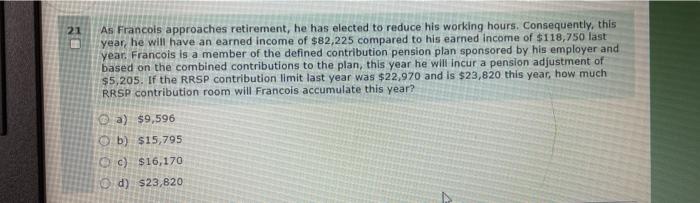

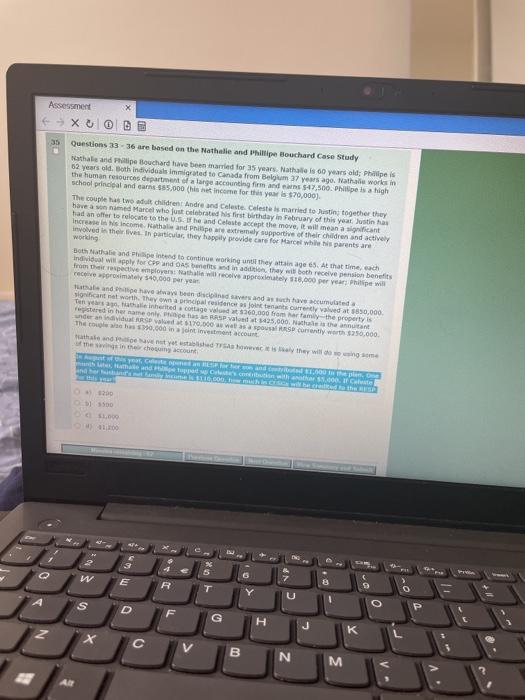

21 As Francois approaches retirement, he has elected to reduce his working hours. Consequently, this year, he will have an earned income of $82,225 compared to his earned income of $118,750 last year. Francois is a member of the defined contribution pension plan sponsored by his employer and based on the combined contributions to the plan, this year he will incur a pension adjustment of $5,205. If the RRSP contribution limit last year was $22,970 and is $23,820 this year, how much RRSP contribution room will Francois accumulate this year? a) $9.596 b) $15,795 Oc) $16,170 d) $23,820 Assessment X | 1 0 0 2 2 35 Questions 33 - 36 are based on the Nathalie and Phillipe Bouchard Case Study Bathalie and Philipe Bouchard ve been red for 3 years that is 60 years old; Philipe is 62 years old. Both individuals immigrated to Canada from Belgium 37 years ago, the work in the human resources department of a large scouting firm and 47,500. Phillip is a high school print and carne 535.000 (his income for this year is $70,000). The couple has two children Andre and Celeste Celeste is married to Desting together they have a won med Marcel who just brated Nisst day in February of this year. Justin had an offer to locate to the US he and Celeste accept the move, it will mean a significant Increase in the and Philipe we extremely supportive of their children and actively involved in their lives. In particular, they provide care for Marcel wis parents are working But to come woning they attinage. At that time, each Individual will for Cod Obesition, they will both receive pension benefits from the veloven wreceive approdesty 158,000 per year Philipe will record 540.000 and have been dever and as such vecumulated significant at they are seen currently ved at 3650,000 Tonyesha hated contage 560,000 from harmly the property is werd in her name has SP 405,000. Netheanntant RS 170.000 la sposa SP currently worth $250,000 The 90.000 account that they willing som Frans, en 1500 Su. ST IN E R A U S D F G H N K V B N M 21 As Francois approaches retirement, he has elected to reduce his working hours. Consequently, this year, he will have an earned income of $82,225 compared to his earned income of $118,750 last year. Francois is a member of the defined contribution pension plan sponsored by his employer and based on the combined contributions to the plan, this year he will incur a pension adjustment of $5,205. If the RRSP contribution limit last year was $22,970 and is $23,820 this year, how much RRSP contribution room will Francois accumulate this year? a) $9.596 b) $15,795 Oc) $16,170 d) $23,820 Assessment X | 1 0 0 2 2 35 Questions 33 - 36 are based on the Nathalie and Phillipe Bouchard Case Study Bathalie and Philipe Bouchard ve been red for 3 years that is 60 years old; Philipe is 62 years old. Both individuals immigrated to Canada from Belgium 37 years ago, the work in the human resources department of a large scouting firm and 47,500. Phillip is a high school print and carne 535.000 (his income for this year is $70,000). The couple has two children Andre and Celeste Celeste is married to Desting together they have a won med Marcel who just brated Nisst day in February of this year. Justin had an offer to locate to the US he and Celeste accept the move, it will mean a significant Increase in the and Philipe we extremely supportive of their children and actively involved in their lives. In particular, they provide care for Marcel wis parents are working But to come woning they attinage. At that time, each Individual will for Cod Obesition, they will both receive pension benefits from the veloven wreceive approdesty 158,000 per year Philipe will record 540.000 and have been dever and as such vecumulated significant at they are seen currently ved at 3650,000 Tonyesha hated contage 560,000 from harmly the property is werd in her name has SP 405,000. Netheanntant RS 170.000 la sposa SP currently worth $250,000 The 90.000 account that they willing som Frans, en 1500 Su. ST IN E R A U S D F G H N K V B N M