Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2023 Income Statement Sales Cost of Goods Sold Depreciation Expense Earnings before Interest and Taxes Interest Expense Taxable Income Tax Expense Net Income Dividends Paid

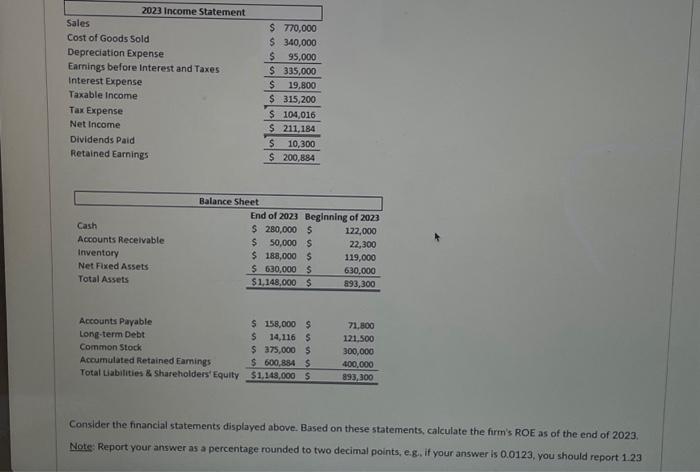

2023 Income Statement Sales Cost of Goods Sold Depreciation Expense Earnings before Interest and Taxes Interest Expense Taxable Income Tax Expense Net Income Dividends Paid Retained Earnings Cash Accounts Receivable Inventory Net Fixed Assets Total Assets Accounts Payable Long-term Debt Common Stock Balance Sheet Accumulated Retained Earnings Total Liabilities & Shareholders' Equity $ 770,000 $ 340,000 $ 95,000 $ 335,000 $ 19,800 315,200 $ $ 104,016 $ 211,184 $ 10,300 $ 200,884 End of 2023 Beginning of 2023 $ 280,000 $ $ 50,000 $ $ 188,000 $ $ 630,000 $ $1,148,000 $ $ 158,000 $ $ 14,116 $ $375,000 $ $ 600,884 $ $1,148,000 $ 122,000 22,300 119,000 630,000 893,300 71,800 121,500 300,000 400,000 893,300 Consider the financial statements displayed above. Based on these statements, calculate the firm's ROE as of the end of 2023. Note: Report your answer as a percentage rounded to two decimal points, e.g., if your answer is 0.0123, you should report 1.23

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started