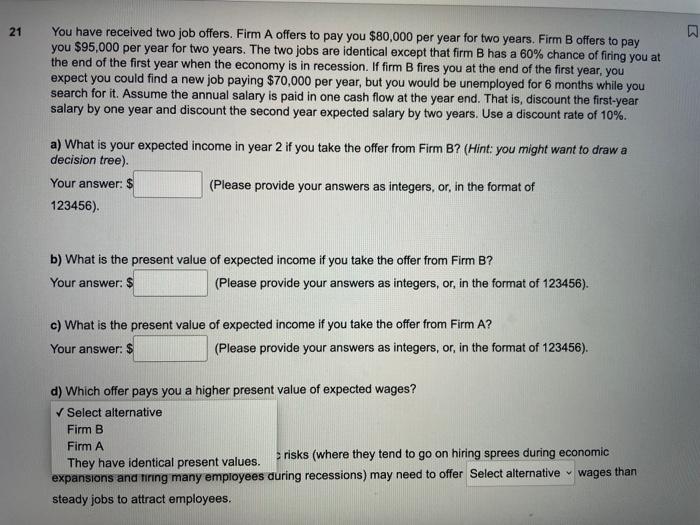

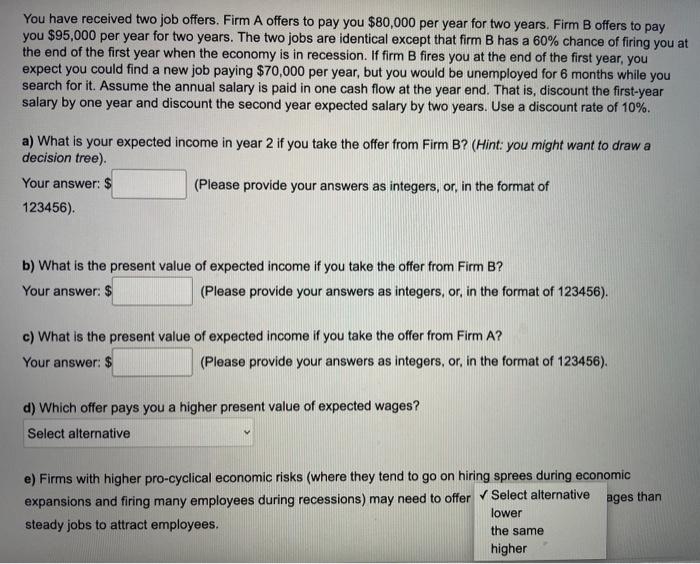

21 You have received two job offers. Firm A offers to pay you $80,000 per year for two years. Firm B offers to pay you $95,000 per year for two years. The two jobs are identical except that firm B has a 60% chance of firing you at the end of the first year when the economy is in recession. If firm B fires you at the end of the first year, you expect you could find a new job paying $70,000 per year, but you would be unemployed for 6 months while you search for it. Assume the annual salary is paid in one cash flow at the year end. That is, discount the first-year salary by one year and discount the second year expected salary by two years. Use a discount rate of 10%. a) What is your expected income in year 2 if you take the offer from Firm B? (Hint: you might want to draw a decision tree). (Please provide your answers as integers, or, in the format of Your answer: $ 123456). b) What is the present value of expected income if you take the offer from Firm B? Your answer: $ (Please provide your answers as integers, or, in the format of 123456). c) What is the present value of expected income if you take the offer from Firm A? Your answer: S (Please provide your answers as integers, or, in the format of 123456). d) Which offer pays you a higher present value of expected wages? Select alternative Firm B Firm A risks (where they tend to go on hiring sprees during economic They have identical present values. expansions and firing many employees during recessions) may need to offer Select alternative wages than steady jobs to attract employees. B You have received two job offers. Firm A offers to pay you $80,000 per year for two years. Firm B offers to pay you $95,000 per year for two years. The two jobs are identical except that firm B has a 60% chance of firing you at the end of the first year when the economy is in recession. If firm B fires you at the end of the first year, you expect you could find a new job paying $70,000 per year, but you would be unemployed for 6 months while you search for it. Assume the annual salary is paid in one cash flow at the year end. That is, discount the first-year salary by one year and discount the second year expected salary by two years. Use a discount rate of 10%. a) What is your expected income in year 2 if you take the offer from Firm B? (Hint: you might want to draw a decision tree). (Please provide your answers as integers, or, in the format of Your answer: $ 123456). b) What is the present value of expected income if you take the offer from Firm B? Your answer: (Please provide your answers as integers, or, in the format of 123456). c) What is the present value of expected income if you take the offer from Firm A? Your answer: $ (Please provide your answers as integers, or, in the format of 123456). d) Which offer pays you a higher present value of expected wages? Select alternative e) Firms with higher pro-cyclical economic risks (where they tend to go on hiring sprees during economic expansions and firing many employees during recessions) may need to offer Select alternative steady jobs to attract employees. ages than lower the same higher