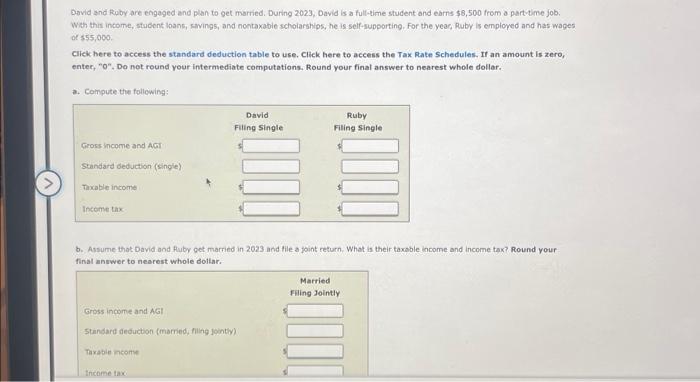

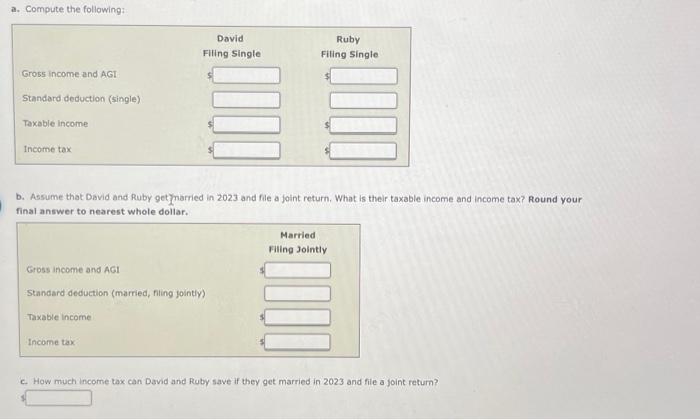

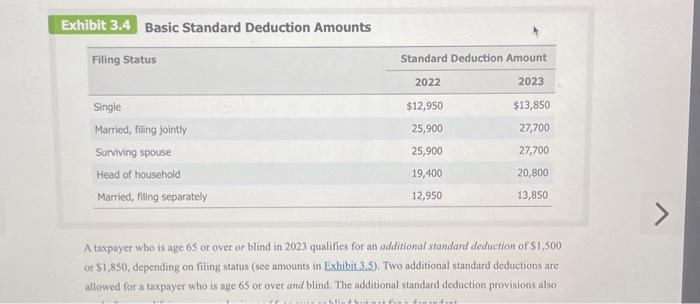

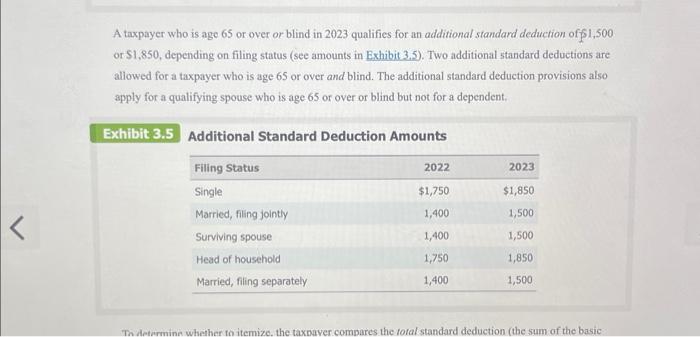

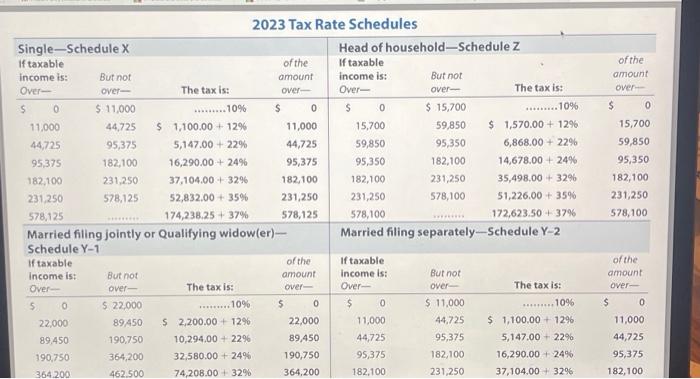

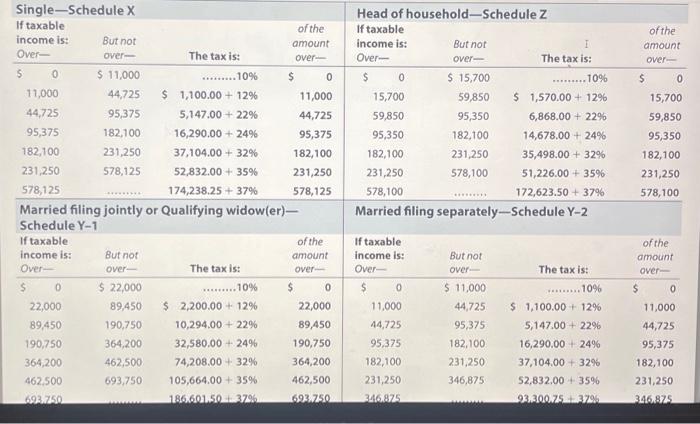

2023 Tax Rate Schedules Basic Standard Deduction Amounts A taxpayer who is age 65 or over or blind in 2023 qualifies for an additional standard deduction of $1,500 or $1,850, depending on filing status (see amounts in Exhibit 3.5). Two additional standard deductions are allowed for a taxpayer who is age 65 or over and blind. The additional standard deduction provisions also \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Single-Schedule X } & \multicolumn{4}{|c|}{ Head of household-Schedule Z } \\ \hline Iftaxableincomeis:Over- & \multirow{2}{*}{Butnotover-$11,000} & \multirow{2}{*}{Thetaxis:...10%} & oftheamountover- & Iftaxableincomeis:Over- & \multirow{2}{*}{Butnotover-$15,700} & \multirow{2}{*}{Thetaxis:......10%} & oftheamountover- \\ \hline 0 & & & $ & 0 & & & s \\ \hline 11,000 & 44,725 & $1,100.00+12% & 11,000 & 15,700 & 59,850 & \$ 1,570.00+12% & 15,700 \\ \hline 44,725 & 95,375 & 5,147.00+22% & 44,725 & 59,850 & 95,350 & 6,868.00+22% & 59,850 \\ \hline 95,375 & 182,100 & 16,290.00+24% & 95,375 & 95,350 & 182,100 & 14,678.00+24% & 95,350 \\ \hline 182,100 & 231,250 & 37,104.00+32% & 182,100 & 182,100 & 231,250 & 35,498.00+32% & 182,100 \\ \hline 231,250 & 578,125 & 52,832.00+35% & 231,250 & 231,250 & 578,100 & 51,226.00+35% & 231,250 \\ \hline 578,125 & .......... & 174,238.25+37% & 578,125 & 578,100 & .......... & 172,623.50+37% & 578,100 \\ \hline \multicolumn{4}{|c|}{MarriedfilingjointlyorQualifyingwidow(er)-ScheduleY-1} & \multicolumn{4}{|c|}{ Married filing separately-Schedule Y-2 } \\ \hline Iftaxableincomeis:Over- & Butnotover- & The tax is: & oftheamountover- & Iftaxableincomeis:Over- & Butnotover- & The tax is: & oftheamountover- \\ \hline 0 & $22,000 & 10% & 0 & 0 & $11,000 & 10% & $ \\ \hline 22,000 & 89,450 & $2,200.00+12% & 22,000 & 11,000 & 44,725 & $1,100.00+12% & 11,000 \\ \hline 89,450 & 190,750 & 10,294.00+22% & 89,450 & 44,725 & 95,375 & 5,147.00+22% & 44,725 \\ \hline 190,750 & 364,200 & 32,580.00+24% & 190,750 & 95,375 & 182,100 & 16,290.00+24% & 95,375 \\ \hline 364,200 & 462,500 & 74,208.00+32% & 364,200 & 182,100 & 231,250 & 37,104,00+32% & 182,100 \\ \hline 462,500 & 693,750 & 105,664,00+35% & 462,500 & 231,250 & 346,875 & 52,832,00+35% & 231,250 \\ \hline 623750 & & 186,601.50+37% & 693.750 & 3468825 & & 23,300,75+3726 & 3464875 \\ \hline \end{tabular} a. Compute the following: b. Assume that David and Ruby get grarried in 2023 and file a foint return. What is their taxable income and income tax? Round your final answer to nearest whole dollar. c. How much income tax can David and Ruby save if they get married in 2023 and file a joint retum? Oovid and Riby are engaged and plan to get married. During 2023, David is a full-time student and earns $8,500 from a part- time job. ot $55,000. Click here to access the standard deduction table to use. Click here to access the Tax Rate Schedules. If an amount is zero, enter, " 0 ". Do not round your intermediate computations, Round your final answer to nearest whole dollar. a. Compute the follewing: b. Assume that David and fluby get married in 2023 and file a joint return. What is their taxoble income and income tax? Round your final answer to nearest whole soliar