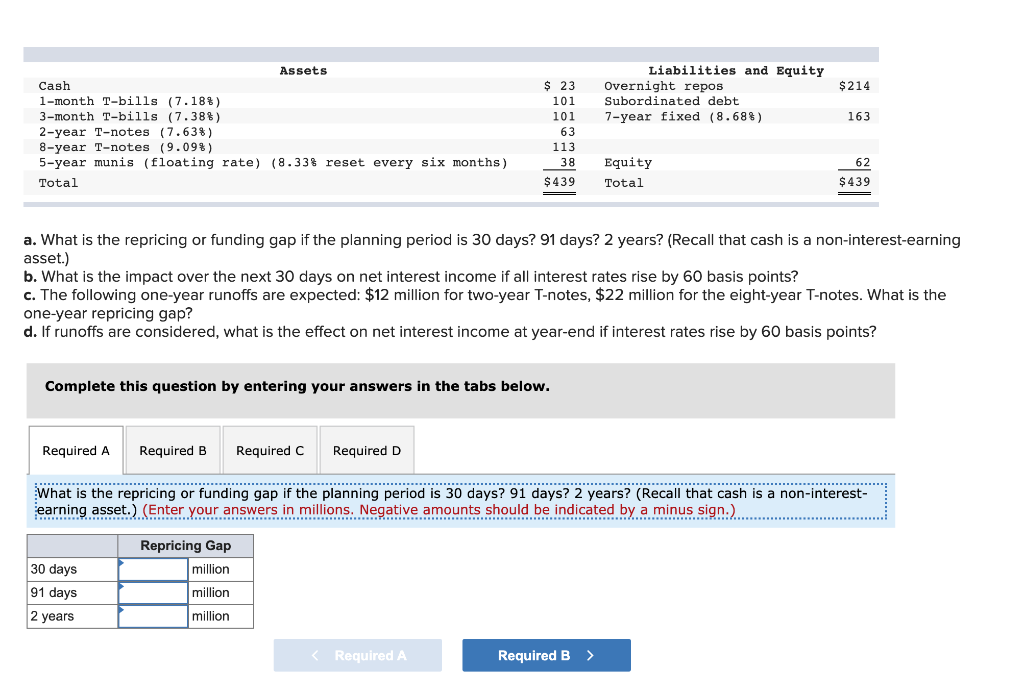

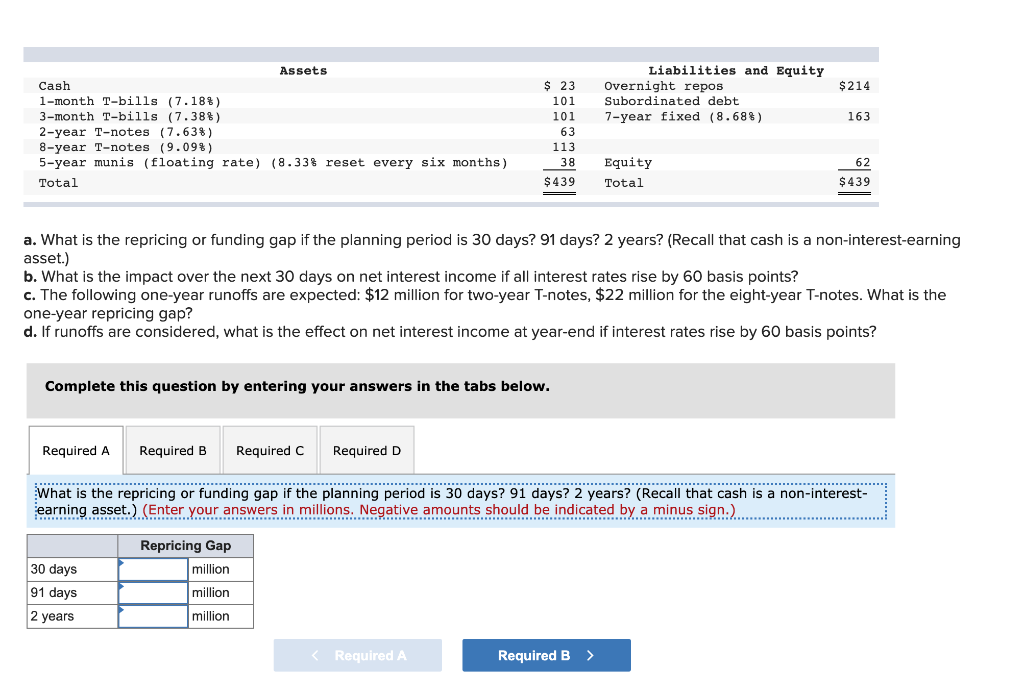

$ 214 Liabilities and Equity Overnight repos Subordinated debt 7-year fixed (8.68%) 163 Assets Cash 1-month T-bills (7.18%) 3-month T-bills (7.38%) 2-year T-notes (7.638) 8-year T-notes (9.098) 5-year munis (floating rate) (8.33% reset every six months) Total $ 23 101 101 63 113 38 $439 Equity Total 62 $439 a. What is the repricing or funding gap if the planning period is 30 days? 91 days? 2 years? (Recall that cash is a non-interest-earning asset.) b. What is the impact over the next 30 days on net interest income if all interest rates rise by 60 basis points? c. The following one-year runoffs are expected: $12 million for two-year T-notes, $22 million for the eight-year T-notes. What is the one-year repricing gap? d. If runoffs are considered, what is the effect on net interest income at year-end if interest rates rise by 60 basis points? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D What is the repricing or funding gap if the planning period is 30 days? 91 days? 2 years? (Recall that cash is a non-interest- earning asset.) (Enter your answers in millions. Negative amounts should be indicated by a minus sign.). 30 days 91 days 2 years Repricing Gap million million million $ 214 Liabilities and Equity Overnight repos Subordinated debt 7-year fixed (8.68%) 163 Assets Cash 1-month T-bills (7.18%) 3-month T-bills (7.38%) 2-year T-notes (7.638) 8-year T-notes (9.098) 5-year munis (floating rate) (8.33% reset every six months) Total $ 23 101 101 63 113 38 $439 Equity Total 62 $439 a. What is the repricing or funding gap if the planning period is 30 days? 91 days? 2 years? (Recall that cash is a non-interest-earning asset.) b. What is the impact over the next 30 days on net interest income if all interest rates rise by 60 basis points? c. The following one-year runoffs are expected: $12 million for two-year T-notes, $22 million for the eight-year T-notes. What is the one-year repricing gap? d. If runoffs are considered, what is the effect on net interest income at year-end if interest rates rise by 60 basis points? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D What is the repricing or funding gap if the planning period is 30 days? 91 days? 2 years? (Recall that cash is a non-interest- earning asset.) (Enter your answers in millions. Negative amounts should be indicated by a minus sign.). 30 days 91 days 2 years Repricing Gap million million million