Answered step by step

Verified Expert Solution

Question

1 Approved Answer

21. GOGO Golf carts currently produces its own electric engines. Electco has offered to sell the electric engines to GOGO at a price of $300

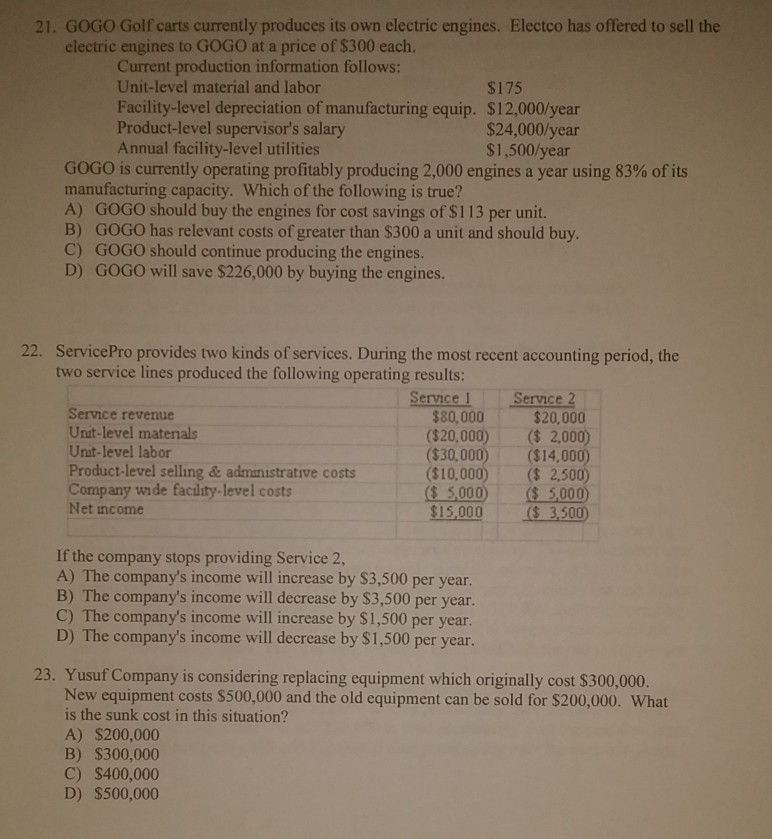

21. GOGO Golf carts currently produces its own electric engines. Electco has offered to sell the electric engines to GOGO at a price of $300 each. Current production information follows: Unit-level material and labor Facility-level depreciation of manufacturing equip. $12,000/year Product-level supervisor's salary Annual facility-level utilities $175 $24,000/year S1,500/year GOGO is currently operating profitably producing 2,000 engines a year using 83% of its manufacturing capacity. Which of the following is true? A) GOGO should buy the engines for cost savings of $113 per unit. B) GOGO has relevant costs of greater than $300 a unit and should buy. C) GOGO should continue producing the engines. D) GOGO will save $226,000 by buying the engines. ServicePro provides two kinds of services. During the most recent accounting period, the two service lines produced the following operating results: 22. Service l Service 2 Service revenue Unt-level matenals Unat-level labor Product-level selling & admnistrative costs Company wide facility-level costs Net income $80,000 ($20,000)2,00 $20,000 0,000) $14,000) ($10,000)2,500) S 5,000 5000 $15,0003,500 If the company stops providing Service 2, A) The company's income will increase by $3,500 per year. B) The company's income will decrease by $3,500 per year. C) The company's income will increase by $1,500 per year. D) The company's income will decrease by $1,500 per year. 23. Yusuf Company is considering replacing equipment which originally cost $300,000. New equipment costs $500,000 and the old equipment can be sold for $200,000. What is the sunk cost in this situation? A) $200,000 B) S300,000 C) $400,000 D) $500,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started