Answered step by step

Verified Expert Solution

Question

1 Approved Answer

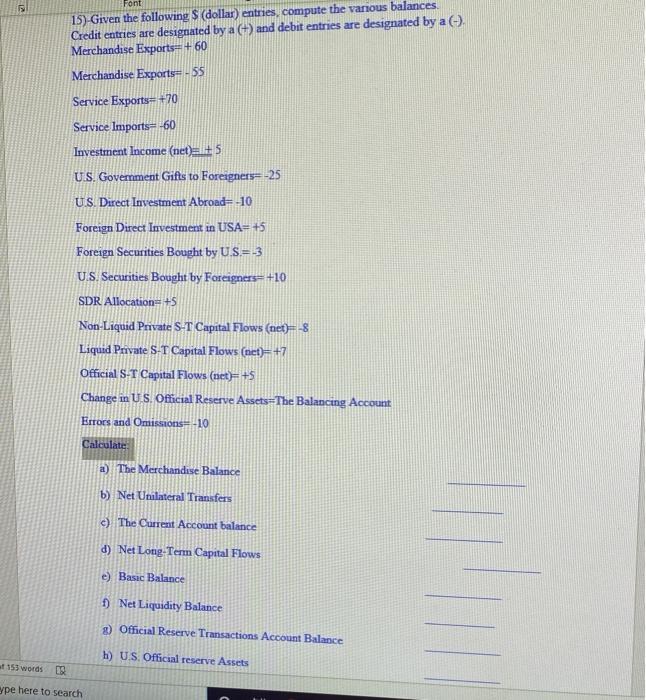

21 Font: 15)-Given the following $ (dollar) entries, compute the various balances. Credit entries are designated by a (+) and debit entries are designated

21 Font: 15)-Given the following $ (dollar) entries, compute the various balances. Credit entries are designated by a (+) and debit entries are designated by a (-). Merchandise Exports- +60 Merchandise Exports=-55 Service Exports- +70 Service Imports -60 Investment Income (net) +5 U.S. Government Gifts to Foreigners--25 US. Direct Investment Abroad=-10 Foreign Direct Investment in USA= +5 Foreign Securities Bought by U.S.=3 U.S. Securities Bought by Foreigners= +10 SDR Allocation=+5 Non-Liquid Private S-T Capital Flows (net)=-8 Liquid Private S-T Capital Flows (net)=+7 Official S-T Capital Flows (net)- +5 Change in U.S. Official Reserve Assets The Balancing Account Errors and Omissions--10 Calculate a) The Merchandise Balance b) Net Unilateral Transfers c) The Current Account balance d) Net Long-Term Capital Flows e) Basic Balance f) Net Liquidity Balance g) Official Reserve Transactions Account Balance h) U.S. Official reserve Assets 153 words 02 ype here to search

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

A merchandise balance60555 Bnet unilateral transfer25 C c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started