Answered step by step

Verified Expert Solution

Question

1 Approved Answer

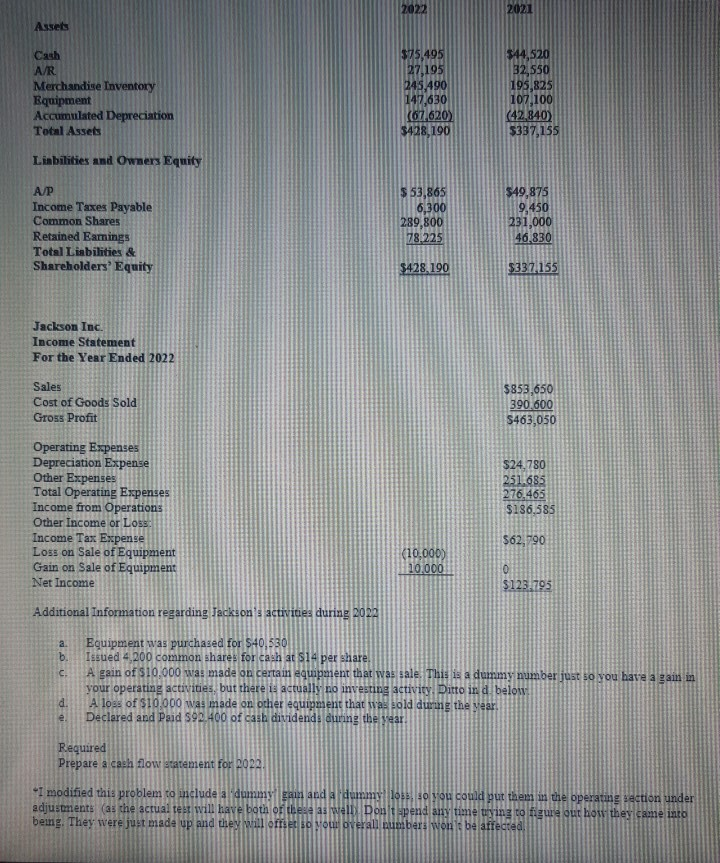

2022 2021 Assets A/R Merchandise Inventory Equipment Accumulated Depreciation Total Assets $75,495 27,195 245,490 147,630 (67.620) $428.190 $44,520 32,550 195,825 107 100 (42,840) 5337,155 Linbilities

2022 2021 Assets A/R Merchandise Inventory Equipment Accumulated Depreciation Total Assets $75,495 27,195 245,490 147,630 (67.620) $428.190 $44,520 32,550 195,825 107 100 (42,840) 5337,155 Linbilities and Owners Equity A/P Income Taxes Payable Common Shares Retained Earnings Total Liabilities & Shareholders' Equity $ 53,865 6,300 289,800 78.225 $49,875 9,450 231,000 46,830 $428.190 $337,155 Jackson Inc. Income Statement For the Year Ended 2022 Sales Cost of Goods Sold Gross Profit $853,650 390.600 $463.050 Operating Expenses Depreciation Expense Other Expenses Total Operating Expenses Income from Operations Other Income or LOSS Income Tax Expense Loss on Sale of Equipment Gain on Sale of Equipment Net Income $24.780 251.685 276.465 $136.585 $62,790 (10,000) 10,000 0 $123.795 Additional Information regarding Jackson's activities during 2022 b. c Equipment was purchased for $40,530 Issued 4,200 common shares for cash at S14 per share A gain of $10,000 was made on certain equipment that was sale. This is a dummy number just to you have a gain in your operating activities, but there is actually no investing activity. Ditto in d below: A loss of $10,000 was made on other equipment that was sold due the Mear. Declared and Paid S90.400 of cash dividend: during the year d Required Prepare a cash flow statement for 1022 "I modified this problem to include a "dummy Eam and dummyllt, so you could put them in the operating section under adjustments (as the actual ter will have both of these as well Don't Pend any time trying to figure out how they came into being. They were just made up and they will offset to you prerall numbers won is be affected 2022 2021 Assets A/R Merchandise Inventory Equipment Accumulated Depreciation Total Assets $75,495 27,195 245,490 147,630 (67.620) $428.190 $44,520 32,550 195,825 107 100 (42,840) 5337,155 Linbilities and Owners Equity A/P Income Taxes Payable Common Shares Retained Earnings Total Liabilities & Shareholders' Equity $ 53,865 6,300 289,800 78.225 $49,875 9,450 231,000 46,830 $428.190 $337,155 Jackson Inc. Income Statement For the Year Ended 2022 Sales Cost of Goods Sold Gross Profit $853,650 390.600 $463.050 Operating Expenses Depreciation Expense Other Expenses Total Operating Expenses Income from Operations Other Income or LOSS Income Tax Expense Loss on Sale of Equipment Gain on Sale of Equipment Net Income $24.780 251.685 276.465 $136.585 $62,790 (10,000) 10,000 0 $123.795 Additional Information regarding Jackson's activities during 2022 b. c Equipment was purchased for $40,530 Issued 4,200 common shares for cash at S14 per share A gain of $10,000 was made on certain equipment that was sale. This is a dummy number just to you have a gain in your operating activities, but there is actually no investing activity. Ditto in d below: A loss of $10,000 was made on other equipment that was sold due the Mear. Declared and Paid S90.400 of cash dividend: during the year d Required Prepare a cash flow statement for 1022 "I modified this problem to include a "dummy Eam and dummyllt, so you could put them in the operating section under adjustments (as the actual ter will have both of these as well Don't Pend any time trying to figure out how they came into being. They were just made up and they will offset to you prerall numbers won is be affected

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started