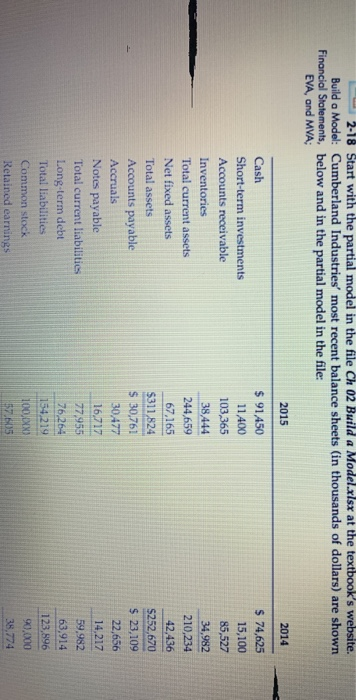

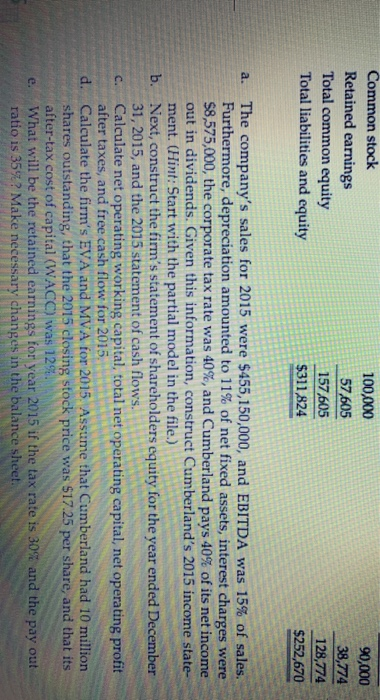

2-18 Start with the partial model in the file Ch 02 Build a Model.xlsx at the textbook's website. Build a Model: Cumberland Industries' most recent balance sheets (in thousands of dollars) are shown Financial Statements, below and in the partial model in the file: EVA, and MVA: 2015 2014 Cash Short-term investments Accounts receivable Inventories Total current assets Net fixed assets Total assets Accounts payable Accruals Notes payable Total current liabilities Long term debt Total liabilities Common stock Retained earnings $ 91,450 11,400 103,365 38444 244,659 67,165 $311,824 $ 30,761 30477 16.717 77,955 76,264 154,219 100XX $7.505 $ 74,625 15,100 85,527 34,982 210,234 42,436 $252,670 $ 23,109 22,656 14,217 59,982 63,914 123,896 90.000 38,774 Common stock Retained earnings Total common equity Total liabilities and equity 100,000 57,605 157,605 $311,824 90,000 38,774 128,774 $252,670 a. The company's sales for 2015 were $455,150,000, and EBITDA was 15% of sales. Furthermore, depreciation amounted to 11% of net fixed assets, interest charges were $8,575,000, the corporate tax rate was 40%, and Cumberland pays 40% of its net income out in dividends. Given this information, construct Cumberland's 2015 income state- ment. (Hint: Start with the partial model in the file.) b. Next, construct the firm's statement of shareholders equity for the year ended December 31, 2015, and the 2015 statement of cash flows. Calculate net operating working capital, total net operating capital, net operating profit after taxes, and free cash flow for 2015 d. Calculate the firm's EVA and MVA for 2015. Assume that Cumberland had 10 million shares outstanding, that the 2015 closing stock price was $17.25 per share, and that its after-tax cost of capital (WACC) was 12%. What will be the retained earnings for year 2015 if the tax rate is 30% and the pay out ratio is 35%? Make necessary changes in the balance sheet. c. e. 2-18 Start with the partial model in the file Ch 02 Build a Model.xlsx at the textbook's website. Build a Model: Cumberland Industries' most recent balance sheets (in thousands of dollars) are shown Financial Statements, below and in the partial model in the file: EVA, and MVA: 2015 2014 Cash Short-term investments Accounts receivable Inventories Total current assets Net fixed assets Total assets Accounts payable Accruals Notes payable Total current liabilities Long term debt Total liabilities Common stock Retained earnings $ 91,450 11,400 103,365 38444 244,659 67,165 $311,824 $ 30,761 30477 16.717 77,955 76,264 154,219 100XX $7.505 $ 74,625 15,100 85,527 34,982 210,234 42,436 $252,670 $ 23,109 22,656 14,217 59,982 63,914 123,896 90.000 38,774 Common stock Retained earnings Total common equity Total liabilities and equity 100,000 57,605 157,605 $311,824 90,000 38,774 128,774 $252,670 a. The company's sales for 2015 were $455,150,000, and EBITDA was 15% of sales. Furthermore, depreciation amounted to 11% of net fixed assets, interest charges were $8,575,000, the corporate tax rate was 40%, and Cumberland pays 40% of its net income out in dividends. Given this information, construct Cumberland's 2015 income state- ment. (Hint: Start with the partial model in the file.) b. Next, construct the firm's statement of shareholders equity for the year ended December 31, 2015, and the 2015 statement of cash flows. Calculate net operating working capital, total net operating capital, net operating profit after taxes, and free cash flow for 2015 d. Calculate the firm's EVA and MVA for 2015. Assume that Cumberland had 10 million shares outstanding, that the 2015 closing stock price was $17.25 per share, and that its after-tax cost of capital (WACC) was 12%. What will be the retained earnings for year 2015 if the tax rate is 30% and the pay out ratio is 35%? Make necessary changes in the balance sheet. c. e