Answered step by step

Verified Expert Solution

Question

1 Approved Answer

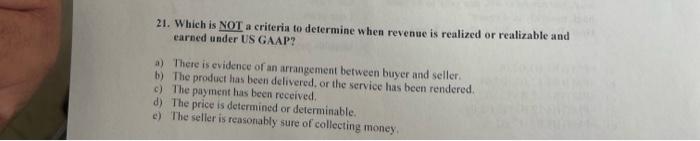

21. Which is NOT a criteria to determine when revenue is realized or realizable and earned under US GAAP? a) There is evidence of an

21. Which is NOT a criteria to determine when revenue is realized or realizable and earned under US GAAP? a) There is evidence of an arrangement between buyer and seller. b) The product has been delivered, or the service has been rendered. c) The payment has been received. d) The price is determined or determinable. e) The seller is reasonably sure of collecting money.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started