Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2123. In its second year of operations, Beachside Properties LLC reports income and expenses from operating the caf, as well as rent income and

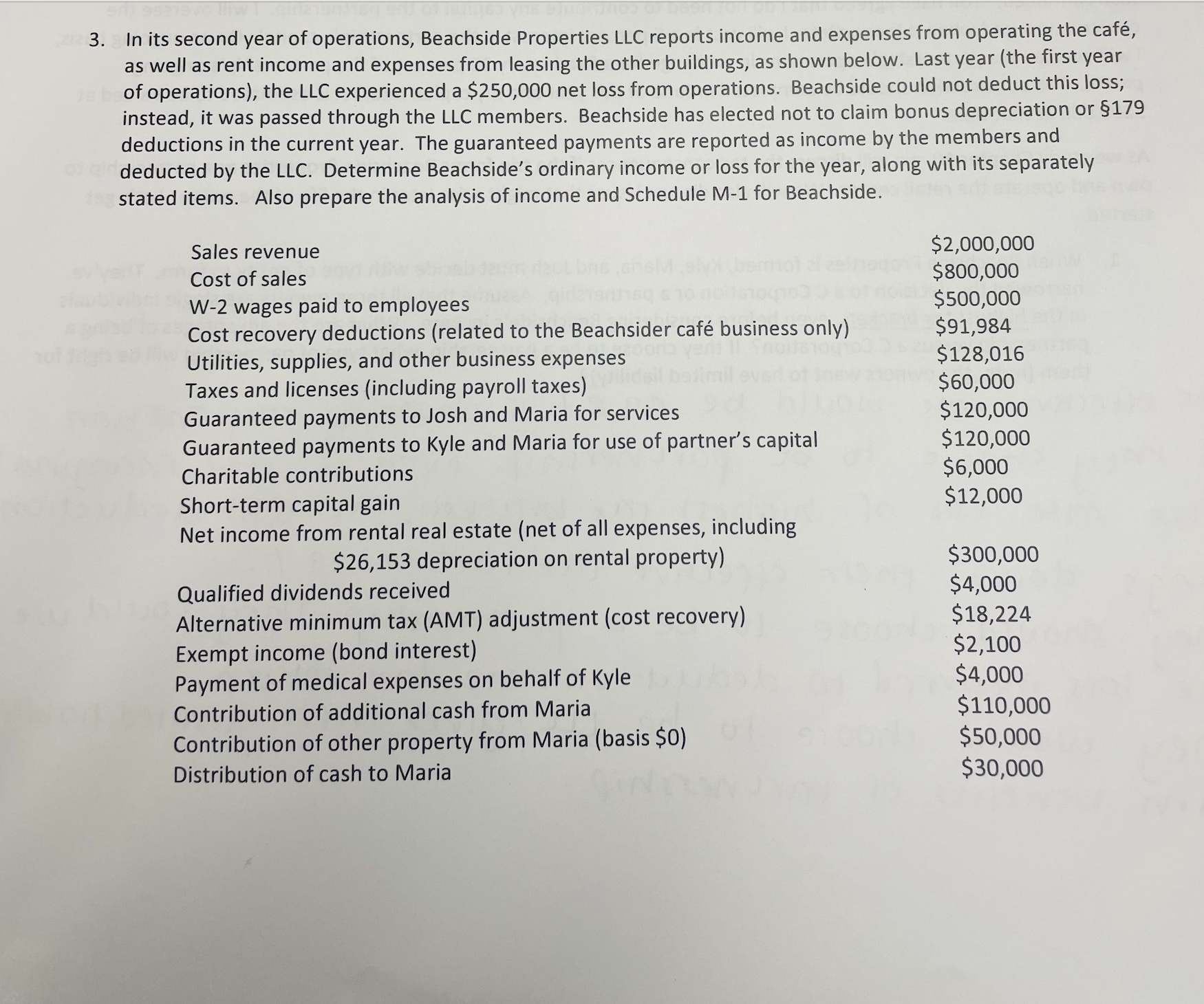

2123. In its second year of operations, Beachside Properties LLC reports income and expenses from operating the caf, as well as rent income and expenses from leasing the other buildings, as shown below. Last year (the first year of operations), the LLC experienced a $250,000 net loss from operations. Beachside could not deduct this loss; instead, it was passed through the LLC members. Beachside has elected not to claim bonus depreciation or 179 deductions in the current year. The guaranteed payments are reported as income by the members and girdeducted by the LLC. Determine Beachside's ordinary income or loss for the year, along with its separately stated items. Also prepare the analysis of income and Schedule M-1 for Beachside. Sales revenue Cost of sales W-2 wages paid to employees Cost recovery deductions (related to the Beachsider caf business only) $2,000,000 $800,000 $500,000 $91,984 Utilities, supplies, and other business expenses Taxes and licenses (including payroll taxes) $128,016 $60,000 Guaranteed payments to Josh and Maria for services Guaranteed payments to Kyle and Maria for use of partner's capital Charitable contributions Short-term capital gain Net income from rental real estate (net of all expenses, including $26,153 depreciation on rental property) Qualified dividends received Alternative minimum tax (AMT) adjustment (cost recovery) Exempt income (bond interest) Payment of medical expenses on behalf of Kyle $120,000 $120,000 $6,000 $12,000 $300,000 $4,000 $18,224 $2,100 $4,000 Contribution of additional cash from Maria $110,000 Contribution of other property from Maria (basis $0) Distribution of cash to Maria $50,000 $30,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Heres a breakdown of Beachside Properties LLCs financial information based on the provided image Ordinary Income or Loss 166324 Separately Stated Items 316000 Analysis of Income and Schedule M1 Analys...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started