Answered step by step

Verified Expert Solution

Question

1 Approved Answer

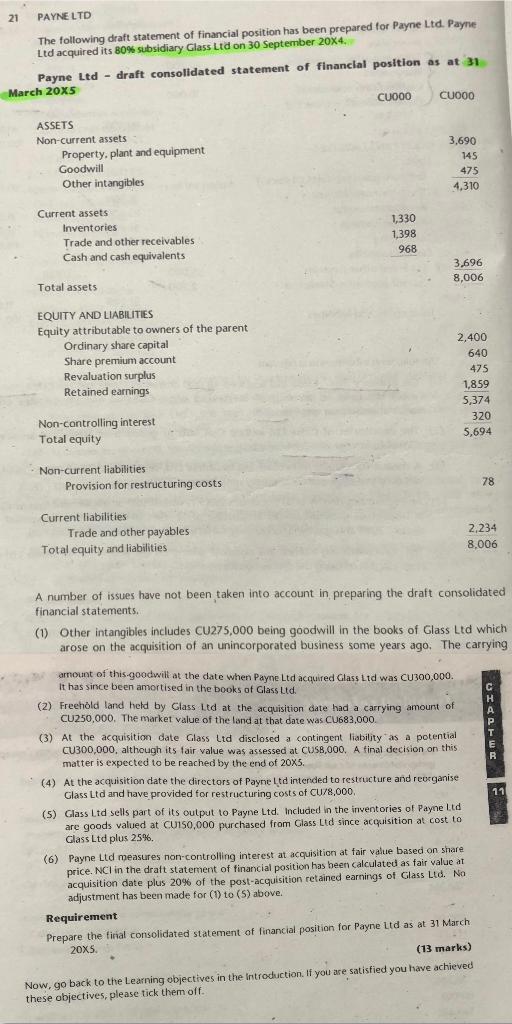

21 PAYNE LTD The following draft statement of financial position has been prepared for Payne Ltd. Payne Ltd acquired its 80% subsidiary Glass Ltd

21 PAYNE LTD The following draft statement of financial position has been prepared for Payne Ltd. Payne Ltd acquired its 80% subsidiary Glass Ltd on 30 September 20X4. Payne Ltd - draft consolidated statement of financial position as at 31 March 20x5 ASSETS Non-current assets Property, plant and equipment Goodwill Other intangibles Current assets Inventories Trade and other receivables Cash and cash equivalents Total assets EQUITY AND LIABILITIES Equity attributable to owners of the parent Ordinary share capital Share premium account Revaluation surplus Retained earnings Non-controlling interest Total equity Non-current liabilities Provision for restructuring costs Current liabilities Trade and other payables Total equity and liabilities CU000 1,330 1,398 968 C0000 3,690 145 475 4,310 3,696 8,006 2,400 640 475 1,859 5,374 amount of this goodwill at the date when Payne Ltd acquired Glass Ltd was CU300,000. It has since been amortised in the books of Glass Ltd. (2) Freehold land held by Glass Ltd at the acquisition date had a carrying amount of CU250,000. The market value of the land at that date was CU683,000. A number of issues have not been taken into account in preparing the draft consolidated financial statements.. (1) Other intangibles includes CU275,000 being goodwill in the books of Glass Ltd which arose on the acquisition of an unincorporated business some years ago. The carrying (3) At the acquisition date Glass Ltd disclosed a contingent liability as a potential CU300,000, although its fair value was assessed at CUSB,000. A final decision on this matter is expected to be reached by the end of 20X5. 320 5,694 (4) At the acquisition date the directors of Payne Ltd intended to restructure and reorganise Glass Ltd and have provided for restructuring costs of CU/8,000. (5) Glass Ltd sells part of its output to Payne Ltd. Included in the inventories of Payne Ltd are goods valued at CUI50,000 purchased from Glass Ltd since acquisition at cost to Glass Ltd plus 25%. 2,234 8,006 (6) Payne Ltd measures non-controlling interest at acquisition at fair value based on share price. NCI in the draft statement of financial position has been calculated as fair value at acquisition date plus 20% of the post-acquisition retained earnings of Glass Ltd. No adjustment has been made for (1) to (5) above. 78 Requirement Prepare the final consolidated statement of financial position for Payne Ltd as at 31 March 20X5. (13 marks) Now, go back to the Learning objectives in the Introduction. If you are satisfied you have achieved these objectives, please tick them off. UNCATURE

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Prepare the final Consolidated studen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started