Answered step by step

Verified Expert Solution

Question

1 Approved Answer

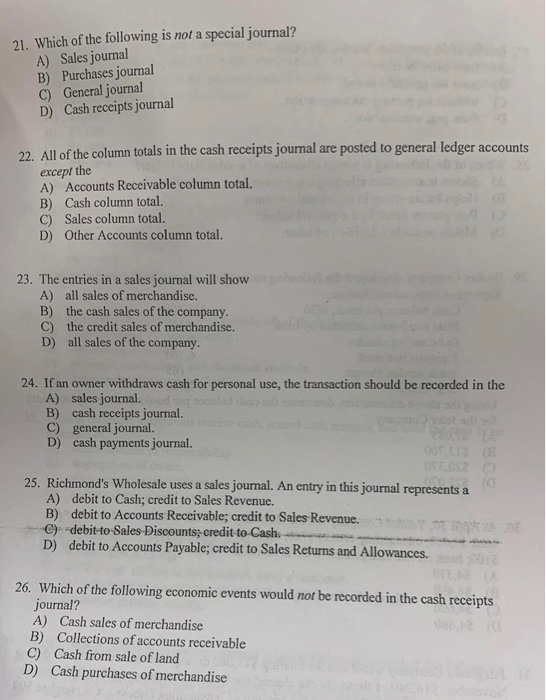

21. Which of the following is not a special journal? A) Sales journal B) Purchases journal C) General journal D) Cash receipts journal 22.

21. Which of the following is not a special journal? A) Sales journal B) Purchases journal C) General journal D) Cash receipts journal 22. All of the column totals in the cash receipts journal are posted to general ledger accounts except the A) Accounts Receivable column total. B) Cash column total. C) Sales column total. D) Other Accounts column total. 23. The entries in a sales journal will show A) all sales of merchandise. B) the cash sales of the company. C) the credit sales of merchandise. D) all sales of the company. 24. If an owner withdraws cash for personal use, the transaction should be recorded in the A) sales journal. food q B) cash receipts journal. C) general journal. D) cash payments journal. adol 25. Richmond's Wholesale uses a sales journal. An entry in this journal represents a A) debit to Cash; credit to Sales Revenue. B) debit to Accounts Receivable; credit to Sales Revenue. C) debit-to-Sales-Discounts; credit to-Cash. D) debit to Accounts Payable; credit to Sales Returns and Allowances. A) Cash sales of merchandise B) Collections of accounts receivable 22 00T.013 (8 OTE002 (3 50.002 (4 26. Which of the following economic events would not be recorded in the cash receipts journal? C) Cash from sale of land D) Cash purchases of merchandise DE

Step by Step Solution

★★★★★

3.32 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Question 21 Which of the following is not a special journal CGeneral journal The sales journal the purchases journal the cash disbursements journal and the cash receipts journal are the four primary s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started