Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2022, Jenna spends $2,000 on course tuition to attend these seminars. She spends another $400 on architecture books during the year. Jenna's daughter, Caitlin,

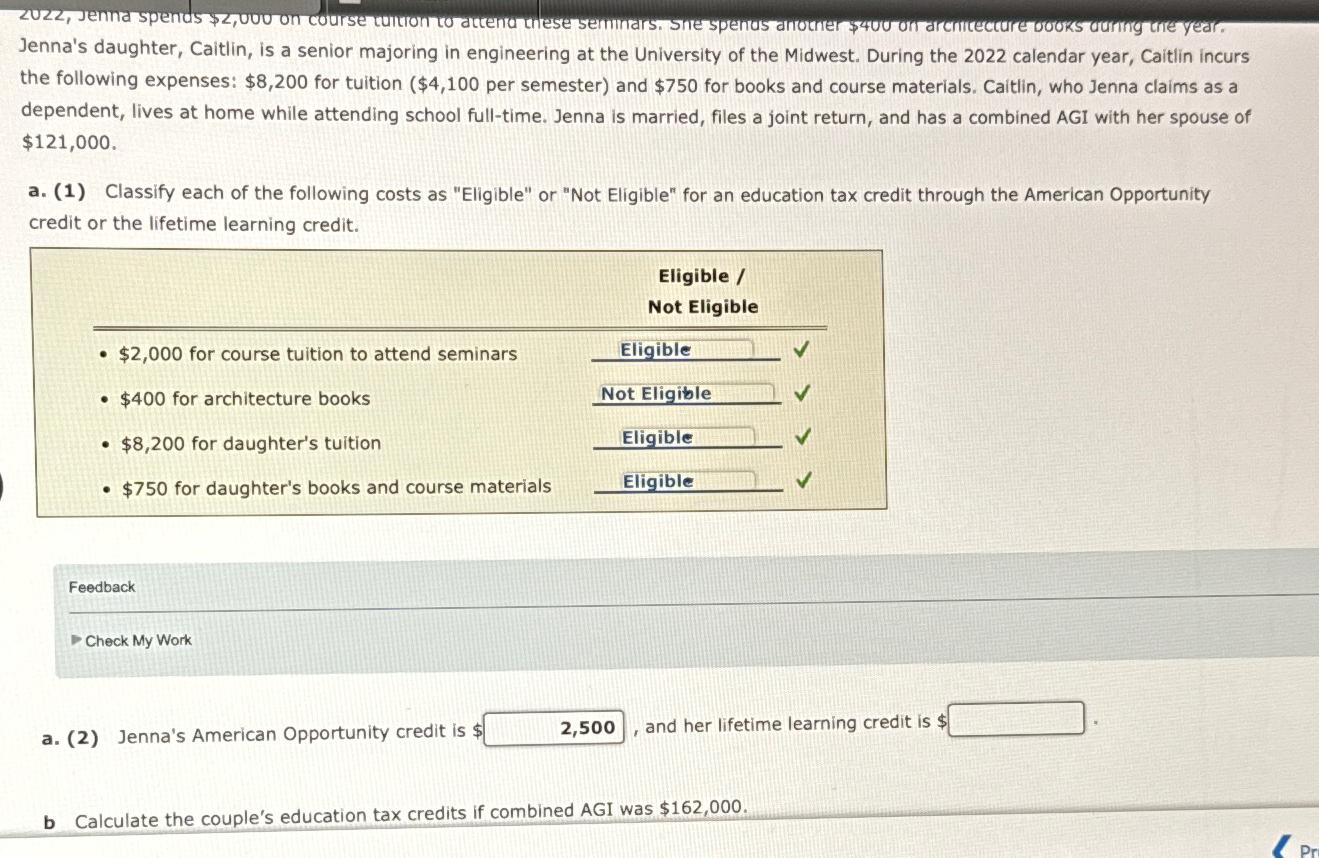

2022, Jenna spends $2,000 on course tuition to attend these seminars. She spends another $400 on architecture books during the year. Jenna's daughter, Caitlin, is a senior majoring in engineering at the University of the Midwest. During the 2022 calendar year, Caitlin incurs the following expenses: $8,200 for tuition ($4,100 per semester) and $750 for books and course materials. Caitlin, who Jenna claims as a dependent, lives at home while attending school full-time. Jenna is married, files a joint return, and has a combined AGI with her spouse of $121,000. a. (1) Classify each of the following costs as "Eligible" or "Not Eligible" for an education tax credit through the American Opportunity credit or the lifetime learning credit. Eligible / Not Eligible . $2,000 for course tuition to attend seminars Eligible Not Eligible $400 for architecture books $8,200 for daughter's tuition. $750 for daughter's books and course materials Feedback Check My Work a. (2) Jenna's American Opportunity credit is $ Eligible Eligible 2,500, and her lifetime learning credit is $ b Calculate the couple's education tax credits if combined AGI was $162,000. Pr

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started