Answered step by step

Verified Expert Solution

Question

1 Approved Answer

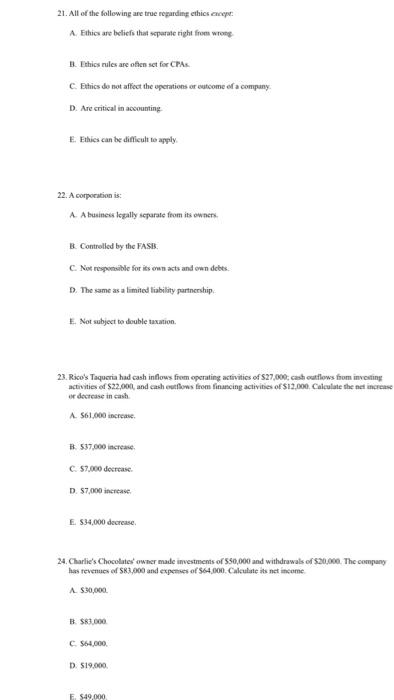

21. All of the following are true regarding ethics except A. Ethics are beliefs that separate right from wrong B. Ethics rules are often

21. All of the following are true regarding ethics except A. Ethics are beliefs that separate right from wrong B. Ethics rules are often set for CPA. C. Ethics do not affect the operations or outcome of a company. D. Are critical in accounting. E. Ethics can be difficult to apply. 22. A corporation is: A. A business legally separate from its owners. B. Controlled by the FASB C. Not responsible for its own acts and own debts. D. The same as a limited liability partnership E. Not subject to double taxation. 23. Rico's Taqueria had cash inflows from operating activities of $27,000 cash outflows from investing activities of $22,000, and cash outflows from financing activities of $12,000. Calculate the net increase or decrease in cash A. $61,000 increase B. 537,000 increase C. $7,000 decrease. D. $7,000 increase E. $34,000 decrease 24. Charlie's Chocolates' owner made investments of $50,000 and withdrawals of $20,000. The company has revenues of $83,000 and expenses of $64,000. Calculate its net income A. $30,000 B. $83,000 C. $64,000, D. $19,000. E. $49,000.

Step by Step Solution

★★★★★

3.58 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 21 C Ethics do not affect the operation...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started