Answered step by step

Verified Expert Solution

Question

1 Approved Answer

21. Steve and Amy offered $187,000 on a home that had been priced at $209,500. The seller agreed to the offer. A 20% down

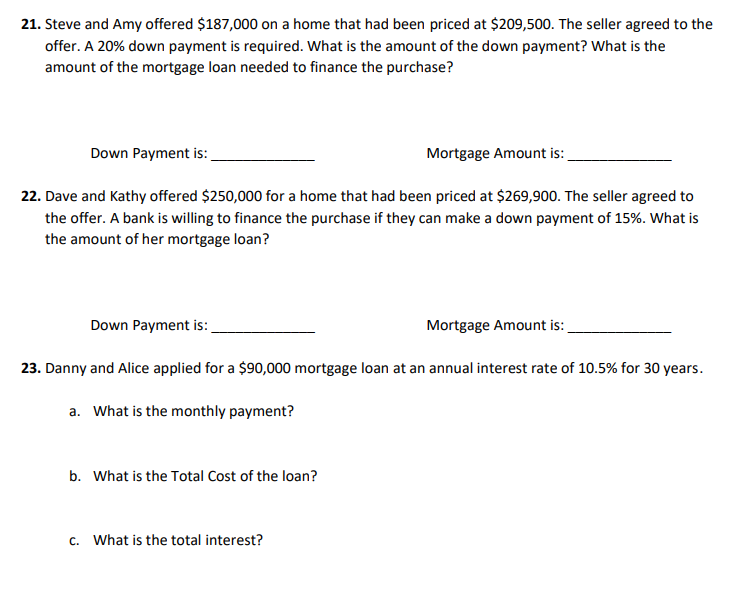

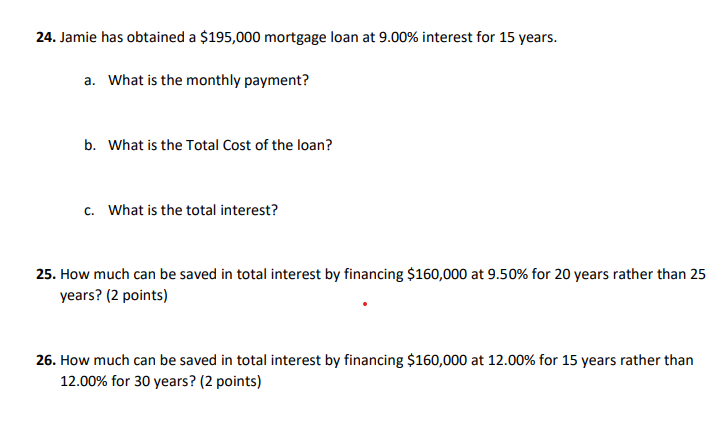

21. Steve and Amy offered $187,000 on a home that had been priced at $209,500. The seller agreed to the offer. A 20% down payment is required. What is the amount of the down payment? What is the amount of the mortgage loan needed to finance the purchase? Down Payment is: Mortgage Amount is: 22. Dave and Kathy offered $250,000 for a home that had been priced at $269,900. The seller agreed to the offer. A bank is willing to finance the purchase if they can make a down payment of 15%. What is the amount of her mortgage loan? Down Payment is: Mortgage Amount is: 23. Danny and Alice applied for a $90,000 mortgage loan at an annual interest rate of 10.5% for 30 years. a. What is the monthly payment? b. What is the Total Cost of the loan? c. What is the total interest? 24. Jamie has obtained a $195,000 mortgage loan at 9.00% interest for 15 years. a. What is the monthly payment? b. What is the Total Cost of the loan? c. What is the total interest? 25. How much can be saved in total interest by financing $160,000 at 9.50% for 20 years rather than 25 years? (2 points) 26. How much can be saved in total interest by financing $160,000 at 12.00% for 15 years rather than 12.00% for 30 years? (2 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

21 Steve and Amy offered 187000 on a home that had been priced at 209500 The seller agreed to the offer A 20 down payment is required What is the amou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started