Answered step by step

Verified Expert Solution

Question

1 Approved Answer

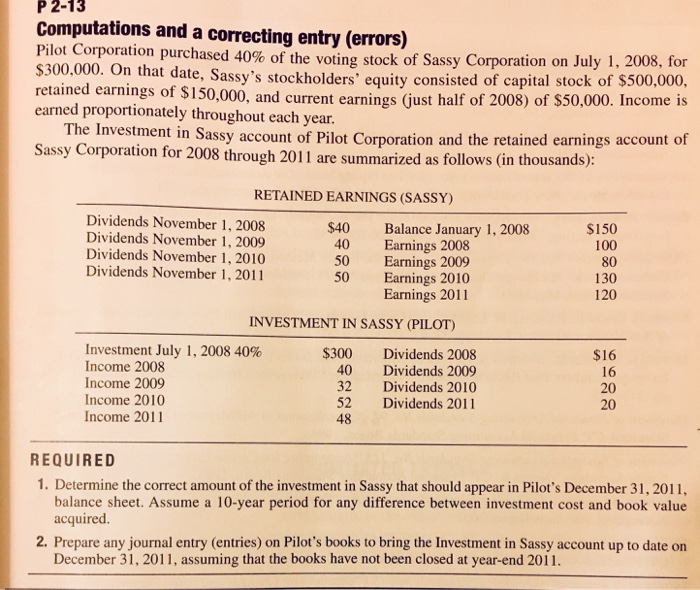

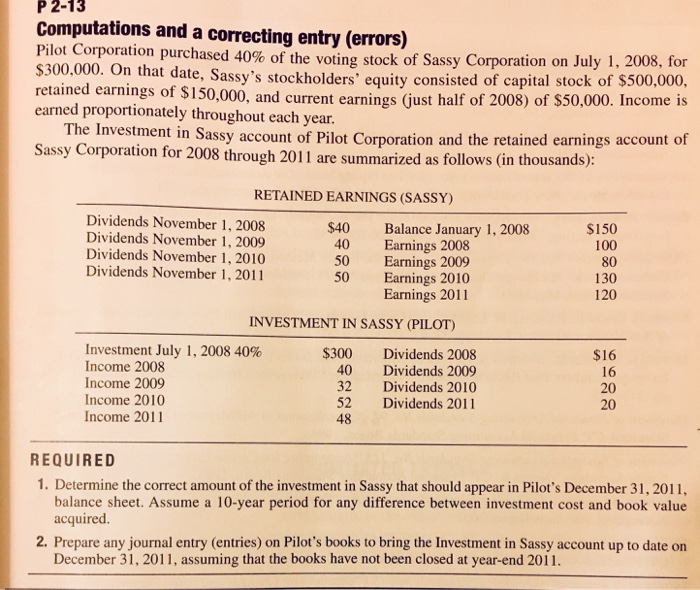

2-13 P Computations and a correcting entry (errors) Pilot Corporation $300,000. On that d retained earnings of $150,000, and current earnings (Gjust half of 2008)

2-13 P Computations and a correcting entry (errors) Pilot Corporation $300,000. On that d retained earnings of $150,000, and current earnings (Gjust half of 2008) of $50,000. Income is purchased 40% of the voting stock of Sassy Corporation on July 1, 2008, for ate, Sassy's stockholders' equity consisted of capital stock of $500,000, earned proportionately throughout each year. The Investment in Sassy account of Pilot Corporation and the retained Sassy Corporation for 2008 through 2011 are summarized as follows (Q earnings account of n thousands): RETAINED EARNINGS (SASSY) Dividends November 1, 2008 Dividends November 1, 2009 Dividends November 1, 2010 Dividends November 1, 2011 S40 40 50 50 Balance January 1, 2008 Earnings 2008 Earnings 2009 Earnings 2010 Earnings 2011 $150 100 80 130 120 INVESTMENT IN SASSY (PILOT) Investment July 1, 2008 40% Income 2008 Income 2009 Income 2010 Income 2011 $300 Dividends 2008 40 Dividends 2009 32 Dividends 2010 52 Dividends 2011 48 $16 16 20 20 REQUIRED 1. Determine the correct amount of the investment in Sassy that should appear in Pilot's December 31,2011, balance sheet. Assume a 10-year period for any difference between investment cost and book value acquired. 2. Prepare any journal entry (entries) on Pilot's books to bring the Investment in Sassy account up to date on December 31, 2011, assuming that the books have not been closed at year-end 2011

2-13 P Computations and a correcting entry (errors) Pilot Corporation $300,000. On that d retained earnings of $150,000, and current earnings (Gjust half of 2008) of $50,000. Income is purchased 40% of the voting stock of Sassy Corporation on July 1, 2008, for ate, Sassy's stockholders' equity consisted of capital stock of $500,000, earned proportionately throughout each year. The Investment in Sassy account of Pilot Corporation and the retained Sassy Corporation for 2008 through 2011 are summarized as follows (Q earnings account of n thousands): RETAINED EARNINGS (SASSY) Dividends November 1, 2008 Dividends November 1, 2009 Dividends November 1, 2010 Dividends November 1, 2011 S40 40 50 50 Balance January 1, 2008 Earnings 2008 Earnings 2009 Earnings 2010 Earnings 2011 $150 100 80 130 120 INVESTMENT IN SASSY (PILOT) Investment July 1, 2008 40% Income 2008 Income 2009 Income 2010 Income 2011 $300 Dividends 2008 40 Dividends 2009 32 Dividends 2010 52 Dividends 2011 48 $16 16 20 20 REQUIRED 1. Determine the correct amount of the investment in Sassy that should appear in Pilot's December 31,2011, balance sheet. Assume a 10-year period for any difference between investment cost and book value acquired. 2. Prepare any journal entry (entries) on Pilot's books to bring the Investment in Sassy account up to date on December 31, 2011, assuming that the books have not been closed at year-end 2011

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started