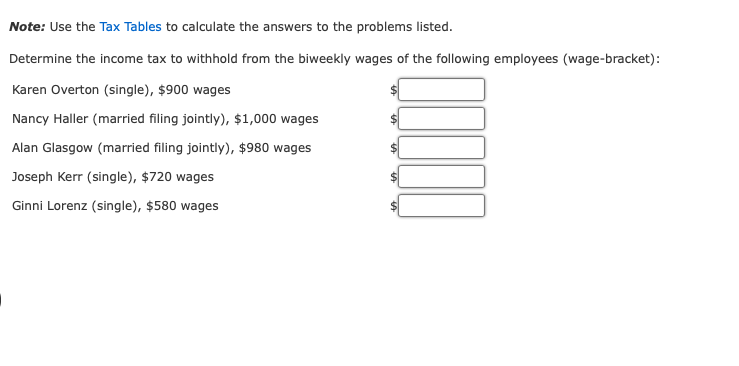

2021 Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later BIWEEKLY Payroll Period If the Adjusted Wage Amount (line 1h) is Married Filing Jointly Head of Household Single or Married Filing Separately Form W-4, Step 2, Checkbox Withholding Standard Withholding At least $385 $0 $0 $395 $0 $0 $405 $0 $0 $415 $0 $0 $425 $0 $0 $435 $0 $0 $450 $0 $0 $465 $0 $0 $480 $0 $0 $495 $2 $2 $510 $3 $3 $525 $5 $5 $540 $6 $555 $570 $585 $600 $615 $630 $645 $660 $675 $690 $705 $720 $735 $750 $765 $780 $795 But less than $395 $405 $415 $425 $435 $450 $465 $480 $495 $510 $525 $540 $555 $570 $585 $600 $615 $630 $645 $660 $675 $690 $705 $720 $735 $750 $765 $780 $795 $810 Standard Withholding $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $8 $9 $11 $12 $14 $15 $17 $18 $20 $21 $23 $24 $26 $27 $29 $30 $32 Form W-4, Step Standard Withholding 2, Checkbox Withholding The Tentative Withholding Amount is: $0 $3 $0 $4 $0 $5 $0 $6 $0 $7 $0 $8 $0 $10 $0 $11 $0 $13 $0 $14 $0 $16 $0 $17 $0 $19 $0 $20 $0 $22 $0 $23 $0 $25 $0 $26 $0 $28 $0 $29 $0 $31 $0 $33 $0 $35 $0 $37 $0 $38 $2 $40 $3 $42 $5 $44 $6 $46 $8 $47 $6 $8 $9 $11 $12 $14 $15 $17 $18 $20 $21 $23 $24 $26 $27 $29 $30 $32 Form W-4, Step 2, Checkbox Withholding $15 $16 $17 $18 $19 $20 $22 $24 $26 $28 $29 $31 $33 $35 $37 $38 $40 $42 $44 $46 $47 $49 $51 $53 $55 $56 $58 $60 $62 $64 $810 $825 $840 $855 $870 $885 $900 $915 $930 $945 $960 $975 $990 $1,005 $1,020 $1,040 $1,060 $1,080 $1,100 $1,120 $1,140 $1,160 $1,180 $1,200 $1,220 $825 $840 $855 $870 $885 $900 $915 $930 $945 $960 $975 $990 $1,005 $1,020 $1,040 $1,060 $1,080 $1,100 $1,120 $1,140 $1,160 $1,180 $1,200 $1,220 $1,240 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $2 $3 $5 $6 $8 $10 $12 $14 $16 $18 $20 $22 $24 $26 $33 $35 $36 $38 $40 $42 $43 $45 $47 $49 $51 $52 $54 $56 $58 $60 $63 $65 $68 $70 $72 $75 $77 $80 $82 $9 $11 $12 $14 $15 $17 $18 $20 $21 $23 $24 $26 $27 $29 $31 $33 $35 $37 $39 $41 $43 $45 $47 $49 $51 $49 $51 $53 $55 $56 $58 $60 $62 $64 $65 $67 $69 $71 $73 $75 $77 $80 $82 $84 $87 $89 $92 $94 $96 $99 $34 $35 $36 $38 $40 $42 $43 $45 $47 $49 $51 $52 $54 $56 $58 $60 $63 $65 $68 $70 $72 $75 $77 $80 $82 $65 $67 $69 $71 $73 $74 $76 $78 $80 $82 $83 $85 $87 $89 $92 $96 $101 $105 $109 $114 $118 $123 $127 $131 $136 TABLE 2-BIWEEKLY Payroll Period 2021 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later BIWEEKLY Payroll Period STANDARD Withholding Rate Schedules (Use these if the box in Step 2 of Form W-4 is NOT checked) Form W-4, Step 2, Checkbox, Withholding Rate Schedules (Use these if the box in Step 2 of Form W-4 IS checked) If the Adjusted Wage Amount (line 1h) is: If the Adjusted Wage Amount (line 1h) is: The tentative amount to of the amount that the Adjusted Plus this Wage percentage- exceeds- The tentative amount to of the amount that the Adjusted Plus this Wage withhold is: percentage- exceeds- But less than- But less than- At least- withhold is: At least- A B C D E A B D E Married Filing Jointly Married Filing Jointly $0 $965 $0.00 0% SO $483 $0.00 0% $965 $1,731 $0.00 10% $483 $865 $0.00 10% $1,731 $4,083 $76.60 12% $865 $2,041 $38.20 12% $4,083 $7,610 $358.84 22% $2,041 $3,805 $179.32 22% $7,610 $13,652 $1,134.78 24% $3,805 $6,826 $567.40 24% 32% 32% $13,652 $17,075 $2,584.86 $17,075 $25,131 $3,680.22 $25,131 $6,826 $8,538 $1,292.44 $8,538 $12,565 $1,840.28 35% 35% $6,499.82 37% $12,565 $3,249.73 37% Single or Married Filing Seperately Single or Married Filing Seperately $0 $483 $0.00 0% $0 $241 $0.00 0% $483 $865 $0.00 10% $241 $433 $0.00 10% $865 $2,041 $38.20 12% $433 $1,021 $19.20 12% $2,041 $3,805 $179.32 22% $1,021 $1,902 $89.76 22% $3,805 $6,826 $567.40 24% $1,902 $3,413 $283.58 24% $1,292.44 32% $3,413 $4,269 $646.22 32% $6,826 $8,538 $8,538 $20,621 $1,840.28 35% $4,269 $10,311 $920.14 35% $20,621 $6,069.33 37% $3,034.84 37% $0 $965 $1,731 $4,083 $7,610 $13,652 $17,075 $25,131 $0 $483 $865 $2,041 $3,805 $6,826 $8,538 $20,621 $10,311 $0 $483 $865 $2,041 $3,805 $6,826 $8,538 $12,565 $0 $241 $433 $1,021 $1,902 $3,413 $4,269 $10,311 Note: Use the Tax Tables to calculate the answers to the problems listed. Determine the income tax to withhold from the biweekly wages of the following employees (wage-bracket): Karen Overton (single), $900 wages Nancy Haller (married filing jointly), $1,000 wages Alan Glasgow (married filing jointly), $980 wages Joseph Kerr (single), $720 wages Ginni Lorenz (single), $580 wages 00000